High Court

When Assessee-Company Can Prove Genuineness Of Transaction, Delhi HC's 'NR Portfolio' Judgment Not Applicable: Calcutta HC

The Calcutta High Court has made it clear that the Delhi High Court decisions in NR Portfolio and Navodaya Castles will hold no value where an assessee-company establishes the identity of its shares subscribers, creditworthiness of the share subscribers and genuineness of the transactions.In CIT v. NR Portfolio Private Limited (2014) and in CITA v. Navodaya Castles Private Limited (2014),...

'Facilitates Resolution Process': Madras HC Upholds Circular Allowing Creditor To Recommend Resolution Professional In Application U/S 95 Of IBC

The Madras High Court bench of Justice D.Bharatha Chakravarthy has held that the circular issued by Insolvency and Bankruptcy Board of India (IBBI) on 21.12.2023 under section 196 of the Insolvency and Bankruptcy Code, 2016 (Code), allowing the creditor to recommend the name of a Resolution Professional in an application filed under Section 95 of the Code cannot be deemed ultra vires...

Court Cannot Set Aside Entire Arbitral Award Due To Fraud In One Claim When Other Claims Rest On Different Grounds: Jharkhand High Court

The Jharkhand High Court bench of Chief Justice M. S. Ramachandra Rao and Justice Rajesh Shankar has held that when two claims decided in an arbitral award are mutually unrelated, the court, under Section 34 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), cannot set aside the entire arbitral award solely because a fraud was committed concerning one of the claims, while...

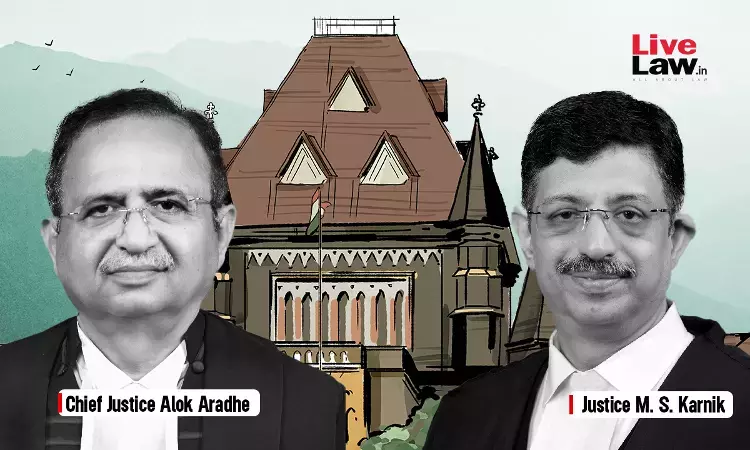

Acquiescence To Termination Notice Of Agreement Bars Interim Relief U/S 9 Of Arbitration Act: Bombay High Court

The Bombay High Court bench of Chief Justice Alok Aradhe and Justice M.S. Karnik has held that when a party is aware of a termination notice issued by the other party and conducts itself on the assumption that the termination has taken effect, it cannot later seek interim relief under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) on the ground that the other...

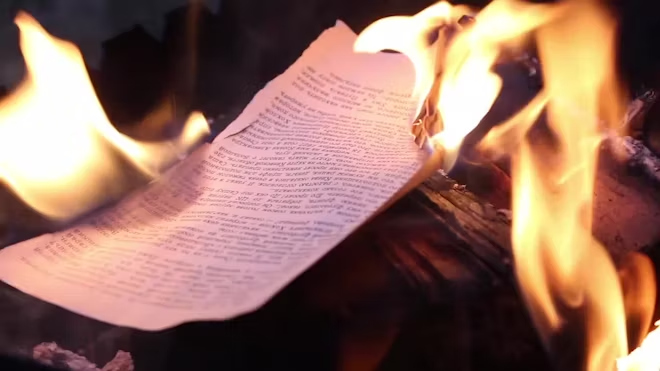

Patna High Court Upholds ₹25 Lakh Service Tax Demand Against Travel Agency Which Failed To Disclose Transactions & Claimed Records Were Lost In Fire

The Patna High Court has recently upheld a service tax demand of ₹25.25 lakh against a travel agency, dismissing its defence that crucial business records had been lost in a fire. The Division Bench comprising Justice Rajeev Ranjan Prasad and Justice Ashok Kumar Pandey observed, “this petitioner having surrendered his service tax registration had not disclosed the transactions in ST-3....

S.29A Of Arbitration Act As Amended By 2019 Amendment Governs All Pending Arbitrations After Coming Into Force: Sikkim High Court

The Sikkim High Court bench of Justices Bhaskar Raj Pradhan and Biswanath Somadderhas held that section 29A, as amended by the 2019 Amendment, shall apply to all arbitration proceedings that were pending at the time the amendment came into force. Brief Facts: The present appeal has been filed under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) against...

Court While Referring Parties To Arbitration Cannot Direct That Arbitral Award Should Be Filed Before It: Jammu & Kashmir High Court

The Jammu & Kashmir and Ladakh High Court bench of Justice Sanjay Dhar has held that the court, while referring parties to arbitration under Section 8 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), cannot direct that the award, passed after the conclusion of the arbitration proceedings, be filed before it. Brief Facts: The defendant had approached the plaintiff...

Dept Cannot Be Blamed If Assessee Is Not Diligent In Checking GST Portal For Show Cause Notice: Delhi High Court

The Delhi High Court has made it clear that an assessee cannot claim he was not granted an opportunity of hearing before an adverse order is passed, if he fails to check the GST portal for show cause notice and respond to the same.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“Since the Petitioner has not been diligent in checking the portal, no reply to...

Orders Under Omitted Rule 96(10) Of CGST Rule, 2017 Post 8th Oct, 2024 Not Valid; No Savings Clause: Uttarakhand High Court

The Uttarakhand High Court stated that orders passed under omitted Rule 96(10) Of CGST Rule, 2017 post 8th Oct, 2024 is not valid. The Division Bench of Chief Justice G. Narendar and Justice Alok Mahra stated that there was no scope for the department to pass any order by invoking the provisions of rule 96(10) of CGST Rule, 2017 after the same was omitted on 8th October, 2024 without...

SMAS Auto-Leasing Entitled To Protection & Preservation Of EVs Leased To 'Blu Smart', 'Gensol' Pending Arbitration: Delhi High Court

The Delhi High Court bench of Justice Jyoti Singh has granted interim relief under Section 9 of the Arbitration and Conciliation Act, 1996 to the the petitioner who is the owner of electric vehicles (EVs) leased under Master Lease Agreements upon apprehensions of financial distress, default in lease payments by the respondents and a risk of dissipation or deterioration of assets...

S.47 Of CPC Cannot Be Used As An Alternative To S.37 Of A&C Act For Unsettling Arbitration Award: Telangana HC

The Telangana High Court has clarified that section 47 of the CPC, which permits objections to be raised in an execution petition before the Trial Court; cannot be used as an alternative to challenge an arbitration award, which is being executed before a Trial Court.The Division Bench of Justice Moushumi Bhattacharya and Justice B.R. Madhusudhan Rao, while passing the order made it clear that...

Calcutta High Court Upholds Quashing Of ₹7.29 Crore Penalty Imposed On Dissolved HUF

The Calcutta High Court has upheld the quashing of penalty proceedings initiated against a dissolved Hindu Joint Family.A division bench of Chief Justice T.S. Sivagnanam and Justice Chaitali Chatterjee (Das) upheld the ITAT order which had relied on a Supreme Court ruling to declare the penalty action void-ab-initio.The Top Court had in CIT vs. Maruti Suzuki India Limited held that notice...