Bombay High Court

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

Does Payment For Transponder Services Constitute 'Royalty' U/S 9(1)(vi) Of Income Tax Act? Bombay High Court Asks CIT To Decide

The Bombay High Court has asked the Commissioner of Income Tax to decide whether payment for transponder services constitutes 'royalty' under Section 9(1)(Vi) of Income Tax Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “the authorities have held the payment to constitute 'royalty' under the domestic law as well as under the Treaty, but by holding...

Bombay High Court Upholds Arbitral Award Against BCCI, Directs Payment Of ₹538.9 Crore To Defunct IPL Franchise Kochi Tuskers Kerala

The Bombay High Court has upheld an arbitral award granting damages amounting to 538.9 crore to Kochi Cricket Private Limited ("KCPL”), the parent company of defunct IPL franchise Kochi Tuskers Kerala.It was held that the Court cannot act as a Court of First Appeal and delve into a fact-finding exercise by revisiting and re-appreciating the record and accepting competing interpretations...

Treaty Provisions Don't Override Customs Law: Bombay High Court Upholds SCN Issued For Alleged Misuse Of Import Exemptions

The Bombay High Court stated that treaty provisions don't override customs law and upheld the show cause notices issued for alleged misuse of import exemptions. The Bench consists of Justices M.S. Sonak and Jitendra Jain observed that based on a treaty provision that is not transformed or incorporated into the national law or statute, the provisions of the existing Customs Act...

Cash Credit Account Cannot Be Treated As Property Of Account Holder Which Can Be Considered U/S 83 Of GST Act: Bombay High Court

The Bombay High Court stated that cash credit account cannot be treated as property of account holder which can be consider under Section 83 of GST Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that the phrase 'including bank account' following the phrase, “any property” would mean a non-cash-credit bank account. Therefore, a “cash credit...

Amount Of Subsidy Received By Assessee From RBI Cannot Be Treated As 'Interest' Chargeable U/S 4 Of Income Tax Act: Bombay High Court

The Bombay High Court held that the amount of subsidy received by the Assessee from RBI cannot be treated as 'interest' chargeable under Section 4 of Income Tax Act. The Division Bench of Chief Justice Alok Aradhe and Justice Sandeep V. Marne stated that “the amount of subsidy received by the Assessee is not relatable in loan or advance given by the assessee to the RBI and...

[Arbitration Act] S.37 Not An Efficacious Alternate Remedy After Rejection Of Plea U/S 34 Seeking Enhanced Compensation: Bombay High Court

The Division Bench of Bombay High Court comprising Justices Jitendra Jain and M.S. Sonak allowed writ petitions seeking enhanced solatium under National Highways Act, 1956 in view of the decision of the Supreme Court in Union of India v Tarsem Singh and Ors. While doing so the Court rejected the argument of the Respondent that the petitions ought to be dismissed as the Petitioners...

Interim Relief U/S 9 Of Arbitration Act Must Be Sought With 'Reasonable Expedition': Bombay High Court

The Bombay High Court bench of Justice A. S. Chandurkar and Justice Rajesh Patil have held that an applicant under Section 9 of the Arbitration and Conciliation Act, 1996 (“the Act”) must approach the court with reasonable expedition. Delay of several years without adequate explanation is a material factor that militates against the grant of such relief. The court observed that...

Acquiescence To Termination Notice Of Agreement Bars Interim Relief U/S 9 Of Arbitration Act: Bombay High Court

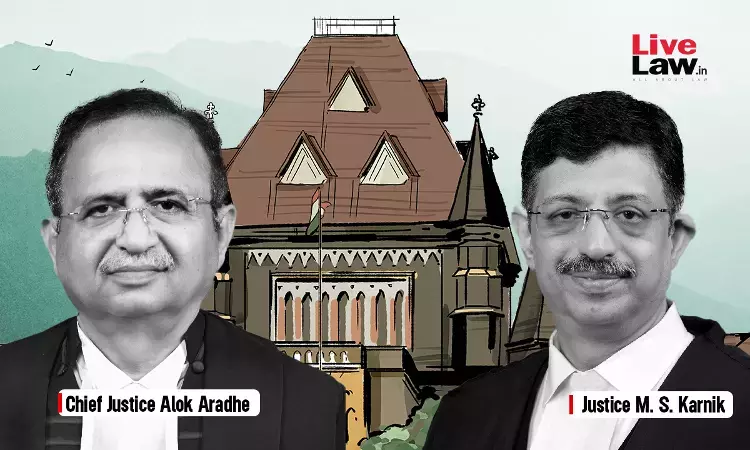

The Bombay High Court bench of Chief Justice Alok Aradhe and Justice M.S. Karnik has held that when a party is aware of a termination notice issued by the other party and conducts itself on the assumption that the termination has taken effect, it cannot later seek interim relief under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) on the ground that the other...

Routing Of Funds Through Tax Havens Not Disclosed During Original Proceedings: Bombay HC Confirms Reassessment

Finding that the Petitioner had failed to disclose all material facts necessary for assessment of tax, the Bombay High Court ruled that the circuitous movement of funds through various companies located in tax havens had not been disclosed in the course of the original proceedings.The High Court therefore confirmed the reopening proceedings initiated against the petitioner.A division bench...

Arbitrator Cannot Be Substituted U/S 29A(6) Of A&C Act Unless Grounds Mentioned U/S 14 & 15 Are Satisfied: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that even though the term "substitution" is mentioned under Section 29-A(6) of the Arbitration and Conciliation Act, 1996 (Arbitration Act), an arbitrator cannot be substituted in an application under this section unless the grounds specified in Sections 14 and 15 of the Arbitration Act are satisfied, which...

Bombay HC Dismisses Appeal Against Order U/S 9 Of Arbitration Act Injuncting Owner Of Kapani Resorts From Disposing Of Interest In Properties

The Bombay High Court bench of Chief Justice Alok Aradhe And Justice M. S. Karnik has upheld the order passed by the Single Judge under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), injuncting the owner of the Kailash property and Kapani Resorts from alienating or disposing of any interest in the properties until the completion of the...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www.livelaw.in/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)