High Court

Insolvency Resolution Professional Is Public Servant, Sanction Needed To Prosecute Him Under Prevention Of Corruption Act: Madras High Court

The Madras High Court has recently directed the Insolvency and Bankruptcy Board of India to consider granting sanction for prosecuting a Resolution Professional for allegedly mismanaging funds of a company during a resolution process. Justice Bharatha Chakravarthy noted that the resolution professional performed duties in connection with the administration of justice, was a person...

Interim Injunction U/S 9 Of Arbitration Act Cannot Be Granted To Prevent Convening Of Meeting For Removal Of Director: Delhi High Court

The Delhi High Court bench of Justices Anil Kshetarpal and Harish Vaidyanathan Shankar has observed that an interim injunction under section 9, Arbitration and Conciliation Act, 1996 (“ACA”) cannot be granted to prevent convening of extraordinary general meeting for removal of a director as it effectively amounts to grant of final relief and impinges upon statutory powers conferred to...

Limitation To Claim GST Refund Begins From Date Of Correct Tax Payment: Patna High Court

The Patna High Court held that limitation for GST refund in wrong head ceases computed from correct payment date. Justices Rajeev Ranjan Prasad and Shailendra Singh after reading Section 77 of the CGST Act, 2017 read with Section 19 of the IGST Act opined that the relevant date for counting the period of limitation would start from the date when the assessee had deposited the tax...

Timeline Prescribed For Filing Statement Of Defence Under Rule 18(3) Of Indian Council Of Arbitration Rules Is Directory In Nature: Delhi HC

The Delhi High Court bench of Justice Manoj Jain has held that the timeline prescribed under Indian Council of Arbitration Rules, 2024 for filing a Statement of Defence by the respondent is directory in nature and can be extended by the Arbitral Tribunal if a sufficient cause is established. The Petitioner challenges an order passed by the Arbitral Tribunal by which it declined to...

Export Incentives Can't Be Denied For Inadvertent Error In Shipping Bill: Karnataka High Court

The Karnataka High Court held that export incentives can't be denied for inadvertent error in shipping bill. The bench opined that …..there are situations where the assessee by inadvertence or even otherwise has uploaded certificate/forms or returns which contains some errors which would require correction. The said correction or amendment cannot be denied on the basis...

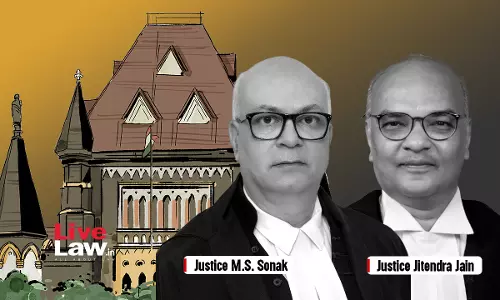

No Sales Tax On HDPE Bags Used To Pack Cement When Sold Separately: Bombay High Court

The Bombay High Court stated that no sales tax can be levied on HDPE (High-Density Polyethylene) bags at cement rate when sold separately. Justices M.S. Sonak and Jitendra Jain were addressing the issue of whether there is an express and independent contract on the sale of HDPE bags in which cement is packed. “HDPE bags used to pack the cement were a distinct commodity with its...

[S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court

The Allahabad High Court has held that under Section 169 of the Central Goods and Service Tax Act, 2017 service on registered email is sufficient service for the purpose of limitation. It held that holding that service was to be made by more than one modes would be absurd and defeat the purpose of the provision. The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar...

Post-Termination Restrictive Covenants In Employment Contracts Are Void U/S 27 Of Contract Act: Delhi High Court

The Delhi High Court bench of Justice Jasmeet Singh has held that post-service restrictive covenants in employment contracts, which operate after cessation of employment, are void and are not enforceable under Section 27 of the Indian Contract Act, 1872 (“Contract Act”) and violate Article 19(1)(g) of the Constitution. The court vacated the injunction granted in an...

Consideration Paid To Foreign Company For Use Of Computer Software Not 'Royalty', No TDS Liability: Delhi High Court

The Delhi High Court has reiterated that consideration paid by an Indian entity to a foreign company for the resale/ use of their computer software is not 'royalty'.A division bench of Justices V. Kameswar Rao and Vinod Kumar thus held that the Indian entity is not liable to deduct TDS in such cases.The bench in this regard relied on Engineering Analysis Centre of Excellence Pvt. Ltd. v....

Income Tax | Interest Earned On Surplus Lending Funds Is Attributable To Banking Business, Qualifies For 80P Deduction: Calcutta High Court

The Calcutta High Court stated that interest earned on surplus lending funds is attributable to banking business, qualifies for 80P deduction under Income Tax Act. Section 80P of the Income Tax Act, 1961 provides 100% tax deductions to cooperative societies for income from specified activities. These activities commonly include marketing agricultural produce, purchasing...

OYO Approaches Delhi High Court Challenging Arbitral Award In Co-Working Space Lease Dispute Against Lenskart

Oyo has filed a section 34 petition before the High Court of Delhi, challenging a few portions of an arbitral award passed in the dispute between Oyo and Lenskart (“Oyo Hotels and Homes Pvt Ltd v. Lenskart Solutions”) pertaining to the termination of a co-working space lease during the COVID-19 pandemic. In the arbitral proceedings, Oyo was partially successful and has filed the...

Parties' Decision To Transact Goods In 'Sound Condition' Prevails Over Prior Agreement To Transact On 'As Is Where Is' Basis”: Delhi HC

The Delhi High Court bench of Justices Anil Kshetarpal and Justice Harish Vaidyanathan Shankar while upholding an arbitral award has observed that if the parties had agreed to transact goods on 'as is where is' basis in the tender document but agreed in the acceptance letter that the goods would be transacted on 'sound condition' basis, then the earlier agreement will stand substituted...

![[S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court [S.169 CGST Act] Service On Registered Email Is Sufficient For Calculating Limitation Period: Allahabad High Court](https://www.livelaw.in/h-upload/2024/08/16/500x300_556088-gst.webp)