High Court

Income Tax Reassessment Notice Generated On Last Day Of Limitation But Uploaded Next Day Due To Portal Glitch Is Time-Barred: Delhi HC

The Delhi High Court recently found time-barred, an income tax reassessment notice generated by the Department on the last day of the limitation window but, issued to the assessee only a day after.The limitation period in the case at hand expired on June 30, 2025 (inclusive).The Income Tax Department claimed that the notice was generated on June 30, 2025 at 21:14:46 and signed on June 30, 2025...

Madras High Court Revives Sreedevi Video's Dispute With Saregama Over Rights To Tamil, Telegu Film Music

The Madras High Court has revived a copyright dispute over the audio rights to iconic Telegu and Tamil films including Sagara Sangamam, Salangai Oli, Shankarabharanam and Sitara, holding that Sreedevi Video Corporation's claim seeking a permanent injunction against Saregama India Ltd must be examined on merits even though its request for a declaration of ownership is time-barred. On...

S.74(5) | GST Proceedings Can Be Closed On Payment Of 15% Pre-SCN Penalty Where Tax Already Deposited Prior To SCN: Delhi High Court

The Delhi High Court recently allowed Delhi Sales Corporation to deposit pre-SCN penalty contemplated under Section 74(5) of the Goods and Services Tax Act, despite issuance of show cause notice under Section 74(8).This, after a division bench of Justices Prathiba M. Singh and Shail Jain noted that the Petitioner-Corporation had already deposited tax and interest in terms of Section...

Reconsidering Cap On Value Of Gold Jewellery Permitted At Airports: CBIC To Delhi High Court

The Central Board of Indirect Taxes and Customs has informed the Delhi High Court that it is considering increasing the cap on the value of gold that can be carried by a person travelling to India by air.Currently, the Baggage Rules 2016 permit any jewellery of 20 grams with a value cap of Rs. 50,000/- in case of a man and 40 grams with a value cap of Rs. 1,00,000/- in case of a woman to...

Delhi High Court Grants Relief to Anantara Hotel Chain, Bars 'Club Anantara' From Using Its Mark

The Delhi High Court has recently restrained Club Anantara Suites and Retreat from using the marks “Anantara”, “Club Anantara” and related domain names after finding them deceptively similar to the trademarks of the luxury ANANTARA hotel chain. The ad-interim injunction, granted in favour of MHG IP Holding Singapore Pte Ltd., the entity that owns and manages intellectual property for...

Educational Consultancy Services For Foreign Universities Qualify As Export Of Service, Entitled To GST Refund: Delhi High Court

The Delhi High Court has held that foreign education consultancy services to students in exchange for admission based commission from foreign universities qualify as 'export of services'.A division bench of Justices Prathiba M. Singh and Shail Jain thus held that Global Opportunities Private Limited will be entitled to claim GST refund on export of services under Section 54 of the Central...

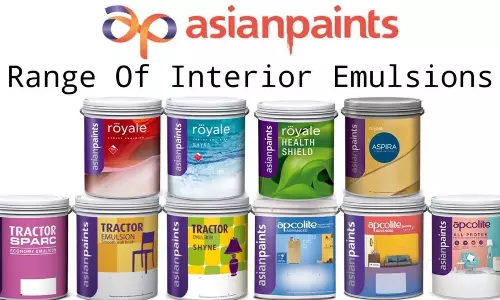

Bombay High Court Grants Interim Relief To Asian Paints, Restrains Competitor From Using Similar Marks

The Bombay High Court has temporaily restrained a rival paint and wall-putty manufacturer from using the marks “ASIANGOLD” and “SUPREME GLOSS” after finding that they infringe Asian Paints' registered trademarks and copyrighted artwork. A single bench of Justice Sharmila U Deshmukh confirmed an earlier ad-interim injunction on November 18, 2025, noting that manufacturer...

GST | Assessee Must Be Given Personal Hearing Since SCN Lacked Reasons: Delhi High Court Quashes Demand Against Stock Broker

The Delhi High Court has set aside the demand raised against a stock broker, noting that both the show cause notice as well as the final order were bereft of any reasons, disabling the broker to make effective representation.“It is seen that the SCN actually does not give any reasons…Even the impugned order does not give any reasons,” a division bench of Justices Prathiba M. Singh and...

Personal Criminal Liability Of Directors U/S 138 NI Act Survives Corporate Liquidation Under IBC: Himachal Pradesh High Court

The Himachal Pradesh High Court has reiterated that liquidation of a company under the IBC does not shield its directors from personal criminal liability in cheque bounce cases under Section 138 of the Negotiable Instruments Act, 1881(“N.I Act”) “15. ….Therefore, the orders passed by the learned Trial Court ordering the continuation of the proceedings against accused nos. 2 and...

Arbitrator Is The Master of Evidence; Court In Appeal Cannot Reassess Facts: Delhi High Court

The Delhi High Court has recently reiterated that an arbitrator is the master of both the quantity and quality of evidence, and therefore the court, while exercising appeal or supervisory jurisdiction, cannot reappreciate factual findings recorded in an arbitral award. The court emphasized that it does not sit as a court of appeal over the findings of the learned Arbitrator and its role...

Suspension Of State Tax Officer For Delayed Report Unjustified When Authority Failed To Act In GST Fraud Case: Allahabad High Court

The Allahabad High Court has held that where loss is caused to the State, a State Tax Officer may not be suspended for mere delay in submitting a report. Justice Vikas Budhwar held that this would be especially impermissible in a case where the authority to act on the report in time chooses not to do so.He held that, despite the fact that the petitioner submitted the report with delay,...

GST Authorities Cannot Assume Jurisdiction For Passing Adverse Orders For Work Concluded Under VAT Regime: Allahabad High Court

The Allahabad High Court has held that GST Authorities cannot claim jurisdiction for levying tax, penalty, and interest on work that was concluded prior to the implementation of the GST Act. Notices were issued to the petitioner, a work contractor, for the Financial Year 2018-19 under the GST Act. The petitioner was unable to reply to the notices in time. Consequently, an ex-parte...