High Court

Delhi High Court Finds No Similarity Between 'OPAL' and 'SHEOPAL'S' Mark, Denies Injunction to OPAL Cosmetics

The Delhi High Court has upheld a Commercial Court order refusing interim injunction to cosmetics brand OPAL, holding that its mark is not deceptively similar to “SHEOPAL'S,” a mark used by Sheopals Pvt. Ltd. (SPL), which also manufactures beauty and wellness products. Delivering judgment on November 26, 2025, a Division Bench of Justice C. Hari Shankar and Justice Om Prakash Shukla...

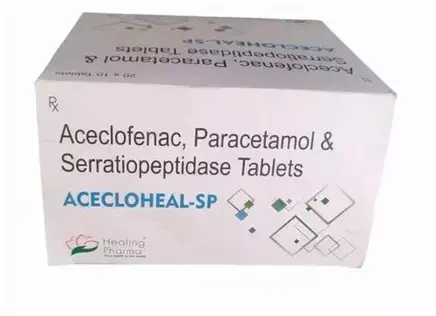

Drug Names Based On International Non-Proprietary Names Cannot Be Monopolised: Bombay High Court Reaffirms

The Bombay High Court has refused to grant an interim injunction to Aristo Pharmaceutical Pvt. Ltd. in its trademark infringement and passing-off suit against Healing Pharma India Pvt. Ltd., ruling that pharmaceutical companies cannot claim exclusivity over trademarks derived from International Non-Proprietary Names (INNs). Justice Sharmila U Deshmukh held that Aristo's registered...

Delhi High Court Protects Gaay Chhap Detergent, Restrains Use Of 'Gopal Gai Chhap' and 'Cow Brand' Marks

The Delhi High Court has granted an interim injunction in favour of Gaay Chhap, a Kanpur-based detergent brand, restraining a Uttar Pradesh trader from using the marks “Gopal Gai Chhap” , “Cow Brand,” and similar labels for detergent soaps, cakes, and washing powders. Justice Tejas Karia passed the order on November 24, 2025, after finding that Gaay Chhap had shown prior and...

Pre-CIRP Tax Claims Extinguished After Plan Approval, Bombay High Court Quashes Tax Notices To V Hotels

The Bombay High Court has recently reaffirmed that income-tax assessment proceedings for any period prior to the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) stand extinguished once the National Company Law Tribunal (NCLT) approves the plan, ruling that the tax department cannot initiate or continue such proceedings thereafter.A Division Bench of Justice B...

Delhi High Court Sets Aside Rejection Of Medilabo's Patent For Neurodegenerative-Disease Drug

The Delhi High Court has set aside a Patent Office order refusing Medilabo RFP's patent application for a pharmaceutical composition used in treating neurodegenerative diseases, holding that the authority rejected the application without examining the amended claims and without explaining how the invention fell within the bar on “methods of treatment” under Section 3(i) of the Patents...

Customs | Oral Waiver Of SCN Untenable In Law, Continued Detention Of Goods Illegal: Delhi High Court

The Delhi High Court has held that continued detention or seizure of goods by the Customs Department would be untenable in law, where the Show Cause Notice or the personal hearing have been waived via an oral waiver.A division bench of Justices Prathiba M. Singh and Shail Jain was dealing with a challenge to detention of Petitioner's gold chain weighing 54 grams.Briefly put, Petitioner...

Karnataka High Court Orders Refund Of ₹10 Crore, Says Payment During GST Search Was 'Not Voluntary' U/S 74(5) CGST Act

The Karnataka High Court held that the assessee's payment of Rs. 10 crores could not be treated as a voluntary payment under Section 74(5) of the CGST Act (Central Goods and Services Tax Act), as the DRC-03 shows 'NIL' entries for both interest and penalty. The bench observed that the 'NIL' entries clearly indicated that the payment was made by the assessee under coercion and...

Statement Made Before Customs Officer U/S 108 Customs Act Over Goods Seizure Not Admissible In Evidence: Delhi High Court

The Delhi High Court has held that statements made by an assessee to the Customs Department under Section 108 of the Customs Act 1962, upon seizure of its goods, is not admissible as evidence in court of law.“Statements under Section 108 would not be admissible in evidence,” said a division bench of Justices Prathiba M. Singh and Shail Jain.Section 108 deals with the power of customs...

Cannot Cancel GST Registration Without Passing Reasoned Speaking Order: Allahabad High Court

The Allahabad High Court has held that while cancelling GST registrations, authorities must pass reasoned and speaking orders. It held that doing otherwise would render the order unsustainable in the eyes of the law. “Once the impugned cancellation order has been passed without putting any proper notice or affording any opportunity of hearing to the petitioner, the same itself is...

S.110 Customs Act | Extension To Issue SCN Must Be Granted Before Expiry Of Initial Six-Month Period: Delhi High Court

The Delhi High Court has made it clear that the six-month extension contemplated under Section 110 of the Customs Act 1962 for issuance of a show cause notice after detention of goods by the Customs must be issued before expiry of the initial six-month window.For context, Section 110 deals with Seizure of goods. It stipulates that where any goods are seized, and no notice is given within...

Delhi High Court Clears 'SoEasy' Trademark For Hindi Learning Platform, Calls It Suggestive and Distinctive

The Delhi High Court has overturned the Trade Marks Registrar's refusal to register the mark “SoEasy” for a Hindi learning and testing platform, holding that the phrase is suggestive rather than descriptive and is therefore capable of trademark protection. The Court directed the Registrar to process the application for registration. In a judgment delivered on November 24, 2025, Justice...

Madras High Court Allows Udaipur Salon To Use 'Bounce', Rejects South Indian Chain's Appeal

The Madras High Court has dismissed appeals filed by Spalon India Private Limited, operator of the “BOUNCE” salon chain in South India, against an order vacating the interim injunction earlier granted in its favour over the use of the word “Bounce” by an Udaipur-based salon, “Bounce Salon & Makeover Studio.”A Division Bench of Justice G Jayachandran and Justice Mummineni...