All High Courts

Once Goods Are Verified And Found To Be Correct In MOV-04, Department Can't Be Permitted To Change Stand Later: Allahabad High Court

The Allahabad High Court has held that when the authority on verification has mentioned the details of the goods found and verified the correctness of the invoices and the goods in transit, it cannot be permitted to change the stand later and say that the goods were not in accordance with the invoice. Justice Piyush Agrawal held “Once on the verification report i.e. MOV-04, the...

Karnataka High Court Grants Ex-Parte Injunctions In Favour Of Neil Patel Digital LLC In Dispute Over Breach Of LLP Agreement

The Karnataka High Court bench of Justice Suraj Govindaraj has passed ex-parte injunctions under Section 9 of the Arbitration and Conciliation Act, 1996, in favour of Neil Patel Digital LLC (“NPD LLC”). The disputes had arisen from breach of the covenants of a Limited Liability Partnership Agreement. The LLP Agreement contained various negative covenants restricting the Respondent...

Lawyers Running Individual Practice Exempt From Levy Of GST, Service Tax: Orissa High Court

The Orissa High Court has reminded the GST and Service tax authorities not to harass practicing lawyers by issuing them notices for levy of GST or service tax.A Chief Justice Harish Tandon and Justice BP Routray thus quashed the notices issued to a Bhubaneswar based lawyer demanding service tax of Rs.2,14,600/- and penalty of Rs.2,34,600/- plus interest.It observed, “in view of the...

SCN Uploaded On 'Additional Notices' Tab Of GST Portal Not Proper: Delhi High Court

The Delhi High Court has made it clear that uploading of show cause notice by the GST department under the 'additional notices' tab on its portal is not proper as the assessee may miss it.The decision is a contrast to a coordinate bench decision rendered in July last year, holding that uploading of notices under the heading 'additional notices' amounts to sufficient service.A division bench...

Delhi High Court Dismisses BSNL's Appeal U/S 37 Of A & C Act, Upholds Arbitral Award Of Rs. 43.52 Crore

The Delhi High Court bench of Justices Vibhu Bakhru and Tejas Karia dismissed BSNL's appeal under Section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) holding that the Single Judge correctly upheld the Arbitrator's finding that Vihaan Networks Limited carried out the work under the Advance Purchase Order, issued on BSNL's specific instructions, which...

Routing Of Funds Through Tax Havens Not Disclosed During Original Proceedings: Bombay HC Confirms Reassessment

Finding that the Petitioner had failed to disclose all material facts necessary for assessment of tax, the Bombay High Court ruled that the circuitous movement of funds through various companies located in tax havens had not been disclosed in the course of the original proceedings.The High Court therefore confirmed the reopening proceedings initiated against the petitioner.A division bench...

Arbitrator Cannot Be Substituted U/S 29A(6) Of A&C Act Unless Grounds Mentioned U/S 14 & 15 Are Satisfied: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that even though the term "substitution" is mentioned under Section 29-A(6) of the Arbitration and Conciliation Act, 1996 (Arbitration Act), an arbitrator cannot be substituted in an application under this section unless the grounds specified in Sections 14 and 15 of the Arbitration Act are satisfied, which...

JCIT Not Empowered To Issue Sanction For Reassessment Under Proviso To S.151(1) Of Income Tax Act: Delhi High Court

The Delhi High Court has held that sanction for initiation of reassessment action against an assessee under the proviso to Section 151(1) of the Income Tax Act 1961, cannot be issued by the Joint Commissioner of Income Tax.Section 151(1) contemplates issuance of sanction by JCIT for initiating reassessment action under Section 148 against an assessee who has already undergone...

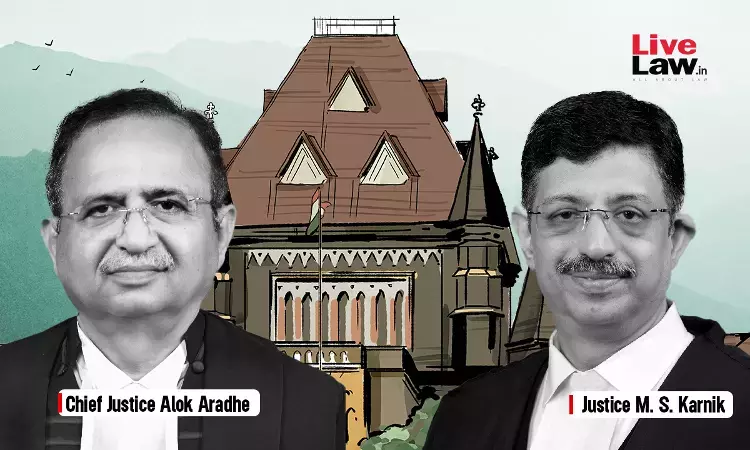

Bombay HC Dismisses Appeal Against Order U/S 9 Of Arbitration Act Injuncting Owner Of Kapani Resorts From Disposing Of Interest In Properties

The Bombay High Court bench of Chief Justice Alok Aradhe And Justice M. S. Karnik has upheld the order passed by the Single Judge under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), injuncting the owner of the Kailash property and Kapani Resorts from alienating or disposing of any interest in the properties until the completion of the...

Order U/S 75(6) Of GST Act Must Be Self-Contained, Mere References To SCNs Is Not Sufficient: Allahabad High Court

The Allahabad High Court has held that order under Section 75(6) of the Goods and Service Tax Act, 2017 must be self-contained and mere reference to previous show cause notices is not sufficient. Section 75 of the GST Act is a general provision relating to determination of tax. Section 75(6) of the GST Act provides that “the proper officer, in his order, shall set out the...

Provisions Of Section 26E SARFAESI Act & Section 34 RDB Act Prevails Over Section 24 Of TNGST Act: Madras High Court

The Madras High Court stated that provisions of Section 26E of the SARFAESI Act and Section 34 of the Recovery of Debts and Bankruptcy Act would prevail over the provisions of Section 24 of the Tamil Nadu General Sales Tax Act. The Division Bench of Justices Anita Sumanth and G. Arul Murugan observed that “in the juxtaposition of Section 26E of the SARFAESI Act with Section 34 of...

Mandatory To Fill Part B Of E-Way Bill In Transactions After April 2018: Allahabad High Court

Recently, the Allahabad High Court has held that it is mandatory for the assesee to download the complete E-way Bill including Part-B of the E-way Bill for transactions after April 2018. Distinguishing the earlier judgment of the High Court in M/s. Varun Beverages Limited vs. State of U.P. and 2 others, M/s. Falguni Steels vs. State of U.P. and others, and others, Justice Rohit...