Delhi High Court

Delhi High Court Temporarily Bars Dr Reddy's From Manufacturing Sunscreen Product With “SUN” Mark On Sun Pharma Plea

The Delhi High Court has recently, temeperorily restrained Dr Reddy's Laboratories Ltd. from further manufacturing sunscreen products bearing labels with the word “SUN”, holding that the usage appears to function as a trademark and not as a mere description. The court directed the company to maintain status quo until the next hearing. A single bench of Justice Manmeet Pritam Singh Arora passed the interim order on December 24, 2025, while hearing a trademark infringement and passing off suit...

India-US DTAA | Outsourcing Customer Care Services To Indian Subsidiary Doesn't Create PE: Delhi High Court

The Delhi High Court has held that outsourcing customer care and back-office services to an Indian subsidiary does not, by itself, result in the creation of a Permanent Establishment (PE) in India under the India–US Double Taxation Avoidance Agreement (DTAA).A Division Bench of Justices V. Kameswar Rao and Vinod Kumar thus dismissed a batch of appeals filed by the Income Tax Department against EXL Service.com Inc., upholding the findings of the Income Tax Appellate Tribunal (ITAT) that the...

Delhi High Court Disposes Meta's Execution Plea, Notes Compliance In “FACEBAKE” Trademark Case

The Delhi High Court has disposed of an execution petition filed by Meta Platforms Inc. (formerly Facebook), after finding that the operators of the “FACEBAKE” and “FACECAKE” brands have substantially complied with an earlier injunction restraining use of marks deceptively similar to Meta's “FACEBOOK” trademark.Justice Manmeet Pritam Singh Arora passed the order on December 24, 2025, while examining compliance of a judgment and decree dated July 6, 2022, that had permanently restrained the...

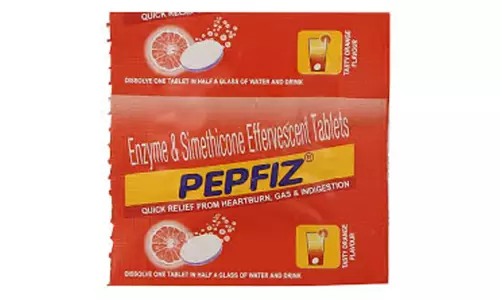

Delhi High Court Bars Biodeal Pharma From Using “PEPFIX-DSR” and “MINOZIL”, Protects Sun Pharma Marks

The Delhi High Court has permanently restrained Biodeal Pharmaceuticals Pvt. Ltd. from using the marks “PEPFIX-DSR” and “MINOZIL” for its pharmaceutical products over similarity with Sun Pharmaceutical Industries Ltd.'s registered trademarks “PEPFIZ” and “MINOZ.”A Single bench of Justice Tejas Karia passed the order on December 16, 2025 Sun Pharma's plea seeking summary judgment in a trademark infringement and passing off suit. The court noted that Biodeal Pharmaceuticals had neither appeared...

Income Tax Act | Delhi High Court Sets Aside Reassessment Against MakeMyTrip Over ₹50 Crore Receipt, Cites Vague S.148A Notices

The Delhi High Court has set aside reassessment proceedings initiated against MakeMyTrip India Pvt. Ltd., holding that the notices issued under Section 148A of the Income Tax Act, 1961 were unreasoned.A Division Bench of Justices V. Kameswar Rao and Vinod Kumar allowed the writ petition filed by the company, which had challenged the reassessment action relating to an alleged unexplained receipt of over ₹50 crore, purportedly arising from information obtained during a search conducted in the case...

Delhi High Court Holds ICC Trademark Rights Under LG Sponsorship Agreement Attract Royalty TDS

The Delhi High Court has dismissed a writ petition filed by LG Electronics India Pvt. Ltd., upholding the Income Tax Department's decision to treat a portion of sponsorship payments made for ICC cricket events as taxable royalty. A Division Bench of Justice V. Kameswar Rao and Justice Vinod Kumar refused to interfere with an order passed under Section 264 of the Income Tax Act, which had held that one-third of the USD 11 million paid by LG to Global Cricket Corporation (GCC), Singapore, was...

Customs Officials Acting In Official Capacity Not Liable To Cross-Examination As Matter Of Right: Delhi High Court

The Delhi High Court has held that Customs officials discharging their duties in an official capacity are not liable to be cross-examined as a matter of right during adjudication proceedings under the Customs Act.A Division Bench of Justices Prathiba M. Singh and Shail Jain made the observation while partially allowing a writ petition challenging denial of Petitioner's request to cross-examine certain persons in a customs duty evasion case.As per the show cause notice, Petitioner was involved in...

Arbitrator Cannot Invalidate Admitted Retirement Deed Without Recording Clear Finding Of Fabrication Or Manipulation: Delhi High Court

The Delhi high Court has dismissed an appeal under section 37 of the Arbitration and Conciliation Act ("Arbitration Act") and upheld an order passed by a Single Judge setting aside an arbitral award which had declared retirement deed of a partner as null and void. A Division bench comprising Justice Navin Chawla and Justice Madhu Jain held that once signatures on the retirement deed were admitted, the arbitral tribunal was not justified in invalidating the deed without returning a...

Delhi High Court Allows Use Of Transitional CENVAT Credit For Mandatory Pre-Deposit Before CESTAT

The Delhi High Court, in a 'rare' scenario where an appeal was sought to be admitted before the CESTAT on the strength of pre-deposit made using through DRC-03, has clarified that pre-deposit was partial component of the demand just as tax, interest and penalty. In a recent judgment dated December 22, 2025, the Delhi High Court dealt with whether CENVAT credit transitioned into the GST regime as on July 01, 2017 could be utilised for the purpose of making pre-deposit or not. A ...

Delhi High Court Refuses To Replace Arbitrator Despite 16-Month Delay, Says Substitution At Final Stage Defeats Expeditious Arbitration

The Delhi High Court rejected an application seeking the substitution a retired Supreme Court Judge as the sole arbitrator, despite a delay of more than 16 months in announcing the arbitral award. The Court found it better suited to grant a short extension to facilitate the finality of the proceedings rather than unsettling them through fresh adjudication. The Bench comprising of Justice Subramonium Prasad, on 16th December, 2025, observed that where arbitral proceedings have concluded and the...

Delhi High Court Grants Bail To Accountant Accused Of Running Fake Firms, Passing Fraudulent ITC On ₹5 Lakh Bond

The Delhi High Court on Friday, December 26 2025 has granted bail to an Accountant allegedly involved in running fictitious firms and passing on fraudulent Input Tax Credit (ITC) upon furnishing a bond of Rs. 5,00,000. A Vacation Bench of Justice Vikas Mahajan found this a fit case for regular bail noting 'no previous involvements' with co-accused already released on bail in 2024 in Bail Application No. 1968/2024. Further, from the status report the Delhi High Court inferred that the...

Arbitrator Cannot Disregard Interest Clause In Invoices While Enforcing Arbitration Clause Contained In Them: Delhi High Court

The Delhi High Court has held that once invoices are accepted as binding contractual documents, an arbitral tribunal cannot selectively enforce some clauses while ignoring other clauses contained in the same invoices. Allowing the appeal under section 37 of the Arbitration and Conciliation Act (Arbitration Act), Justice Chandrasekharan Sudha set aside an arbitral award on the ground that the arbitral tribunal had erred in refusing to grant contractual claim for interest. The appellant...