GST&VAT&CST

Supply Of Holographic Stickers By Prohibition & Excise Dept For Affixing On Alcohol Bottles Is Supply Of “Goods”, Not Taxable: Madras High Court

The Madras High Court has recently observed that the supply of holographic stickers or excise labels by the Prohibition and Excise Department which is to be affixed on manufactured and bottles alcoholic liquor is a supply of “goods” simplicitor and not a supply of “service”. The court thus ruled that such supply of holographic stickers would not be taxable under the...

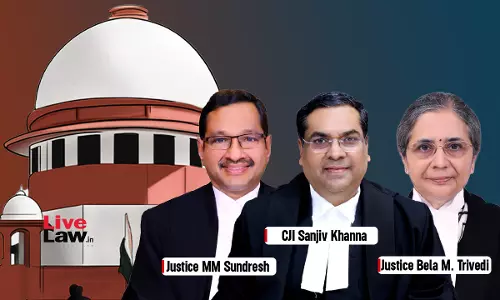

Some Merit In Allegations That GST Officials Coerce Assesses To Pay Tax With Threat Of Arrest; It's Impermissible: Supreme Court

The Supreme Court on Thursday (February 27) observed that there was some merit in the allegation that tax officials coerce assesses to pay the Goods and Services Tax with the threat of arrest. This observation was made by the Court on the basis of data.The Court said that if any person is feeling coerced to pay GST, they can approach the writ court for refund of the tax paid by them...

GST Act | Can Time Limit To Adjudicate Show Cause Notice Be Extended By Notification Under S.168A? Supreme Court To Consider

The Supreme Court is to decide whether the time limit for adjudicating show cause notice and passing an order can be extended by the issuance of notifications under Section 168-A of the GST Act. This provision empowers the Government to issue notification for extending the time limit prescribed under the Act which cannot be complied with due to force majeure.“The issue that falls for...

Article 226 Can't Be Invoked Against An SCN Issued U/S 74 Of CGST Act At Preliminary Stage: Kerala High Court

The Kerala High Court stated that Article 226 cannot be invoked against a show cause notice issued under Section 74 of the CGST Act at preliminary stage. “Article 226 of the Constitution of India is not meant to be used to break the resistance of the Revenue in this fashion. In exercise of such jurisdiction, the High Court is required to refrain from issuing directions...

Cash Seized From Assessee Cannot Be Retained By GST Dept Or IT Dept Prior To Finalisation Of Proceedings: Kerala High Court

The Kerala High Court stated that illegal cash seizure by GST Department and handing over to Income Tax Department is illegal under Section 132A of the Income Tax Act. The Division Bench of Justices A.K. Jyasankaran Nambiar and Easwaran S. held that “Cash amount seized from the premises of the assessee cannot be retained either by the GST Department of the State or the...

Delay Of Two Days In Issuing GST Notice Can't Be Condoned: Andhra Pradesh High Court

The Andhra Pradesh High Court stated that delay of two days in issuing the GST notice cannot be condoned. The Division Bench of Justices R. Raghunandan Rao and Harinath N. observed that “the time permit set out under 73(2) of the Act is mandatory and any violation of that time period cannot be condoned, and would render the show cause notice otiose.” In this case,...

GST Registration Cannot Be Refused Merely Because Assessee Belongs To Another State: Andhra Pradesh High Court

The Andhra Pradesh High Court stated that GST registration can't be refused merely because the assessee belongs to another State. “Though the apprehension of the respondents may not be misplaced, it would not mean that registration can be refused on a ground, which is not available under the Statute or the Rules. There do not appear to be any restriction for persons outside the...

Short Tax | Timeline For Issuing Show Cause Notice U/S 73(2) Is Mandatory, Not Discretionary: Andhra Pradesh High Court

The Andhra Pradesh High Court has held that the time permit set out under 73(2) of the AP GST Act for issuance of show cause notice in relation to alleged short payment of tax, etc. is mandatory in nature.A division bench of Justices R Raghunandan Rao and Harinath N. added that any violation of that time period cannot be condoned and would render the show cause notice otiose.It observed,...

S.107 CGST Act Prescribes Independent Regime Of Limitation For Filing Appeals, Application Of S.5 Limitation Act Stands Excluded: Delhi HC

The Delhi High Court has held that since Section 107 of the Central Goods and Services Tax Act, 2017 prescribes an “independent regime” to determine the limitation period for filing statutory appeals, the provision for condonation of delay under Section 5 of the Limitation Act stands excluded.A division bench of Justices Yashwant Varma and Dharmesh Sharma observed, “The facility to...

Ensure Counsel Appearing On Advance Service Are Instructed Properly: Delhi HC Asks Customs, GST Department, DRI And DGGI To Frame SOP

The Delhi High Court has asked the Customs Department, the Central GST Department, the Directorate of Revenue Intelligence (DRI), Directorate of General GST Intelligence (DGGI) to make sure that counsel representing them on advance service are instructed properly.A bench of Justices Prathiba M. Singh and Dharmesh Sharma ordered the Commissioner of Customs to prepare an SOP as to the manner...

GST Registration And Payment Of Tax After Inspection Is Not Voluntary Conduct: Madras High Court

The Madras High Court stated that GST registration and payment of tax after inspection is not a voluntary conduct.The Bench of Justice K. Kumaresh Babu observed that “there is a deliberate attempt to evade payment of tax by not registering himself under the Act and also issuing receipts as donation to the Trust. Only after the inspection they have agreed to pay the tax by...