All High Courts

Mens Rea Not Prerequisite For Imposing Penalty U/S 117 Of Customs Act: Karnataka High Court

The Karnataka High Court held that mens rea is not a prerequisite for imposing a penalty under Section 117 of the Customs Act. Section 117 of the Customs Act, 1962, addresses penalties for contraventions not specifically mentioned elsewhere in the Act. Justices S.G. Pandit and K.V. Aravind stated that a plain reading of Section 117 of the Act makes it clear that whenever...

Tax Demands Raised Post Approval Of IBC Resolution Plan Are Not Enforceable: Karnataka High Court

The Karnataka High Court recently reiterated that tax demands raised by revenue authorities after the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) are unenforceable if the claims were not submitted during the Corporate Insolvency Resolution Process (CIRP).A single bench of Justice M Nagaprasanna observed,“There is no jurisdiction to parallelly...

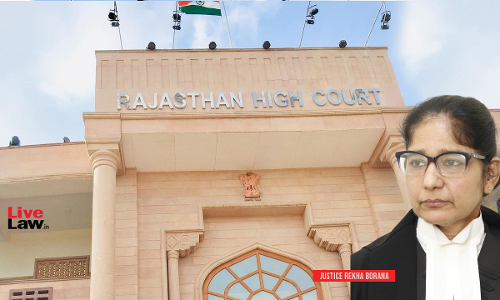

Bank Can Assign Debt Even If NPA Classification Is Later Declared Invalid: Rajasthan High Court

The Rajasthan High Court dismissed a writ petition filed against SBI's assignment of debt in favor of Alchemist Asset Reconstruction Company Ltd. (AARC) holding that even if NPA classification is later declared invalid, it does not affect the validity of assignment of debt. Justice Rekha Borana held that “the assignment cannot be invalidated merely because the NPA classification...

Objections U/S 47 CPC Can't Be Entertained In Enforcement Of Arbitral Awards U/S 36 Of A&C Act: Orissa High Court

The Orissa High Court has recently held that objections under Section 47 of the Code of Civil Procedure ('CPC') cannot be allowed to be raised in the enforcement proceeding of an arbitral award, as enunciated under the provision of Section 36 of the Arbitration and Conciliation Act, 1996 ('A & C Act').While bringing clarity as to applicability of Section 47 of CPC to arbitral proceedings,...

Performance Of Every Contract Would Be Jeopardised If Partial Breakdown Of Machinery Is Considered 'Force Majeure' Event: Delhi High Court

The Delhi High Court partly set aside an arbitral award which directed the National Council of Educational Research and Training (NCERT) to refund of Rs. 2 crore to M/s Murli Industries Ltd. holding that the finding of the arbitrator that breakdown of a machinery constituted a force majeure event cannot be sustained. The court however upheld the arbitrator's finding that the time was...

Information Regarding GST Returns Of Company Cannot Be Disclosed Under RTI Act: Bombay High Court

The Bombay High Court on Tuesday (October 14) held that a company's Goods and Services Tax (GST) returns filing cannot be disclosed under the Right To Information (RTI) Act. Sitting at Aurangabad bench, single-judge Justice Arun Pednekar noted that section 158(1) of the GST Act prohibits disclosure of information of GST returns to third parties and that section 8(1)(j) of the RTI Act too...

Pendency Of Appeal U/S 37 A&C Act Against First Award Does Not Bar Fresh Arbitration Proceedings: Bombay High Court

The Bombay High Court held that pendency of an appeal under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) does not prohibit a party from initiating a fresh round of arbitration when an earlier arbitral award has already been set aside. Accordingly, the present application under section 11 of the Arbitration Act was allowed and a sole...

Apportionment Of Liability Without Evidence Is Akin To 'Panchayati Approach': Bombay High Court Sets Aside NSE Arbitral Award Against Broker

The Bombay High Court set aside an arbitral award passed under National Stock Exchange (NSE) bye-laws that had upheld an order passed by Investor Grievance Redressal Panel (IGRP) directing Peerless Securities Limited to pay ₹7.18 lakhs to Vostok (Fareast) Securities Pvt. Ltd. for the losses caused by unauthorised trading in the trading and future segment. The IGRP had held that...

Claim For Demurrage As Liquidated Damages Does Not Constitute Debt Until Liability Is Determined: Andhra Pradesh High Court

The Andhra Pradesh High Court refused to grant interim relief for attachment of goods and security under section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) holding that the liquidated damages in the form of demurrage does not constitute debt until the liability is determined by an arbitral award. Justice Challa Gunaranjan held that “petitioner has moved...

Mortgage, Enforcement And Related Declaratory Reliefs Are Non-Arbitrable: Bombay High Court

The Bombay High Court Bench of Justice Sandeep V Marne has observed that enforcement of mortgage is a right in rem and any dispute seeking enforcement of mortgage cannot be referred to arbitration. Civil suit will lie for enforcement of such a right in rem. Facts Defendant No.1 and his partners are developers appointed for redevelopment of Defendant No.5 – Society under...

SARFAESI Charge Created Before GST Charge Takes Precedence Over It: Karnataka High Court

'If a claim is made under the IBC Act and there is no claim under the SARFAESI Act, RDB Act, or GST Act, the claim under the IBC Act can be implemented without issue. Similarly, if a claim is made under the GST Act and there are no claims under the SARFAESI Act, RDB Act, or IBC Act, the claim under the GST Act can be executed without difficulty'

Income Tax Act | Deputy Commissioner Cannot Act Beyond DRP Directions; Assessment After S.144C(13) Time Limit Invalid: Bombay High Court

The Bombay High Court stated that the Deputy Commissioner cannot act beyond the dispute resolution panel (DRP) directions; assessment completed beyond Section 144C(13) of the Income Tax Act, 1961, the time limit is invalid. Section 144C(13) of the Income Tax Act, 1961 mandates the completion of the assessment within one month from the end of the month in which DRP directions are...