High Court

Input Tax Credit Can't Be Blocked If Credit Balance Is Nil: Bombay High Court

The Bombay High Court on Tuesday held that Input Tax Credit (ITC) cannot be blocked under Rule 86-A of the Central Goods and Services Tax Rules, 2017, if the electronic credit ledger of a taxpayer shows a nil balance on the date of the blocking order. A Division Bench of Justice M S Sonak and Justice Advait M Sethna observed, “Therefore, on a plain reading of the rule, if on...

Delhi High Court Drops Suo Moto Contempt Action Against Income Tax Officer For Allegedly Passing Unreasoned Order

The Delhi High Court has dropped the civil contempt proceedings initiated against a Principal Commissioner of Income Tax (now retired) six years ago, for alleged wilful disobedience of its order to give reasons for insisting an assessee to deposit 20% demand in appeal.The proceedings were initiated suo moto in 2019 on a prima facie opinion but on a closer scrutiny, Justice Vikas Mahajan now...

[Arbitration Act] Limitation For Filing S.11 Application To Be Calculated From Date Of S.21 Notice, Not From Date Of Dispute: Rajasthan HC

The Rajasthan High Court, Jaipur Bench, has held that the limitation for filing a Section 11 application under the A&C Act would be calculated from the date of serving the Section 21 notice to the other side and not from the date when the cause of action had arisen. The bench of Justice Anoop Kumar Dhand was hearing a Section 11 application praying for the appointment of...

Customs | FERA Penalty U/S 50 Not Applicable For Export Shortfall Below 10%; Exporter Can Write-Off Unrealised Bills: Madras High Court

The Madras High Court stated that the FERA (Foreign Exchange Regulation Act) penalty under Section 50 is not applicable for export shortfall below 10%; the exporter can write off unrealised bills. Justices S.M. Subramaniam and C. Saravanan stated that even otherwise, since Section 18(1)(a) of the Foreign Exchange Regulation Act is to be read along with Section 18(2) and Section 18(3)...

Income Tax Act | Assessee Can Challenge Cash Credit Addition U/S 68 In Remand Proceedings; Tribunal's Direction Not Binding: Kerala High Court

The Kerala High Court held that the assessee is free to challenge the cash credit addition under Section 68 of the Income Tax Act in remand proceedings; the tribunal's directions are not binding. As per Section 68 of the Income Tax Act, 1961, any sum found credited in the books of a taxpayer, for which he offers no explanation about the nature and source thereof or the...

[Finance Act] Retrospective Abolition Of ITSC Doesn't Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court

The Delhi High Court has held that the Finance Act 2021, which retrospectively abolished the Income Tax Settlement Commission (ITSC), responsible for enabling compromise between the state and its tax payers, cannot create a void.For context, the Finance Act 2021 envisaged replacing the ITSC with a body known as the Interim Board of Settlements from 01.02.2021. However, the Act came into force...

Delhi High Court Asks GST Appellate Tribunal To Examine 'Profiteering' Allegations Against Tata Play

The Delhi High Court recently asked the GST Appellate Tribunal to re-look into the profiteering allegations levelled against DTH services provider Tata Play.The direction was made by a division bench comprising Justices Prathiba M. Singh and Shail Jain while dealing with the company's appeal against the show cause notice and consequential order passed against it by the erstwhile...

[Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court

The Rajasthan High Court Jaipur Bench has held that a Section 11 petition under the A&C Act without issuing the notice invoking arbitration (“NIA”) u/s 21 of the A&C Act would be maintainable if the Respondents were aware of the dispute being referred to arbitration. The bench noted that the Respondents were well-versed in the dispute raised by the Petitioner. They could...

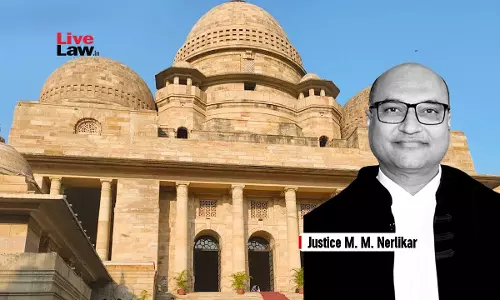

Prior IBC Proceedings Don't Bar Criminal Prosecution Of Directors Under S. 138 Negotiable Instruments Act: Bombay High Court

The High Court of Bombay, Nagpur Bench, comprising Justice M.M. Nerlikar, has held that the prior initiation of IBC proceedings does not bar criminal prosecution of directors under section 138 of the Negotiable Instruments Act. Background of the Case The petitioner extended a short-term loan of Rs. 15 lakhs to the respondent through its directors. A post-dated cheque was issued as...

Power Of High Court To Extend Arbitrator's Mandate Is “Co-Extensive” With Power To Appoint Arbitrator: Calcutta HC

The Calcutta High Court has held that when an arbitrator is appointed by the High Court under section 11 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), an application under section 29A(4) seeking extension of the mandate of the arbitrator can be entertained by the High Court only and not by the Principal Civil Court or Commercial Court having territorial jurisdiction...

Income Tax | Rajasthan High Court Quashes Repeated Orders To Transfer Case, Calls Revenue's Approach 'Rigid' & 'Adamant'

The Rajasthan High Court has come down heavily on the Revenue Department for being “rigid and adamant” to transfer the case of the petitioner from Udaipur to Delhi under Section 127 of the Income Tax Act, 1961, despite the coordinate bench's earlier decision that quashed the same order.Section 127 of the Act empowers the income tax authorities to transfer a case from one Assessing officer...

Pre-Show Cause Notice Consultation Not An Empty Formality, Mandatory When Demand Is Over ₹50 Lakhs: Bombay High Court

The Bombay High Court has held that pre-show cause notice consultation is not an empty formality; mandatory before the show cause notice (SCN) in demands above Rs. 50 lakhs. The question before Justices M.S. Sonak and Advait M. Sethna was whether a pre-consultation notice would be mandatory before issuing show cause notices where the tax demand exceeds Rs. 50 Lakhs. The bench...

![[Arbitration Act] Limitation For Filing S.11 Application To Be Calculated From Date Of S.21 Notice, Not From Date Of Dispute: Rajasthan HC [Arbitration Act] Limitation For Filing S.11 Application To Be Calculated From Date Of S.21 Notice, Not From Date Of Dispute: Rajasthan HC](https://www.livelaw.in/h-upload/2023/05/28/500x300_474032-justice-anoop-kumar-dhand.webp)

![[Finance Act] Retrospective Abolition Of ITSC Doesnt Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court [Finance Act] Retrospective Abolition Of ITSC Doesnt Nullify Settlement Applications Filed Between Feb 1 To Mar 31, 2021: Delhi High Court](https://www.livelaw.in/h-upload/2020/02/05/500x300_369852-delhi-high-court-intervenes-in-the-control-of-experiments-on-animals.jpg)

![[Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court [Arbitration Act] S.11 Application Is Maintainable Even Without Notice U/S 21 If Other Party Is Aware Of Dispute: Rajasthan High Court](https://www.livelaw.in/h-upload/2024/04/09/500x300_533108-rajasthan-high-court-jaipur-bench-1.webp)