High Court

Delhi High Court Sets Aside Reassessment Order Against Vedanta; Orders Fresh Consideration After GST Case Over Alleged ₹424-Crore ITC Fraud Closed

In granting relief to Vedanta Limited, the Delhi High Court has set aside an order of the the Income Tax Department for initiation of reassessment action against the Copper manufacturer, over alleged fraudulent availment of Input tax credit worth over ₹424 Crore.A division bench of Justices Prathiba M. Singh and Shail Jain observed that the GST Department had already closed the...

Bombay High Court Restrains Local Retail Shop From Infringing 'The Body Care' Mark

The Bombay High Court has temporarily restrained a Mumbai-based retail store from using the name “The Body Care Shop”, ruling that it infringes the registered trademark “The Body Care”, owned by a city-based cosmetics business.A single bench of Justice Sharmila U Deshmukh delivered the order on November 7, 2025, in response to a trademark infringement and passing off petition filed by...

Arbitration Agreement Is Valid Even Without Signature If Parties Acted Upon It: Kerala High Court

The Kerala High Court held that written agreement need not to be signed by the parties if the consensus ad idem and intention to arbitrate is reflected from the conduct of the parties and documentary evidence. Justice S. Manu allowed the application seeking reference to arbitration holding that an arbitration agreement in writing may exist even without signatures provided there is a...

Typographical Error In Title Of Arbitral Award Can Be Corrected Beyond 30 Days If Caused By Tribunal's Mistake: Delhi High Court

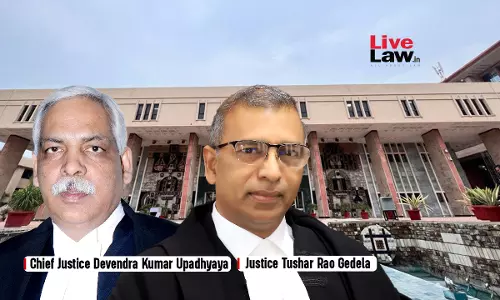

The Delhi High Court held that a clerical or typographical error in the title of an arbitral award can be corrected even after 30 day limitation period provided under section 33 of the Arbitration Act if the mistake originated from the tribunal itself and not from the parties. The Division Bench comprising Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela...

Bombay High Court Restrains Surat Company From Using German Entity's 'PETROFER' Mark

The Bombay High Court has granted an interim injunction in favour of German lubricant manufacturer Petrofer Chemie H.R. Fischer GmbH & Co. and its Indian licensee Hardcastle Petrofer Private Limited, restraining United Petrofer Limited, a Surat-based company, from using the mark 'PETROFER'. A single bench of Justice Arif S Doctor passed the order on November 6, 2025, while deciding...

Conduct Inter-Ministerial Consultation On Whether Import Of Massagers/Sex Toys Is Allowed Or Not: Delhi High Court Tells CBIC

The Delhi High Court has directed the CBIC (Central Board of Indirect Taxes and Customs) to conduct inter-ministerial consultation in respect of coming up with a uniform policy permitting or prohibiting the import of products declared as 'body massagers' or sex toys. The bench opined that the question as to whether any product is obscene or not cannot, obviously, be left at the...

Private Hospitals Liable To Pay VAT On Supply Of Medicines & Implants To In-Patients: Gujarat High Court

The Gujarat High Court has held that the supply of medicines and implants by private hospitals to in-patients amounts to 'deemed sale' and is liable to VAT (Value Added Tax). The issue before the bench was whether the supply of medicines, stents, implants, consumables, etc., during the course of treatment of patients amounts to 'sale' as defined in section 2(23) of the VAT...

Working Men/Women's Hostels Are Residential Properties, Cannot Be Taxed At Commercial Rates: Madras High Court

The Madras High Court has recently ruled that hostels providing accommodation to working men and women are residential properties and, therefore, property tax, water tax, and electricity charges cannot be levied at commercial rates. The ruling came in response to petitions filed by hostel owners in Chennai and Coimbatore challenging Chennai municipal authorities and the Chennai Metropolitan...

CENVAT Rules Cannot Apply Retrospectively To Concluded MODVAT Proceedings: Allahabad High Court

Recently, the Allahabad High Court has held that where proceedings under the MODVAT (Modified Value Added Tax) Scheme had concluded prior to the introduction of the CENVAT (Central Value Added Tax) Rules, it would not be open to the revenue department to issue fresh notices against the assessee under the new scheme. The MODVAT scheme, allowing manufacturers a tax credit on input duties,...

Multiple Agreements Forming Part Of Same Commercial Project Can Be Referred To Single Arbitration: Gujarat High Court

The Gujarat High Court recently held that various agreements entered into between the parties forming part of the same commercial project can be referred to Arbitration, and one arbitrator can be appointed to adjudicate all the disputes arising from the various agreements. The Bench of Chief Justice Sunita Agarwal, while hearing a petition u/s 11 of the A&C Act, moved by...

Arbitral Award Without Corroboration Of Claim Certificate Patently Illegal: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when there is no appearance of a qualified person to corroborate the claim certificate, the arbitral award suffers patent illegality.A Division Bench of Chief Justice G.S. Sandhawalia and Justice Ranjan Sharma remarked that: “In the absence of corroboration of the certificate… and any qualified person putting in appearance, the award of...

Delhi High Court Restrains Patanjali from Broadcasting 'Dhoka' Chyawanprash Ad in Dabur's Plea

The Delhi High Court has barred Patanjali Ayurved from airing an advertisement that labeled all other Chyawanprash products as “dhoka” (deception), ruling that it constitutes commercial disparagement. The restriction will remain in place until the next hearing on February 26, 2026. The court also directed Patanjali to remove, block, or disable the advertisement across all platforms within...