All High Courts

CCTV Footage Of Assessee's Family Cannot Be Used By GST Dept, Violates Right To Privacy: Delhi High Court

The Delhi High Court has issued directions safeguarding the right to privacy in GST search proceedings, stating that any family-related CCTV footage which violates the privacy of family members cannot be used or disseminated in any manner. “Some of the concerns which are raised by the Petitioners such as right to privacy of the family being violated, etc., deserve to be...

Plea Against Misuse Of Digital Signature Does Not Amount To Denying Existence Of Arbitration Agreement: Calcutta High Court

The Calcutta High Court Bench of Justice Krishna Rao, while referring parties to arbitration, has observed that if the Plaintiff alleges that its digital signatures were used without its consent, such an allegation of fraud does not amount to a denial of the existence of the arbitration agreement. Facts The Plaintiffs had filed an application praying for an interim order, whereas...

Commercial Unit Buyers Not Barred From Seeking Arbitration Relief After Availing Remedies Under RERA: Delhi High Court

The Delhi High Court bench of Justice Pratibha M. Singh and Justice Shail Jain has held that Buyers of commercial units are not prohibited from seeking arbitration relief subsequent to availing remedies under RERA, provided that the arbitration petitions were filed after a change in circumstances. Background The Appellants had entered into a Memorandum of Understanding (MoU) with...

Compensation Received From NHAI For Acquisition Of Land Not Taxable: Chhattisgarh High Court

The Chhattisgarh High Court held that the compensation received against the acquisition of land from the NHAI (National Highways Authority of India) is not exigible to tax under Section 96 of the RFCTLARR Act (Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013). Section 96 of the Right to Fair Compensation and Transparency in...

Unadjudicated Claims Cannot Be Secured Through Interim Relief U/S 9 Of A&C Act Merely Due To Financial Distress: Delhi HC

The Delhi High Court Bench of Justice Jasmeet Singh has observed that mere financial distress of the other party would not be a ground to allow interim relief and grant its unadjudicated claim under Section 11 of the Arbitration Act (ACA)."However, the calculation of any permissible rebate and the resolution of quality-based objections require factual findings and interpretation of the terms...

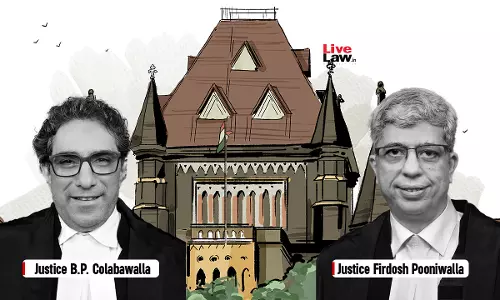

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...

Delhi High Court Transfers Winding-Up Petitions Against Vigneshwara Developwell Pvt Ltd To NCLT

The Delhi High Court has transferred winding-up petitions filed against Vigneshwara Developwell Pvt Ltd to the NCLT. The petition was filed under Sections 433(e), 434, and 439 of the Companies Act, 1956, seeking winding up of the respondent company due to its inability to pay the debt of the petitioner. During the pendency of the petition, an application was filed for the transfer...

Income Tax Act | Draft Assessment Order Not Permissible U/S 144C(1) When TPO Makes No Variation: Bombay High Court

The Bombay High Court has held that a draft assessment order is not permissible under section 144C(1) of the Income Tax Act when the TPO (transfer pricing officer) makes no variation. Section 144C(1) of the Income Tax Act, 1961, provides that the Assessing Officer should forward a draft of the proposed assessment order to the eligible assessee if any variation of the income or...

Rajasthan High Court Partly Quashes CBIC Circular Restricting ITC Refund For Inverted Duty Structure Up To 18.07.2022

The Rajasthan High Court has quashed Point No. 2 of the Circular No. 181/13/2022-GST dated 10.11.2022, restricting ITC claims on the inverted duty structure prior to 18.07.2022. The bench, consisting of Justices Dinesh Mehta and Sangeeta Sharma, stated that if the impugned clarification is tested on the anvil of reasonableness, it falls foul to Article 14 of the Constitution of...

Failure To Mention Correct Value In GSTR-5A Filing Is Not Suppression U/S 74 CGST Act: Karnataka High Court

The Karnataka High Court has stated that a failure to mention the correct value in returns or apply the correct GST rate is not suppression under section 74 of the Central Goods and Services Tax (CGST). Justice S.R. Krishna Kumar stated that "...though the revenue alleged in the impugned SCN that the assessee failed to mention the value of services correctly in the GSTR-5A returns...

Rajasthan GST Act | HC Calls For 'Purposive' Interpretation Of S.107, Asks Why Assessment Orders Cannot Be Sent On Assessee's Email

The Rajasthan High Court has questioned why the tax department can send attachment orders via email, but not assessment orders, to ward off any communication gap or confusion about the date of communication.The Court was hearing a petition filed against the order of the Appellate Authority, State Tax, that had rejected an appeal preferred by the petitioner under Section 107(1) of the...

S. 67 CGST Act | Officer Below Rank Of Joint Commissioner Cannot Inspect Assessee's Premises Without Authorisation: Karnataka High Court

The Karnataka High Court has held that an officer below the rank of Joint Commissioner cannot, by himself, inspect the premises of the assessee without authorisation under Section 67 of the Central Goods and Services Tax. The bench further stated that there is no requirement to provide a copy of the authorisation and details of the order passed by the Joint Commissioner, but the...