Calcutta High Court

Income Tax | Reassessment Cannot Be Initiated On Identical Survey Material Already Accepted In Earlier Proceedings: Calcutta High Court

The Calcutta High Court held that reassessment under Section 148 of the Income Tax Act is impermissible when it is based on the same survey material that the Assessing Officer (AO) has already examined and accepted in earlier proceedings. Justice Om Narayan Rai stated that the reassessment proceeding is clearly impermissible………It would be a clear case of “change of opinion”. Indeed, the principle that assessment of a given assessee for a given assessment year cannot be reopened by the...

Appellate Authority Must Consider Cess-Disclosure In Annual Return, 'No Negative Mandate' For Late-Filing: Calcutta High Court

The Calcutta High Court in a matter concerning non-disclosure of Cess in monthly return GSTR-3B which came to be rectified by filing annual return in GSTR-09, has set aside appellate order. The High Court has directed the Authority to revisit the matter and consider subsequent rectification in GSTR-09 of initial error of non-disclosure. In an order dated November 26, 2025 the Single Bench of Justice Om Narayan Rai noted that at the time of finalization of the books of account,...

Income Tax Return Must Be Accepted For Assessing Victim's Income In Motor Accident Claims: Calcutta High Court Grants ₹39 Lakh Compensation

The Calcutta High Court held that when a victim's income tax return is filed, it is a reliable and authentic basis for assessing income in motor accident claims. The bench granted compensation of Rs. 39 Lakh to the claimants (mother and father) of the victim. Justice Biswaroop Chowdhury stated that once an Income Tax Return is accepted by the Income Tax Authority, it becomes an authentic document with regard to the income of the victim. When Income Tax Return is not filed it...

Calcutta High Court Upholds ₹29.96 Crore Arbitral Award Against Bihar State Power Generation Company, Refuses To Interfere In Barauni Power Plant Dispute

The Calcutta High Court, Commercial Division, dismissed a petition filed by the Managing Director, Bihar State Power Generation Co. Ltd. (BSPGCL) under section 34 of the Arbitration and Conciliation Act, 1996, challenging an arbitral award passed in favour of R S Constructions. Justice Gaurang Kanth, on 4th December, 2025, while upholding the finality of the arbitral award, ruled that the arbitral tribunal had adopted a “logical, reasoned and plausible” view while granting compensation ...

Calcutta High Court Denies Interim Relief To Indian Importer In 'PL SUPREME' Trademark Row With Chinese Manufacturer

The Calcutta High Court has refused an interim injunction to Kolkata-based torch importer Parul Ruparelia and an associated entity in their trademark infringement and passing-off suit over the mark “PL SUPREME” against the Chinese manufacturers of the torch.It held that Chinese manufacturer Camme Wang and its associated entity are the prior adopters and owners of the mark. Delivering judgment on December 5, 2025, Justice Ravi Krishan Kapur held that the Chinese manufacturer's superior right to...

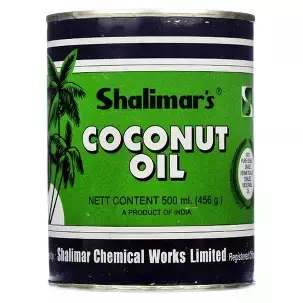

Calcutta High Court Says KMP Coconut Oil Packaging Looks Too Similar to Shalimar's, Upholds Injunction

The Calcutta High Court has upheld an interim injunction in favour of Shalimar Chemical Works Pvt. Ltd. that restrains Edible Products (India) Ltd., which sells coconut oil under the “KMP” brand, from using packaging the court found deceptively similar to Shalimar's long used trade dress. A division bench of Justice Sabyasachi Bhattacharyya and Justice Supratim Bhattacharya in an order dated December 3, dismissed Edible Products' appeal. The court said that in a passing-off case the overall...

'High Courts Do Not Substitute Statutory Tribunals', Calcutta High Court Refuses To Halt Guarantors' Insolvency Proceedings

The Calcutta High Court on Wednesday held that it cannot interfere with personal insolvency proceedings initiated under the Insolvency and Bankruptcy Code, holding that such proceedings must take their course before the National Company Law Tribunal. A single bench of Justice Krishna Rao said the High Court could not halt a proceeding that falls within the jurisdiction of the adjudicating authority. The court said, “The National Company Law Tribunal being the statutory forum under the...

'Unilateral Appointment Of Arbitrator Violates Principles Of Natural Justice': Calcutta High Court Sets Aside Arbitral Award

The Calcutta High Court on Tuesday set aside an ex-parte arbitral award ruling that unilateral appointment of a sole arbitrator by one of the parties is violative of the Principles of Natural Justice and fatally vitiates the arbitral process, thereby resulting in nullity. Justice Shampa Sarkar in a judgement delivered on 2nd December, 2025, allowed the application filed by YD Transport Company and its proprietor under section 34 of the Arbitration and Conciliation Act, 1996. Court...

Parties' Conduct Overrides Clause: Calcutta High Court Rejects Literal Interpretation Of Arbitration Venue Clause

The Calcutta High Court on Tuesday dismissed Chittaranjan Locomotive Works' application for an unconditional stay of an arbitral award dated March 14th, 2024. Justice Shampa Sarkar on 2nd December, 2025 ruled that the conduct of the parties and arbitrator and the award publication proceedings in Kolkata constituted “contrary indicia”, sufficient to displace Chittaranjan as the contractual venue. The controversy stems from a tender issued by the Railway Administration, Chittaranjan...

Income Tax Act | S. 153C Proceedings Unsustainable Without Incriminating Material Found In Search: Calcutta High Court

The Calcutta High Court has held that proceedings under Section 153C of the Income Tax Act cannot be initiated unless incriminating material relating to the assessee is found during a search and both the assessing officers (the Assessing Officer of the searched person as well as the Assessing Officer of the person other than the searched person) record the necessary satisfaction.Section 153C of the Income Tax Act contains a special provision relating to the assessment of 'other person', pursuant...

Income Tax Act | Refund Can't Be Withheld U/S 245 Unless Department Establishes Tax Liability: Calcutta High Court

The Calcutta High Court stated that the Income Tax Department cannot withhold a refund under Section 245 of the Income Tax Act, 1961, unless it establishes tax liability. The Bench of Justice Raja Basu Chowdhury observed that it is true that Section 245 of the said Act authorises the Income Tax Department to set off a refund against remaining tax payable. Unfortunately, in this case, the respondent has not been able to demonstrate that any amount is payable or is due from the...

IGST ITC Declared In GSTR-9 Can Be Set Off Against Tax Demand If Missed In Monthly GSTR-3B: Calcutta High Court

The Calcutta High Court has stated that IGST (Integrated Goods and Services Tax) ITC (Input Tax Credit) declared in GSTR-9 can be set off against tax demand if missed in the monthly GSTR-3B. Justice Om Narayan Rai bench observed that the appellate authority did not justify why the IGST ITC declared in GSTR-9 could not be set off against the tax demand. In this case, the assessee/petitioner failed to claim Input Tax Credit (ITC) in respect of IGST pertaining to the months of May...