High Court

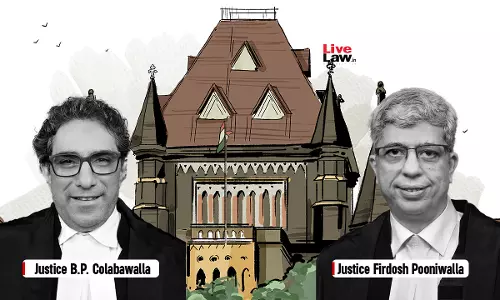

Income Tax | Interest On Fixed Deposits, TDS Refund Linked To Business Qualifies For S. 80IA Deduction: Bombay High Court

The Bombay High Court held that interest on fixed deposits, TDS refund linked to business qualifies for deduction under Section 80IA of the Income Tax Act. Section 80IA of the Income Tax Act, 1961 provides tax incentives for businesses operating in certain sectors such as infrastructure, power, and telecommunications. Justices B.P. Colabawalla and Firdosh P. Pooniwalla...

Executing Court Empowered To Grant Statutory Interest Not Mentioned In Award U/S 36 Of Arbitration Act: Allahabad High Court

Following the judgment of the Delhi High Court in Union of India and Anr. v. Sudhir Tyagi, the Allahabad High Court has held that under Section 36 of the Arbitration and Conciliation Act, 1996, the Executing Court is empowered to grant statutory interest which may not have been mentioned in the arbitral award.In Union of India and Anr. v. Sudhir Tyagi, it was held that “..the interpretation...

Dismissal Of Plea U/S 8 Of A&C Act Amounts To Res Judicata; S.11 Court Cannot Refer Parties To Arbitration: Delhi High Court

The Delhi High Court bench of Justice Purushaindra Kumar Kaurav, while dismissing a Section 11 petition under the A&C Act, observed that dismissing a Section 8 application under the A&C Act amounts to res judicata. The Section 11 Court cannot refer the parties to Arbitration if the order dismissing Section 8 is not set aside or interfered with. A Collaboration Agreement...

GST Dept Can't Probe Misuse Of GSTIN By Third Party, Power Lies With Economic Offences Wing: Delhi High Court

The Delhi High Court has made it clear that allegations of misuse of a trader's GST identification number by a third party cannot be probed by the GST Department.A division bench of Justices Prathiba M. Singh and Shail Jain observed,“Section 132 of the CGST Act, 2017 provides for certain offences which the GST Department can take cognizance of. However, the allegation here is that the...

Filing Application U/S 10 Of Commercial Courts Act With S.34 Petition Fulfills Requirements U/S 34 Of A&C Act: Rajasthan High Court

The Rajasthan High Court Bench of Justices Sanjeev Prakash Sharma and Chandra Prakash Shrimali has held that merely if an application filed under Section 10, Commercial Courts Act (“CCA”) does not mention Section 34, Arbitration and Conciliation Act (“ACA”) in the heading, it does not mean that the application cannot be treated as an application under Section 34, ACA....

'Mere Prospect Of Filing Review Not Grounds To Hold Seized Goods': Delhi High Court Orders Customs To Release Woman's Gold Jewellery

The Delhi High Court has granted relief to a Muslim woman whose gold bangles were seized by the Customs Department on return from Mecca and were withheld despite an order of the Adjudicating Authority, directing release.A division bench of Justices Prathiba M. Singh and Shail Jain observed that merely because the Department plans to seek a review of the order for return, as upheld by...

Department Can't Withhold Refund In Terms Of S.54(11) GST Act Unless Appeal Against Refund Order Is Filed: Delhi High Court

The Delhi High Court has made it clear that the power to withhold refund under Section 54(11) of the Central Goods and Service Tax Act 2017 cannot be exercised by the Department in absence of an appeal against the refund order.The provision stipulates that where an order giving rise to a refund is the subject matter of an appeal and the Commissioner is of the opinion that grant of such refund...

Officer Appointed Under State GST Act Is Authorised To Discharge Duties As Proper Officer For IGST & CGST: Allahabad High Court

The Allahabad High Court has held that an officer appointed under the State Goods & Service Tax Act will be Proper Officer under the Integrated Goods & Service Tax Act as well as the Central Goods & Service Tax Act. Perusing Section 4 of the IGST Act read with rule 20 of the CGST Act, Justice Piyush Agrawal held that “The provision provides that the Officer...

Govt Notifications Imposing Restrictions On Usage In Contracts For Supply Of Gas Are Laws Under Article 12, Must Be Complied With: Delhi HC

The Delhi High Court, while dismissing a Section 34 petition, observed that the five contracts entered into between the parties were subject to the restrictions imposed by the Government. By providing the gas at a subsidised price, the Government has the authority to regulate the use of such gas. The bench of Justice Subramonium Prasad held that the Ministry of Petroleum and Natural...

'Total Non-Application Of Mind': Delhi High Court On Dept's Rejection Of Trader's Plea For GST Cancellation, Subsequent Cancellation Order

The Delhi High Court recently expressed its disapproval with the GST Department for rejecting a trader's application for retrospective cancellation of his GST registration on medical grounds, and later cancelling his registration with retrospective effect.Stating that this approach reflects a “complete non-application of the mind”, a division bench of Justices Prathiba M. Singh and Shail...

Non-Signatory Must Have Live & Proximate Connection To Arbitration Agreement For Being Pulled Into Proceedings U/S 9 Of A&C Act: Telangana HC

The Telangana High Court Division Bench comprising of Justice Moushumi Bhattacharya and Justice B.R. Madhusudhan Rao has observed that for being pulled into the proceedings u/s 9 of the Arbitration & Conciliation Act, a non-signatory must have a live and proximate connection to arbitration agreement. The bench observed that the law has pushed the boundaries to pull in non-signatories...

Import Of Counterfeit iPhones Dilutes Brand Equity, Affects Consumer Welfare: Delhi High Court In Customs Fraud Case

The Delhi High Court has expressed concern over alleged import of counterfeit iPhones, stating that such imports not only affect brand owners but also adversely affect consumer welfare— as old and used products could get re-branded as new ones.A division bench of Justices Prathiba M. Singh and Shail Jain thus observed,“Consumers in India may be made to pay more for used, second hand...