Delhi High Court

Non-Bailable Warrants Can't Be Issued Against Person Summoned As Witness Or Suspect During ED Probe: Delhi High Court

The Delhi High Court has held that non-bailable warrants (NBWs) can't be issued against a person who has only been summoned as a witness or suspect in a money-laundering investigation, unless such person is shown to be accused of non-bailable offence.Justice Amit Sharma thus quashed the NBWs issued by the Enforcement Directorate against UK-based businessman Sachin Dev Duggal in connection with money laundering allegations.ED had sought issuance of NBWs on the ground that Petitioner failed to...

120-Day Timeline In S.132B Income Tax Act For Deciding Assessee's Plea To Release Seized Assets Not Mandatory: Delhi High Court

The Delhi High Court has held that the 120-day period prescribed under the second proviso to Section 132B(1)(i) of the Income Tax Act, 1961 for deciding an assessee's request for release of seized assets is not mandatory, and a decision taken beyond the said period does not automatically become invalid.A division bench of Justices V. Kameswar Rao and Vinod Kumar was dealing with a petition challenging the Income Tax Department's refusal to release jewellery seized during search proceedings under...

Delhi High Court Upholds Injunction Against Use Of 'Medilice Lice Killer' For Anti-Lice Hair Oil

The Delhi High Court has recently upheld an injunction restraining Rapple Healthcare from using the mark “Medilice Lice Killer” for its anti-lice hair oil, holding that it infringed and amounted to passing off of the registered trademark “MEDILICE” owned by Wings Pharmaceuticals Private Limited. The court, however, reduced the damages awarded to Wings Pharmaceuticals from Rs 10 lakh to Rs 3 lakh. A division bench of Justice C Hari Shankar and Justice Om Prakash Shukla dismissed an appeal...

Software Receipts Can't Be Taxed On PE Assumption Already Rejected By ITAT: Delhi High Court

The Delhi High Court has held that software receipts cannot be subjected to tax deduction at source (TDS) on the assumption of a Permanent Establishment (PE) when such an assumption has already been rejected by ITAT, setting aside a withholding certificate issued under Section 197 of the Income Tax Act.A division bench of Justices V. Kameswar Rao and Vinod Kumar was dealing with a petition filed by Zscaler Inc, a US-based software company, challenging the Assessing Officer's order granting TDS...

Customs | Mere Location Of DRI Or Central Revenues Control Lab In Delhi Doesn't Confer Jurisdiction: Delhi High Court

The Delhi High Court has held that merely because DRI headquarters or Central Revenues Control Laboratory (CRCL) are located in Delhi does not confer jurisdiction upon it to deal with Customs disputes arising in Tamil Nadu.A division bench of Justices Prathiba M. Singh and Renu Bhatnagar made the observation while dealing with the case of Petitioners, situated in Chennai, but challenging seizure memos in Delhi on the ground that its goods were tested at CRCL, Delhi.The judges observed,“The...

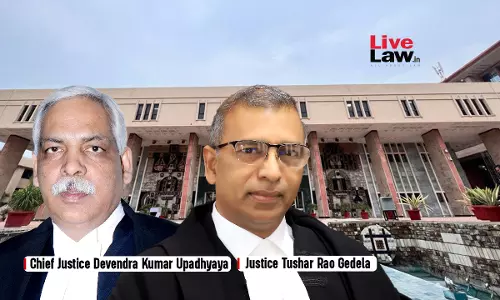

Delhi Air Pollution An 'Emergency': High Court Asks Centre To Consider Temporary GST Relief On Air Purifiers

The Delhi High Court on Wednesday orally remarked that the authorities must provide exemption from GST on air purifiers, considering the air pollution situation in the national capital as an “emergency.”A division bench comprising Chief Justice DK Upadhyaya and Justice Tushar Rao Gedela was hearing a PIL to declare air-purifiers as “medical devices” and remove imposition of 18% GST on them.At the outset, the Court expressed displeasure on the fact that nothing has been done in the matter....

Statutory Appeal Cannot Be Rendered Illusory Due To DRAT Vacancies, Administrative Hurdles: Delhi High Court

The Delhi High Court on Tuesday observed that litigants cannot be denied an effective appellate remedy under debt recovery law when their statutory appeal remains unheard due to tribunal vacancies, recusals and administrative difficulties. On a plea by two auction purchasers, a division bench of Justice Anil Kshetarpal and Justice Harish Vaidyanathan Shankar held that while courts normally refrain from exercising writ jurisdiction when a statutory appeal is available, such restraint cannot...

Delhi High Court Upholds Interim Order Restraining 'HP+' Mark Over Similarity With 'HP' Screw Brand

The Delhi High Court's division bench has upheld an interim order stopping Ganraj Enterprises, a Maharashtra-based maker of screws, from using the marks “HP+” and “HP®+” on its products. The court held that using these marks for self-drilling screws and related goods infringes the registered “HP” trademark owned by Landmark Crafts Pvt. Ltd A Division Bench of Justice C Hari Shankar and Justice Om Prakash Shukla delivered the judgment on December 23, 2025, dismissing an appeal filed by Ganraj...

Extension Of Time To Adjudicate SCN U/S 28 Customs Act Need Not Be Communicated To Importer: Delhi High Court

The Delhi High Court has held that the Customs Department need not communicate to an importer that the time for adjudicating a show cause notice issued to it has been extended by virtue of Section 28(9) of the Customs Act, 1962.Section 28(9) sets time limits for the Customs officer to finalize demand proceedings after issuing SCN for unpaid/short-levied duty, requiring determination within six months for normal cases (S. 28(1)) and one year for specific cases (S. 28(4)). The provision allows...

“Resources Completely Wasted Away”: Delhi High Court Fines Customs For Delaying Release Of Seized Goods Despite Order

The Delhi High Court has criticised the Customs Department for wasting public resources by withholding seized goods despite an adjudication order already having directed its unconditional release, eventually leading to avoidable litigation.A Division Bench of Justices Prathiba M. Singh and Shail Jain observed,“The present is a case which shows how the resources of the Customs Department are completely being wasted away in such matters.”The Court was dealing with a petition moved by a traveller...

Delhi High Court Upholds ₹9.73 Crore Duty On Import Of IPL Broadcast Equipment, Reduces Penalty For Misdeclaration

The Delhi High Court recently upheld the import duty imposed by the Customs, Central Excise & Service Tax Settlement Commission on a company authorised by BCCI to provide broadcast equipment and associated services for covering the Indian Premier League in 2012.A division bench of Justices Prathiba M. Singh and Shail Jain observed that under normal circumstances, this duty would have been liable to be refunded to the Petitioner as the import was merely temporary in nature.However, since...

Delhi High Court Orders Take Down Of Illegal Sale Of Merchandise, Social Media Posts On Former Cricketer Sunil Gavaskar

The Delhi High Court on Tuesday passed an ad interim injunction order protecting the personality rights of former Indian cricketer Sunil Gavaskar.Justice Manmeet Pritam Singh Arora ordered take down of various listings pertaining to illegal and unauthorised sale of merchandise using Gavaskar's personality attributes. The judge also ordered removal of various social media posts available on Meta platforms and X (formerly Twitter) wherein uploaders had attributed incorrect quotes to Gavaskar. It...