GST

Printing Digital Images/Letters On Paper Constitutes Services, Attracts 18% GST Not 12%: Kerala High Court

The Kerala High Court has held that printing digital images/letters on paper constitutes services, and attracts 18% GST not 12%.The question before the bench was to determine whether the assessee's printing activities ie. converting the figures, letters, photographs etc., in a digital form, into physical format by printing it on paper were liable to GST at 12% or 18%.Justice Ziyad Rahman...

Delhi High Court Asks GST Appellate Tribunal To Examine 'Profiteering' Allegations Against Tata Play

The Delhi High Court recently asked the GST Appellate Tribunal to re-look into the profiteering allegations levelled against DTH services provider Tata Play.The direction was made by a division bench comprising Justices Prathiba M. Singh and Shail Jain while dealing with the company's appeal against the show cause notice and consequential order passed against it by the erstwhile...

Supreme Court Issues Notice To IndiGo On Plea Of Customs Dept & GST Council Against Ruling On IGST Exemption For Imported Parts

The Supreme Court on Monday sought a response from IndiGo's parent company, InterGlobe Aviation, on a petition filed by the Customs Department challenging a Delhi High Court ruling that exempted the airline from paying Integrated Goods and Services Tax (IGST) on imported aircraft parts that were repaired and serviced abroad.A Bench comprising Justice BV Nagarathna and Justice R Mahadevan...

[S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs

The Jammu & Kashmir and Ladakh High Court has held that intelligence-based enforcement actions can be initiated by either the Central or the State tax authorities, irrespective of taxpayer assignment, and such actions do not require a separate notification for cross-empowerment.The court dismissed a batch of writ petitions filed by several companies challenging show cause notices issued...

Delhi High Court Flags Glitch In GST Portal Generating Notice For Personal Hearing After Decision On Appeal

The Delhi High Court recently came across a peculiar case relating to Input Tax Credit refund claim, whereby a notice for personal hearing was issued to the trader, after the Appellate Authority rejected its plea.A division bench comprising Justices Prathiba M. Singh and Shail Jain flagged the glitch in the Department's portal, which generated a personal hearing notice after the passage of...

S.171 GST Act | Businesses Registration Can Be Cancelled Over Non-Reduction Of Prices After GST-Rate Cut: Delhi High Court

The Delhi High Court has held that an authority constituted under Section 171 of the Central Goods and Services Tax Act 2017 can order businesses to reduce their prices following reduction in GST rates applicable to their products.A division bench of Justices Prathiba M. Singh and Shail Jain further held that such authority can also impose penalty or cancel GST registration of those in...

After GST Rate Cut, Non-Reduction Of Price Can't Be Justified By Secretly Increasing Product Quantity At Same MRP : Delhi High Court

The Delhi High Court has made it clear that when GST rates applicable on a given product are reduced by the GST Council, its benefit should trickle down to the end consumer by reduction in prices of such products.A division bench of Justices Prathiba M. Singh and Shail Jain observed that letting manufacturers increase the quantity of the product while charging the same MRP will defeat the...

Assignment Of Tax Dues By GST Dept Doesn't Violate Article 265 Or GST Act If CIRP Has Been Initiated: NCLAT New Delhi

The NCLAT, Principal Bench, New Delhi, comprising Justice Rakesh Kumar Jain (Member-Judicial) and Mr. Naresh Salecha (Member-Technical), has held that the assignment of tax dues by the GST Department doesn't violate Article 265 or the GST Act if CIRP has been initiated. The corporate debtor was admitted into CIRP, and Ms. Dilip Mehta was appointed as the interim...

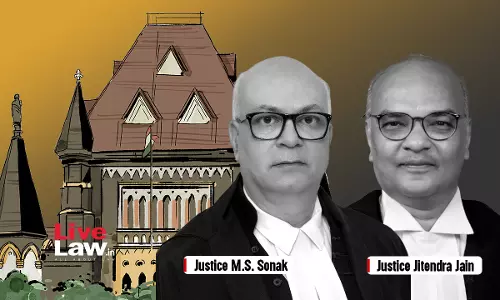

Pending Proceedings Under Omitted CGST Rules 89(4B) & 96(10) Lapse In Absence Of Savings Clause: Bombay High Court

The Bombay High Court has held that all pending proceedings under the omitted CGST Rules 89(4B) & 96(10) lapse in the absence of a savings clause. The bench agreed with the assessee/petitioners that the provisions of Section 6 of the General Clauses Act are not attracted and therefore the pending proceedings can claim no immunity or protection. Unless the Respondents...

Provisional Attachment Of Bank Accounts Cannot Be Done Merely Upon Issue Of Show Cause Notice U/S 74 GST Act: Allahabad High Court

The Allahabad High Court has held that provisional attachment of bank accounts cannot be done merely upon issue of show cause notice under Section 74 of the Goods and Service Tax Act, 2017. Referring to the judgment of the Supreme Court in Radha Krishan Industries v. State of H.P. and its earlier judgment in R.D. Enterprises v. Union of India, the bench of Justice Shekhar B....

Allahabad High Court Issues Notice On Plea Challenging S.127 CGST Act Over 'Unbridled' Power Given To Authorities To Impose Penalty On Assessee

Recently, the Allahabad High Court has issued notices to office of the Solicitor General of India and Advocate General, Uttar Pradesh in a writ petition challenging the validity of Section 127 of the Central and State Goods and Service Tax Act, 2017. Section 127 of the Central and State Goods and Service Tax Act, 2017 empowers the proper officer to impose penalty when he is of the...

CCTV Footage Of Assessee's Family Cannot Be Used By GST Dept, Violates Right To Privacy: Delhi High Court

The Delhi High Court has issued directions safeguarding the right to privacy in GST search proceedings, stating that any family-related CCTV footage which violates the privacy of family members cannot be used or disseminated in any manner. “Some of the concerns which are raised by the Petitioners such as right to privacy of the family being violated, etc., deserve to be...

![[S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs [S.6 CGST Act] J&K&L High Court Upholds GST Show Cause Notices Based On Intelligence Inputs](https://www.livelaw.in/h-upload/2025/06/10/500x300_604075-sanjeev-kumar-sanjay-parihar.webp)