GST&VAT&CST

Assessment Proceedings Against Deceased Person Invalid Without Notice To Legal Heirs U/S 93 Of CGST Act: Kerala High Court

The Kerala High Court stated that assessment proceedings against deceased person invalid without notice to legal heirs under Section 93 CGST Act. Justice Ziyad Rahman A.A. addressed the issue where the wife of the deceased, challenged the GST DRC-07 summary order issued in the name of her deceased husband. The wife/petitioner has challenged the orders on the ground that,...

Battery Packs Imported To Manufacture Phones Fall Under 12% GST Category: CESTAT Allows Samsung's Appeal

The Customs, Excise & Service Tax Appellate Tribunal at Delhi has held that lithium-ion batteries used for the manufacture of mobile phones up to March 31, 2020 would attract 12% GST.A Bench of Justice Dilip Gupta (President) and Hemambika R. Priya (Technical Member) added that if lithium-ion batteries were not used in the manufacture of mobile phones, they would attract 28% GST up to...

Goods Confiscated U/S 130 Of GST Act Can Be Released During Pendency Of Appeal If Not Auctioned: Kerala High Court

The Kerala High Court has stated that goods confiscated under Section 130 GST Act can be released during pendency of appeal if not yet auctioned. Justice Ziyad Rahman A.A. was addressing the case where the grievance of the assessee/petitioner is against confiscation order passed by the Enforcement Officer/2nd respondent, under Section 130 of the GST...

GST | Alleging Denial Of Hearing Insufficient If Assessee Itself Wasn't Diligent In Responding To SCN Or Attending Hearing: Delhi High Court

The Delhi High Court has refused to interfere with a demand order passed by the GST Department without hearing the assessee, after noting that the assessee itself was not diligent in responding to the show cause notice or attending the personal hearing despite notice.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Considering the fact that (i) The...

S.75(5) Of CGST Act Contemplates A Maximum Of Three Adjournments, Cannot Be Construed As A Minimum Of Three Hearings: Delhi High Court

The Delhi High Court has held that the provision of maximum three adjournments that can be granted to a taxpayer during the course of adjudication proceedings, cannot be construed to mean that the taxpayer must be given a minimum of three hearings.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“A perusal of Section 75(5) of the Central Goods and Service...

Assessee Can Seek Refund Of Unutilised ITC In Personal Bank Account If Business Is Shut Down: Calcutta High Court

Calcutta High Court recently directed the proper officer under the GST Act to consider ordering refund of the unutilised ITC of an Assessee to his personal bank account, as his business was closed and its GST registration stood cancelled.The Petitioner was aggrieved by a direction of the proper officer, though allowing the refund sanction to the tune of Rs. 68,66,238/- but, directing the...

Taxpayers Must Be Vigilant About Communications On GST Portal, Department Can't Be Blamed: Delhi High Court

The Delhi High Court has made it clear that if an assessee fails to respond to a show cause notice duly communicated to it on the GST portal, the Department cannot be blamed for passing an order raising demand, without hearing the assessee.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Since the Petitioner has not been diligent in checking the portal, no...

Restoration Of Cancelled GST Registration Permissible If Taxpayer Clears Dues And Files Returns: Gauhati High Court

The Gauhati High Court stated that the restoration of cancelled GST registration is permissible if the taxpayer clears dues and files returns. The Bench of Justice Sanjay Kumar Medhi observed that “proviso to sub-rule (4) of Rule 22 of the CGST Rules 2017 provides that if a person, who has been served with a show cause notice under Section 29(2)(c) of the CGST Act, 2017, is ready...

If SCN Is Issued Without GST Authority's Signature, Demand Order Can't Be Saved Even If It Is Signed: Jharkhand High Court

The Jharkhand High Court has made it clear that an order raising GST demand cannot be saved even if it is properly authenticated by the issuing authority, if the show cause notice preceding it was not signed.A division bench of Chief Justice M.S. Ramachandra Rao and Justice Rajesh Shankar was dealing with a Petitioner's grievance that Form GST DRC-01A issued to him under section 73(1) of...

Two Contradictory GST Orders On Same Allegations Not Sustainable: Kerala High Court

The Kerala High Court has stated that two contradictory GST orders on the same allegations are not sustainable, and the second order cannot exist if the first one already dropped the proceedings. The Bench of Justice Ziyad Rahman A.A. observed that the proceedings were dropped in the first order after accepting the explanation by the assessee, yet a second order was passed on the...

Amount Deposited Under Protest Can't Be Treated As Admission Of Tax Liability: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when a taxpayer deposits an amount “under protest”, it does not amount to an admission of tax liability.A Division Bench of Justice Tarlok Singh Chauhan and Justice Sushil Kukreja observed as follows; “Once the petitioner had deposited the amount 'under protest', the same could not have been considered to be an admission of liability because...

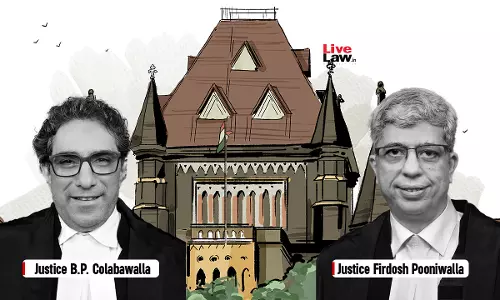

Design & Engineering Services To Foreign Entities Are Zero-Rated Supplies; Assessee Eligible For Refund Of Unutilized ITC U/S 54 Of CGST Act: Bombay HC

The Bombay High Court stated that design and engineering services to foreign entities are zero-rated supplies; assessee eligible for refund of unutilized ITC U/S 54 CGST. The Division Bench of Justices B.P. Colabawalla and Firdosh P. Pooniwalla observed that assessee is not an agency of the foreign recipient and both are independent and distinct persons. Thus, condition (v)...