High Court

Delhi High Court Bars Former Distributor from Selling CREED Perfume, Awards Rs 37.42 Lakh in Damages

The Delhi High Court has granted a permanent injunction in favor of Fontaine Limited, owner of the luxury perfume brand CREED, restraining a former distributor from selling CREED products or using the CREED trademark after the expiry of their distribution agreement. The court also awarded Fontaine damages of Rs 37.42 lakh and legal costs of Rs 7.97 lakh for the unauthorized use of the...

Centre Cannot Retain Wrongly Paid IGST Once Correct Tax Is Paid To State GST Authorities: Karnataka High Court

The Karnataka High Court has held that the Centre cannot retain wrongly paid IGST (Integrated Goods and Services Tax) once the correct tax is paid to the State authorities. Justice S.R. Krishna Kumar observed that since the assessee had wrongly paid IGST and later paid the correct tax to the State GST, the Central government must refund IGST to the assessee....

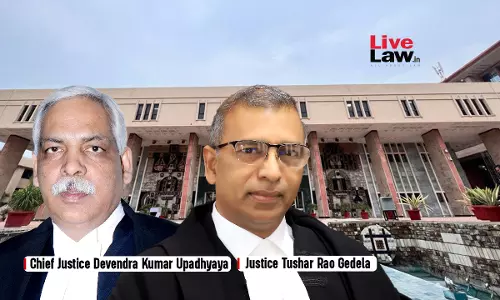

Tariff During Registration Was To Remain Fixed For 25 Years; CSPDCL Waived Its Rights: Delhi High Court Allows IREDA's Appeal Over GBI Scheme

The Delhi High Court Bench of Chief Justice and Justice Tushar Rao Gedela has observed that under the Generation Based Incentive Scheme (GBI) Scheme, 2010 by Ministry of New and Renewable Energy, the tariff at the time of registration of project would remain constant for a period of 25 years and any upward revision of tariff by State Electricity Regulatory Commissions (“SERC”) from...

Contractor Can Claim Increased GST During Work, Even If Bills Were Paid Before Rates Increased: Kerala High Court

The Kerala High Court has held that a contractor can claim increased GST (Goods and Services Tax) during work, even if bills were paid before the rate increase. Justice Ziyad Rahman A.A. opined that at the time of execution of the contract, the rate was only 5% and the increase took place during the execution of the work. Thus, the assessee is entitled to a differential amount of tax....

Delhi High Court Restrains Websites Enabling Illegal Downloads Of Saregama India's Copyrighted Music

The Delhi High Court has recently restrained several online sites that facilitate “stream-ripping” (illegal downloading) of music, barring them from downloading, reproducing, or distributing copyrighted songs and recordings owned by Saregama India Limited. The injunction will remain in effect until February 27, 2026.The order was passed by Justice Tejas Karia on November 10, 2025, in a...

Suspension Of Proceedings By Arbitrator For Non-Payment Of Revised Fees Amounts To Effective Withdrawal From Office: Bombay High Court

The Bombay High Court held that an arbitrator who suspended the proceedings indefinitely on the ground of non-payment of revised fees and thereafter failed to conduct hearings must be deemed to have withdrawn from office under section 15 of the Arbitration and Conciliation Act, 1996 (Arbitration Act). The court further held that the arbitrator's mandate had also expired by efflux of...

Delhi High Court Rejects FMC's Plea to Block Natco Insecticide Over Patent Dispute

The Delhi High Court on Monday dismissed an application by FMC Corporation seeking to restrain Natco Pharma Limited from manufacturing and selling its insecticidal product “Cyantraniliprole 10.26% OD.” FMC alleged that Natco's product used a chemical intermediate covered by Claim 12 of its patent IN'645, which is set to expire on December 6, 2025.A sinhle bench of Justice Mini...

Kerala High Court Directs GST Department To Ensure No Tax Evasion In Frozen Chicken Sale

Disposing of a writ petition alleging that frozen chicken was being sold at 0% GST instead of the applicable 5%, the Kerala High Court recently directed the GST department to ensure that no tax evasion takes place. Justice Ziyad Rahman A.A. also noted that the State GST Department was already investigating the matter. Hence, the Court disposed of the writ petition filed by the...

Invention Requiring Destruction Of Human Embryos Not Patentable: Calcutta High Court

The Calcutta High Court on Monday upheld the Patent Office's rejection of a patent application on the grounds that the invention involved the destruction of human embryos and was therefore unethical and contrary to public order and morality.A single bench of Justice Ravi Krishan Kapur, affirming the Patent Office's decision to reject the invention under Section 3(b) of the Patents Act,...

Delhi High Court Refuses To Waive Pre-Deposit For Customs Brokers' Appeal Against ₹30 Crore Penalty, Says They 'Misused' License

Stating that Customs Brokers have a significant responsibility under the Customs Act, the Delhi High Court refused to waive the pre-deposit for appeal by certain Customs Housing Agents against ₹30 crore penalty imposed upon them over import fraud.A division bench of Justices Prathiba M. Singh and Shail Jain observed,“The clear position is that the Customs Brokers have a...

S.74 Finance Act Cannot Be Invoked To Seek Redetermination Of Service Tax Liability: Bombay High Court

On November 14th, 2025, the High Court of Bombay at Aurangabad dismissed a writ petition filed by M/s Suman Construction (“assessee” hereinafter), a government-registered civil contractor, which had challenged the service tax demand raised on road construction works for government departments. The principal issue before the Court was whether the assessee could invoke...

Award Holder Cannot Claim Compound Interest When Tribunal Grants Only Simple Interest In Arbitral Award: Meghalaya High Court

The Meghalaya High Court set aside an order of the Commercial Court, Shillong which had accepted the calculation of the award holder's method of calculating interest and directed Power Grid Corporation of India Ltd. (PGCIL) to pay the remaining amount under an arbitral award. The Court held that the Executing Court had effectively modified the award by permitting computation of...