All High Courts

Delhi High Court Bars Hotel From Using 'Bukhara' Trademark, Grants Interim Relief to ITC

The Delhi High Court has restrained a city based hotel, Bukhara Inn, from using the name “Bukhara,” ruling that it infringed ITC Limited's well-known trademark associated with its iconic restaurant, Bukhara, at ITC Maurya, New Delhi. The order was passed by Justice Manmeet Pritam Singh Arora on November 7, 2025, in a suit filed by ITC Limited, which operates its hospitality business...

Delhi High Court Bars Another Company from Using Ching's 'Schezwan Chutney' Mark

In yet another order granting relief to Ching's Secret sauces maker Capital Foods Pvt. Ltd., the Delhi High Court has once again stepped in to protect the company's trademark “Schezwan Chutney.”Earlier this week, on November 3, 2025, the Court had restrained a Uttar Pradesh-based food manufacturer from using the name “Schezwan Tufani Chutney” or any expression deceptively similar...

Delhi High Court Restrains Pharma Firm from Using Marks Similar To Mankind Pharma's 'Kind' Brand

The Delhi High Court has recently restrained De Harbien Life Sciences Pvt. Ltd., a pharmaceutical company, from using the marks “NEFROKIND” and “SILOKIND.” The Court found these marks deceptively similar to Mankind Pharma Limited's well-known trademarks “MANKIND,” “KIND,” and other “KIND” formative marks.A Single Bench of Justice Manmeet Pritam Singh Arora passed the...

Delhi High Court Blocks 26 Websites From Streaming Italy's 'Serie A' Football Matches Illegally, Grants Dynamic Injunction To DAZN

The Delhi High Court has restrained 26 websites from illegally streaming live matches of the ongoing 'Serie A Championship', after finding that they were broadcasting the content without authorization from DAZN Limited which is the exclusive rights holder of the sporting event. Justice Tejas Karia passed the order on November 6, 2025, in a suit filed by DAZN Limited...

No Depreciation On SIPCOT Payments For Infrastructure Development, But Eligible For 5% Annual Revenue Deduction: Madras High Court

The Madras High Court has held that depreciation on payment to State Industries Promotion Corporation of Tamil Nadu Limited (SIPCOT) for infrastructure development is not allowed, but the assessee is eligible for 5% annual revenue deduction. Chief Justice Manindra Mohan Shrivastava and G. Arul Murugan were addressing the appeal pertaining to the claim of depreciation on the sum...

Punjab & Haryana High Court Stays Injunction Against Radico Khaitan In 'Kashmyr'-'Cashmir' Trademark Dispute Over Deceptive Similarity

The Punjab and Haryana High Court has stayed an order of the Commercial Court, Karnal which had restrained Radico Khaitan Ltd. from using the mark “Kashmyr” for its liquor products following a trademark suit initiated by Picadilly Agro Industries Ltd., proprietor of the marks “Cashmir” and “Cashmere.” A Division Bench comprising Justice Ashwani Kumar Mishra and Justice...

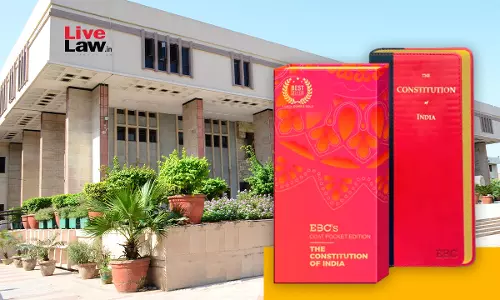

Delhi High Court Refers EBC–Rupa Trademark Dispute on Constitution Pocket Edition To Mediation

The Delhi High Court has recently referred a trademark dispute between EBC Publishing Pvt. Ltd. and Rupa Publications India Pvt. Ltd. to mediation before the Delhi High Court Mediation and Conciliation Centre. The dispute concerns the alleged deceptive similarity between the publishers' coat-pocket editions of the Constitution of India. Justice Manmeet Pritam Singh Arora passed the order...

District Court Can Hear Design Infringement Cases Unless Cancellation Is Sought : Rajasthan High Court

The Rajasthan High Court has recently held that District Courts are empowered to hear design infringement cases unless the opposing party formally seeks cancellation of the registered designs. The bench at Jaipur made this ruling while setting aside the transfer of three such cases filed by Jaipur-based carpet exporter S.N. Kapoor Export against Saraswati Global Ltd., another trader from...

Disclosure Of Income & Payment Of Income Tax Do Not Bar Proceedings Under Benami Transactions Act: Kerala High Court

The Kerala High Court has held that disclosure of income and payment of tax under the Income Tax Act, 1961, does not preclude initiation of proceedings under the Prohibition of Benami Property Transactions Act, 1988. Justice Ziyad Rahman A.A. agreed with the department that the fact that the assessees have disclosed the income in the return and the same was proceeded against under...

Auction Under SARFAESI Act Valid When Property Valued By Valuer Is Registered U/S 34AB Of Wealth-Tax Act: Madras High Court

The Madras High Court held that an auction under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 (SARFAESI) Act, 1957, is valid when the property is valued by a valuer and registered under Section 34AB of the Wealth-Tax Act. Section 34AB of the Wealth-Tax Act, 1957, provides the process for individuals to become...

Madras High Court Strikes Down 'Original Choice' Trademark, Rules in Favor of 'Officer's Choice'

The Madras High Court on Friday ruled in favour of Allied Blenders and Distillers Pvt. Ltd. (ABD), the maker of Officer's Choice whisky, and ordered the removal of John Distillers Ltd.'s (JDL) 'Original Choice' trademark from the register of trademarks. A Division Bench of Justice G Jayachandran and Justice Mummineni Sudheer Kumar in an order held that Original Choice was deceptively similar...

Voluntary GST Cancellation Not Grounds To Freeze Company's Bank Account: Rajasthan High Court

The Rajasthan High Court has directed the Bank of Baroda to de-freeze the account of the petitioner-company, allowing it to use it freely till finally deciding the company's representation, observing that the bank could not freeze the account merely because the company's GST registration was voluntarily cancelled.The bench of Justice Nupur Bhati was hearing a petition filed by a company...