High Court

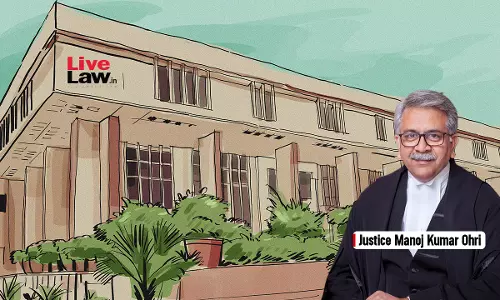

Liquidated Damages Clause Does Not Permit Automatic Recovery Of Full Amount, Actual Loss Must Be Proven: Delhi High Court

The Delhi High Court bench of Justice Manoj Kumar Ohri has held that the law mandates proof of actual loss despite the presence of an Liquidated Damages (LD) clause and does not allow automatic recovery of the entire LD amount upon breach. Therefore, the Petitioner's unilateral adjustment without adjudication was unlawful. The AT rightly held that such unilateral recovery does not obviate...

Limitation Act Applies To Proceedings Under Interest On Delayed Payments To Small Scale & Ancillary Industrial Undertakings Act: Telangana High Court

The Telangana High Court bench of Justice P. Sam Koshy and Justice N. Tukaramji have held that the provisions of the Limitation Act, 1963 are applicable to proceedings initiated under the Interest on Delayed Payments to Small Scale and Ancillary Industrial Undertakings Act, 1993. The Court clarified that the overriding effect under Section 10 of the 1993 Act applies only to the express...

No Equity In Taxation Law: Himachal Pradesh High Court On Tax Liability Of Auction Purchaser

Himachal Pradesh High Court held that an auction Purchaser is liable to pay the outstanding taxes on vehicles acquired through auction. It stated that there is no equity in taxation law and equity would only come into play in case there is no law operating in the field.Justice Tarlok Singh Chauhan & Justice Sushil Kukreja: “It is more than settled that there is no equity in taxation law...

Limitation U/S 34(3) Of Arbitration Act Begins From Date Of Receipt Of Award When Delivery Is Undisputed: Rajasthan High Court

The Rajasthan High Court bench of Justices Avneesh Jhingan and Bhuwan Goyal has held that when the delivery of the arbitral award at the registered address is not disputed, the limitation period under Section 34(3) of the Arbitration Act cannot be suspended on the ground that the appellant became aware of the award at a later date. The limitation period must be computed from the...

Arbitration Clause Prevails Over Exclusive Jurisdiction Clause, Court At Designated Seat Retains Jurisdiction: Delhi High Court

The Delhi High Court bench of Justice Purushaindra Kumar Kaurav has held that when an exclusive jurisdiction clause is expressly made "subject to" the arbitration clause, and the arbitration clause designates a different territorial location as the seat of arbitration, the arbitration clause prevails. In case of conflict, the jurisdiction of the court is determined by the seat...

'Industrial Building' Not Limited To Manufacturing Units, Can Include IT & Software Offices For Purposes Of Property Tax: Delhi High Court

The Delhi High Court has held that the scope of an 'Industrial Building' cannot be restricted merely to traditional notions of manufacturing involving tangible and physical goods.Justice Purushaindra Kumar Kaurav rather held that an 'Industrial Building' encompasses IT sector businesses where non-material inputs such as data, digital content, or intellectual capital are subjected to...

Plea Of Waiving Arbitration Clause Cannot Be Examined By Referral Court U/S Of 8 A&C Act, Falls Within Domain Of Tribunal: Delhi High Court

The Delhi High Court bench of Justice Purushaindra Kumar Kaurav while allowing an application under Section 8, Arbitration and Conciliation Act, 1996 (“ACA”) has observed that the plea of waiver of arbitration clause is a plea concerning rights in personam and does not render the dispute to be manifestly non-arbitrable. Consequently, the determination of such a plea properly...

Director Of Govt Dept Ineligible To Act As Arbitrator In Dispute Between Dept & Other Party Due To Bar U/S 12(5) Of A&C Act: HP High Court

The Himachal Pradesh High Court bench of Justices Tarlok Singh Chauhan and Sushil Kukreja has held that the statutory bar under subsection (5) of Section 12 of the Arbitration Act applies squarely, as the Director, Department of Digital Technologies and Governance, cannot be considered an independent and impartial arbitrator due to his potential role as a consultant or advisor...

Disallowance U/S 143(1)(a) Of Income Tax Act Inapplicable When Issue Involved Is Pending Before Supreme Court: Chhattisgarh High Court

The Chhattisgarh High Court has held that an Assessing Officer (AO) cannot apply Section 143(1)(a) of the Income Tax Act, 1961 (the 1961 Act), to disallow a claim where the issue involved, such as the deductibility of employees' contributions to EPF/ESI under Section 36(1)(va), was pending consideration before the Supreme Court in Checkmate Services Pvt. Ltd. v. CIT [(2023) 6 SCC 451].In...

Original Claim Can Be Amended At Argument Stage In Arbitration Proceedings, Provisions Of CPC Do Not Apply Strictly: Calcutta High Court

The Calcutta High Court bench of Justice Shampa Dutt (Paul) has held that an amendment to the original claim may be permitted during arbitral proceedings, even at the stage of final arguments, particularly when costs have been imposed on the party seeking the amendment and accepted by the opposite party—provided the amendment does not materially alter the nature of the original claim...

No Fixed Format For Sending Notice U/S 21 Of A&C Act, Outlining Clear Intention To Adopt Arbitration Is Sufficient: Delhi High Court

The Delhi High Court bench of Justice Jasmeet Singh has held that there is no prescribed format for a notice invoking arbitration. The legal requirement is that the party invoking arbitration must clearly outline the disputes between the parties and state that if these disputes remain unresolved, arbitration proceedings will be initiated. The intention to resolve the disputes...

Fresh Cause Of Action Cannot Accrue U/S 18 Of Limitation Act If Liability Is Acknowledged After Expiry Of Period Of Limitation: Delhi High Court

The Delhi High Court bench of Justices Subramonium Prasad and Harish Vaidyanathanshankar has held that for a valid acknowledgment under section 18 of the Limitation Act, 1963 certain essential requirements must be met. Firstly, the acknowledgment must be made before the relevant period of limitation has expired. Secondly, it must pertain specifically to the liability concerning the right...