Allahabad High Court

UPGST Act | Lien Cannot Be Created On Assessee's Bank Account After Over A Year Has Passed From Payment Of Tax: Allahabad High Court

Recently, the Lucknow Bench of the Allahabad High Court has held that under the UPGST Act, a lien cannot be created on the assessee's bank account an year subsequent to the payment of taxes. Section 62(2) of the UPGST Act provides that where a registered person submits a valid return within 60 days of the service of the order under Section 62(1), the said assessment order would...

UPGST Rules | Reason To Believe Must Be Reduced In Writing While Operating Under Rule 86A: Allahabad High Court

The Allahabad High Court has held that while acting under Rule 86A of the UPGST Rules, authorities must record 'reason to believe' in 'writing'. It held that not doing so would be contrary to the purpose of the Rule. “It may not forgotten, granting ITC and maintaining its chain is the soul of a successful GST regime. Therefore, any doubt or suspicion alone may not lead an action by...

CENVAT Rules Cannot Apply Retrospectively To Concluded MODVAT Proceedings: Allahabad High Court

Recently, the Allahabad High Court has held that where proceedings under the MODVAT (Modified Value Added Tax) Scheme had concluded prior to the introduction of the CENVAT (Central Value Added Tax) Rules, it would not be open to the revenue department to issue fresh notices against the assessee under the new scheme. The MODVAT scheme, allowing manufacturers a tax credit on input duties,...

Arbitral Award In One Proceeding Can Be Used As Evidence In Another: Allahabad High Court Upholds ₹126 Cr Award To Adani

The Allahabad High Court has held that an arbitral award given in one proceedings can be used as evidence in other arbitral proceedings, though the weightage given to it may vary on case to case basis.While dealing with an arbitral award of more than Rs. 126 crores in favour of Adani Enterprises Ltd., the bench of Chief Justice Arun Bhansali and Justice Jaspreet Singh held“An Arbitral...

Compensation U/S 3G National Highways Act Can Be Challenged Under Arbitration Act, Writ Petition Not Maintainable: Allahabad High Court

The Allahabad High Court has held that compensation awarded under Section 3G of the National Highways Act, 1956 can be challenged under the Arbitration and Conciliation Act, 1996 and writ petitions for the same will not be maintainable.A bench of Justice Mahesh Chandra Tripathi and Justice Anish Kumar Gupta held“Section 3G(6) of the Act, 1956 expressly provides that the provisions of...

S.238 IBC Is Non-Obstante Clause, Overrides Provisions Of Electricity Act: Allahabad High Court

The Allahabad High Court has held that the Insolvency and Bankruptcy Code, 2016 overrides the provisions of Electricity Act, 2003 read with Electricity Supply Code, 2005.A bench of Justice Arindam Sinha and Justice Prashant Kumar held“Section 238 of Insolvency and Bankruptcy Code, 2016 is a non- obstante clause meaning it grants the IB Code a power of overriding effect on other laws, for...

Allahabad High Court Stays Rs.110 Crore GST Demand On Dabur's Hajmola Candy

The Allahabad High Court on October 10 stayed a ₹110 crore GST show cause notice issued to Dabur India Ltd. over the classification of its Hajmola Candy Tablets.A bench of Justice Saumitra Dayal Singh and Justice Indrajeet Shukla passed the interim order in a petition filed by Dabur challenging the DGGI notice issued earlier this year.The dispute revolves around how Hajmola Candy Tablets...

Under SARFAESI & RDB Acts, Dues Of Secured Creditors Take Precedence Over Govt Dues: Allahabad High Court

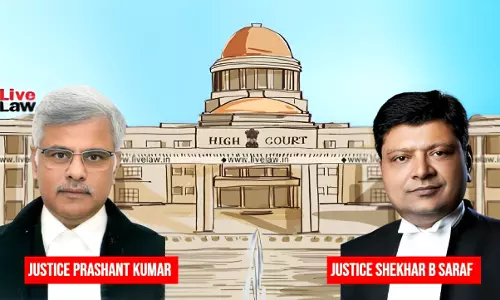

The Allahabad High Court has held that under Section 26-E of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 and Section 31B of the Recovery of Debts and Bankruptcy Act, 1993, the debts of the secured creditors will take precedence over all over debts including crown debts.The bench of Justice Shekhar B. Saraf and Justice Praveen Kumar...

Taxpayer Cannot Be Left At Mercy Of Assessing Officer Who Chooses To Delay Payment Of Genuine Refunds: Allahabad High Court

While dealing with a writ petition for refund of Tax Deducted at Source (TDS), the Allahabad High Court has held that when the documents for TDS are provided by the assesee, the Assessing Officer must process the refund and cannot delay payment of refund in genuine cases. The bench of Justice Shekhar B. Saraf and Justice Prashant Kumar held “a taxpayer should not be left at...

Who Is Prescribed Authority For Appeal U/S 54 U.P. Water Supply & Sewerage Act? Allahabad High Court Asks State

Recently, the Allahabad High Court has asked the State to clarify as to who is the prescribed authority under Section 54 of the U.P. Water Supply and Sewerage Act, 1975 to decide appeal against the assessment order passed by JaI Sansthan or any other agency under sub-section (2) of Section 53 of the Act. Petitioner, Hindustan Aeronautics Limited Transport Aircraft Division Chakeri,...

Notice U/S 148 Income Tax Act Must Be Delivered To Addressee Personally By Post To Complete Service U/S 27: Allahabad High Court

The Allahabad High Court has held that notices under Section 148 and 282 of the Income tax Act, 1961 must be delivered to the assesee personally through speed post and not merely upon his address to complete service under Section 27 of the General Clauses Act, 1897. It held that presumption of sufficient service arises only when the notice is sent by registered post as in registered...

Provisional Attachment Of Bank Accounts Cannot Be Done Merely Upon Issue Of Show Cause Notice U/S 74 GST Act: Allahabad High Court

The Allahabad High Court has held that provisional attachment of bank accounts cannot be done merely upon issue of show cause notice under Section 74 of the Goods and Service Tax Act, 2017. Referring to the judgment of the Supreme Court in Radha Krishan Industries v. State of H.P. and its earlier judgment in R.D. Enterprises v. Union of India, the bench of Justice Shekhar B....