CUSTOM&EXCISE&SERVICE TAX

Compensation Paid By Employee To Employer For Resigning From Service Without Giving Requisite Notice Is Not A Taxable Service: CESTAT

The Bangalore Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) consisting of S.K. Mohanty (Judicial Member) and P.Anjani Kumar (Technical Member) has held that any compensation paid by the employee to the employer for resigning from the service without giving the requisite notice, would not be termed as consideration for the contract of employment and would not fall...

Liquidated Damages Does Not Attract Service Tax: CESTAT Hyderabad

The Hyderabad Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has ruled that receipt of liquidated damages by the service provider for breach of conditions under an agreement to provide services would not attract Service Tax. The Bench, consisting of members P.K. Choudhary (Judicial Member) and P.V. Subba Rao (Technical Member), held that claim...

Foreign Origin Gold Bar With Unexplained Source Is Liable For Absolute Confiscation As It amounts To Importation Of Prohibited Goods: CESTAT

The Chennai Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) consisting of P.Dinesha (Judicial Member), while remanding the matter back, held that the gold bar with a foreign marking, the source of which is not explained, is liable for absolute confiscation since the same would amount to the importation of a prohibited good. A specific intelligence was gathered...

Additions Cannot Be Made To Assessee's Income On Basis Of Document Declared By The CESTAT As 'Dumb Document': Ahmedabad ITAT

The Ahmedabad Bench of ITAT has ruled that additions cannot be made to assessee's taxable income under the Income Tax Act, 1961 on the basis of documents that are declared as 'dumb documents' by the CESTAT in the service tax proceedings before it. The Bench, consisting of members Madhumita Roy (Judicial Member) and Waseem Ahmed (Accountant Member), held that though the proceedings...

Denial Of Availment Of CENVAT Credit On Performa Invoices, Despite All Information, Is Absolutely Wrong: CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) consisting of Rachna Gupta (Judicial Member) held that the denial of availment of Cenvat Credit on performa invoices was absolutely wrong.The appellant/assessee is in the business of manufacturing zinc concentrate, lead concentrate, etc. and is also engaged in providing and receiving goods transport...

Service Tax Not Payable On Liquidated Damages: CESTAT

The Delhi Bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) consisting of S.K. Mohanty (Judicial Member) and P.V. Subba Rao (Technical Member) has held that service tax is not payable on liquidated damages recovered on the failure to fulfil the contract.The appellants/assessees are public sector undertakings established by the Government of Madhya Pradesh for...

Exported Goods Cannot Be Confiscated Under Section 113 Of Customs Act: CESTAT Hyderabad

The Hyderabad Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has ruled that Section 113 of the Customs Act only provides for confiscation of goods that are to be exported and not for goods which have already been exported. The Bench, consisting of P.K. Choudary (Judicial Member) and P. Venkata Subba Rao (Technical Member), held that the purpose of the...

Unsubstantiated Show Cause Notice And Cancellation Of Licence: CESTAT Restore Customs Broker's Licence

The Delhi bench of the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) headed by Justice Dilip Gupta (President) and P.V. Subba Rao (Technical Member) has restored the customs broker's licence as the show cause notice or the inquiry report lacked details about the non-existence of the exporter. The appellant, M/s. Perfect Cargo and Logistics, is licenced as a customs...

Interest Free Security Deposits Are Not Exigible To Service Tax: CESTAT Ahmedabad

The Ahmedabad Bench of the Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has ruled that interest free refundable security deposits are not exigible to service tax since they are not collected in consideration for providing a service. The Bench, consisting of members Ramesh Nair (Judicial Member) and Raju (Technical Member), held that there is no provision in the Service...

Plea In Supreme Court Challenges The Constitutional Validity Of Levy Of GST On Lease/ Rent Payments

The Supreme Court of India has asked the petitioner(s) to serve an advance copy to the Additional Solicitor General to seek instructions in a plea challenging constitutional validity of levy of GST on lease/ rent payments. Justice M.R. Shah and Justice B.V. Nagarathna, while hearing the matter, observed, "Let one advance copy be served on Shri N. Venkataraman, learned ASG, who may...

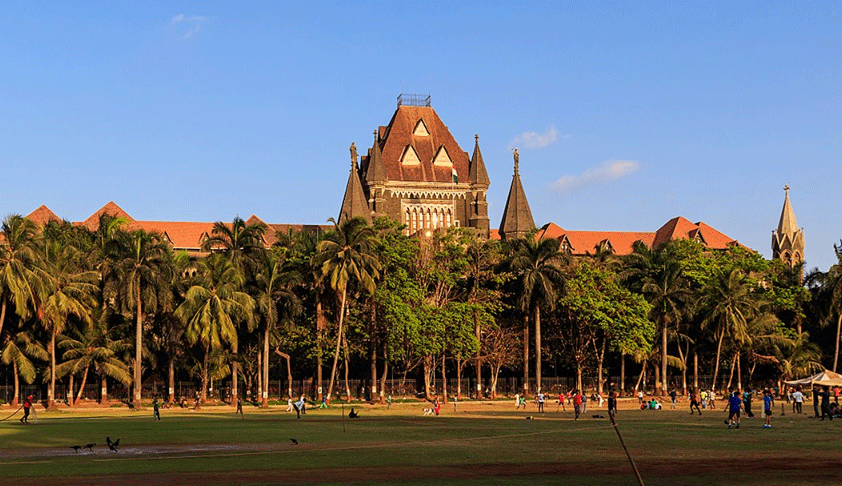

Appeal Against CESTAT Order, On Classification Of Goods, And Determination Of Customs Duty Lies Before The Supreme Court: Bombay High Court

The Bombay High Court has ruled than an appeal from an order passed by the Customs, Excise & Service Tax Appellate Tribunal (CESTAT), involving the question with respect to classification of goods under the Customs Act, 1962, would lie before the Supreme Court under Section 130E of the Customs Act, since it is primarily related to determination of the rate of customs...

Cannot Waive The Statutory Mandate of Pre-Deposit Merely On The Plea Of Financial Hardships: Kerala High Court

The Kerala High Court bench of Justice Bechu Kurian Thomas has ruled that the high court cannot waive the statutory mandate of pre-deposit merely on the plea of financial hardships. The petitioner/assessee, a proprietor of an establishment named M/s. Swathi Constructions at Shoranur, is in the business of laying power lines on behalf of people who have executed contracts with the...