High Court

GST | Alleging Denial Of Hearing Insufficient If Assessee Itself Wasn't Diligent In Responding To SCN Or Attending Hearing: Delhi High Court

The Delhi High Court has refused to interfere with a demand order passed by the GST Department without hearing the assessee, after noting that the assessee itself was not diligent in responding to the show cause notice or attending the personal hearing despite notice.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Considering the fact that (i) The...

S.75(5) Of CGST Act Contemplates A Maximum Of Three Adjournments, Cannot Be Construed As A Minimum Of Three Hearings: Delhi High Court

The Delhi High Court has held that the provision of maximum three adjournments that can be granted to a taxpayer during the course of adjudication proceedings, cannot be construed to mean that the taxpayer must be given a minimum of three hearings.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“A perusal of Section 75(5) of the Central Goods and Service...

Assessee Can Seek Refund Of Unutilised ITC In Personal Bank Account If Business Is Shut Down: Calcutta High Court

Calcutta High Court recently directed the proper officer under the GST Act to consider ordering refund of the unutilised ITC of an Assessee to his personal bank account, as his business was closed and its GST registration stood cancelled.The Petitioner was aggrieved by a direction of the proper officer, though allowing the refund sanction to the tune of Rs. 68,66,238/- but, directing the...

Taxpayers Must Be Vigilant About Communications On GST Portal, Department Can't Be Blamed: Delhi High Court

The Delhi High Court has made it clear that if an assessee fails to respond to a show cause notice duly communicated to it on the GST portal, the Department cannot be blamed for passing an order raising demand, without hearing the assessee.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Since the Petitioner has not been diligent in checking the portal, no...

Restoration Of Cancelled GST Registration Permissible If Taxpayer Clears Dues And Files Returns: Gauhati High Court

The Gauhati High Court stated that the restoration of cancelled GST registration is permissible if the taxpayer clears dues and files returns. The Bench of Justice Sanjay Kumar Medhi observed that “proviso to sub-rule (4) of Rule 22 of the CGST Rules 2017 provides that if a person, who has been served with a show cause notice under Section 29(2)(c) of the CGST Act, 2017, is ready...

If SCN Is Issued Without GST Authority's Signature, Demand Order Can't Be Saved Even If It Is Signed: Jharkhand High Court

The Jharkhand High Court has made it clear that an order raising GST demand cannot be saved even if it is properly authenticated by the issuing authority, if the show cause notice preceding it was not signed.A division bench of Chief Justice M.S. Ramachandra Rao and Justice Rajesh Shankar was dealing with a Petitioner's grievance that Form GST DRC-01A issued to him under section 73(1) of...

Two Contradictory GST Orders On Same Allegations Not Sustainable: Kerala High Court

The Kerala High Court has stated that two contradictory GST orders on the same allegations are not sustainable, and the second order cannot exist if the first one already dropped the proceedings. The Bench of Justice Ziyad Rahman A.A. observed that the proceedings were dropped in the first order after accepting the explanation by the assessee, yet a second order was passed on the...

Amount Deposited Under Protest Can't Be Treated As Admission Of Tax Liability: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when a taxpayer deposits an amount “under protest”, it does not amount to an admission of tax liability.A Division Bench of Justice Tarlok Singh Chauhan and Justice Sushil Kukreja observed as follows; “Once the petitioner had deposited the amount 'under protest', the same could not have been considered to be an admission of liability because...

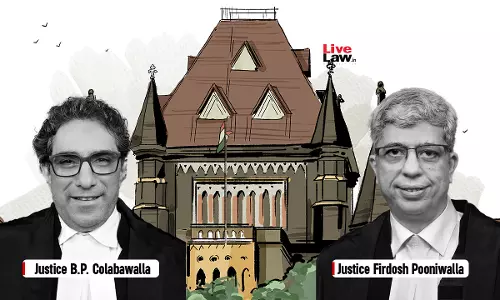

Design & Engineering Services To Foreign Entities Are Zero-Rated Supplies; Assessee Eligible For Refund Of Unutilized ITC U/S 54 Of CGST Act: Bombay HC

The Bombay High Court stated that design and engineering services to foreign entities are zero-rated supplies; assessee eligible for refund of unutilized ITC U/S 54 CGST. The Division Bench of Justices B.P. Colabawalla and Firdosh P. Pooniwalla observed that assessee is not an agency of the foreign recipient and both are independent and distinct persons. Thus, condition (v)...

GST | Separate Demands For Reversal Of Availed ITC & Utilisation Of ITC Is Prima Facie Duplication Of Demand: Delhi High Court

The Delhi High Court has observed that demand raised against an assessee qua reversal of availed Input Tax Credit (ITC) and qua utilisation of ITC prima facie constitutes double demand.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted liberty to the Petitioner-assessee to approach the Appellate Authority against such demand, and waived predeposit qua demand...

Omission Of Rule 96(10) Of CGST Rules Operates Prospectively But Applies To All Pending Proceedings: Gujarat High Court

The Gujarat High Court stated that omission of Rule 96(10) Of CGST Rules, 2017 operates prospectively but applies to all pending proceedings. The Division Bench of Justices Bhargav D. Karia and D.N. Ray was addressing the issue where a group of petitions have challenged the vires of Rule 96(10) of the Central/State Goods and Services Tax Rules, 2017 as substituted by the Central...

Cash Credit Account Cannot Be Treated As Property Of Account Holder Which Can Be Considered U/S 83 Of GST Act: Bombay High Court

The Bombay High Court stated that cash credit account cannot be treated as property of account holder which can be consider under Section 83 of GST Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that the phrase 'including bank account' following the phrase, “any property” would mean a non-cash-credit bank account. Therefore, a “cash credit...