Bombay High Court

Setting Aside Of Arbitral Award Leaves It Open To Parties To Choose To Arbitrate Again: Bombay High Court

The Bombay High Court Bench of Justice Somsekhar Sundaresan has observed that once an arbitral award has been set aside by the court in the exercise of its powers under Sections 34 and 37 of the Arbitration and Conciliation Act, 1996, the parties would be restored to the original position and a fresh arbitration in such circumstances would not amount to the proverbial “second bite at...

Arbitration Clause In Invoices Can Be Binding On Parties When They Acted Upon The Invoices And No Objections Were Raised: Bombay HC

The Bombay High Court bench of Justice Somasekhar Sundaresan has observed that where the correspondence between the parties included invoices which contained an arbitration clause and the parties acted upon those invoices without protesting, then it could be deemed that the party had accepted the arbitration clause. Background Facts and Issue The Respondent had availed of...

LLP Can Be Bound By Arbitration Clause Despite Not Being Signatory To LLP Agreement: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the mere fact that an LLP is not a signatory to an LLP Agreement does not, by itself, preclude it from being a party to arbitration proceedings initiated between Partners under the arbitration clause of such an agreement. The Court observed that an LLP is not a “third party” to its LLP Agreement but an...

Restaurant Service Or Bakery Product? Bombay High Court To Decide If Donuts & Cakes Should Be Taxed At 5% Or 18% Under GST

The Bombay High Court is to decide whether the donuts and cakes should be classified as restaurant service or a bakery product under Goods and Services Tax. The Division Bench of Justices B.P Colabawalla and Firdosh P. Pooniwalla were addressing the issue of whether the supply of donuts falls within the ambit of restaurant services under Service Accounting Code (SAC) 9963 or should...

ITAT Cannot Perpetuate Ex-Parte Order: Bombay High Court Orders Tribunal To Grant Opportunity Of Hearing To Assessee Before Proceeding On Merits

The Bombay High Court has disapproved of the Income Tax Appellate Tribunal dismissing the appeal against an ex-parte order passed against a former employee of Pfizer Healthcare without providing him an opportunity of hearing.Stating that ITAT cannot “perpetuate” the ex-parte order, a division bench of Justices GS Kulkarni and Advait M. Sethna directed the Tribunal to hear the employee...

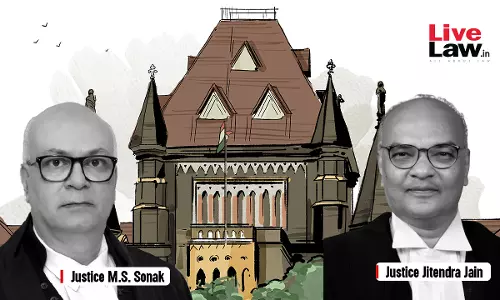

ITAT Cannot Overstep Its Authority By Deciding On Merits When It Had Already Concluded Appeal Was Not Maintainable: Bombay High Court

The Bombay High Court stated that ITAT cannot overstep its authority by deciding on merits when it has already concluded an appeal was not maintainable. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “Once the ITAT concluded that the Appeal before it against the impugned communication/order was not “maintainable”, there was no question of...

Court At Designated Venue In Arbitration Agreement Can Entertain Application U/S 11 Of Arbitration Act: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the court having supervisory over designated venue of the Arbitration proceedings would have jurisdiction to entertain application under section 11 of the Arbitration and Conciliation Act, 1996 (“Arbitration Act”) in absence of any contrary indicia indicating any other place to be the seat of...

When There Is Ambiguity In Arbitration Agreement, Business Efficacy Test Can Applied To Discern Intent Of Parties To Arbitrate: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that when there is an ambiguity in the agreement with respect to arbitration related provisions, the business efficacy test can be applied to discern true intent of the parties to arbitrate. Brief Facts: The present petition has been filed under section 11 of the Arbitration and Conciliation Act, 1996...

Mandate Of Facilitation Council Is Not Terminated Even If It Fails To Render Award Within 90 Days U/S 18(5) Of MSME Act: Bombay High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the mandate of the MSME Facilitation Council (Council) cannot be terminated merely on the ground that it failed to render an award within 90 days under section 18(5) of the Micro, Small and Medium Enterprises Development Act, 2006 (“MSME Act”) from the date of entering reference as this time period is...

Notice Issued To Non-Existing Entity Post-Merger Is Substantive Illegality, Dept Cannot Cite Technical Glitch: Bombay High Court

The Bombay High Court stated that notice issued to a non-existing entity post-merger is a substantive illegality and not some procedural violation. “we cannot condone the fundamental error in issuing the impugned notices against a non-existing company despite full knowledge of the merger. The impugned notices, which are non-est cannot be treated as “good” as urged on behalf...

While Commercial Speech Falls Within Free Speech, Contract Prohibit Adverse Remarks: Bombay HC Imposes 90-Day Injunction On Wonderchef's Distributor

Observing that commercial speech is a part of 'free speech' guaranteed by the Constitution of India, the Bombay High Court imposed a 90-day injunction against an Australia-based distributor of Wonderchef Home Appliances, owned by Celebrity Chef Sanjeev Kapoor, from making any comments or communications which could harm the reputation of the company, due to a contractual clause preventing...

Court Cannot Assume Jurisdiction To Appoint Arbitrator Unless Request For Reference Of Dispute Is Received By Respondent: Bombay High Court

The Bombay High Court bench of Justice R. M. Joshi has held that compliance with Section 21 of the Arbitration and Conciliation Act, 1996 is mandatory and that the court cannot assume jurisdiction to appoint an Arbitrator under Section 11 unless a request for a reference of dispute is received by the respondent. Brief Facts: The dispute arose with respect to a sub-contract...