Karnataka High Court

'Reasoned Order' Passed By Arbitrator/District Court Cannot Be Interfered With U/S 37 Of A&C Act: Karnataka High Court

The Karnataka High Court bench of Justice H.P. Sandesh has reiterated that when a reasoned order has been passed by the Arbitrator, the same cannot be interfered with. In the case, the court found that the District Court had properly considered sections 73 and 74 of the Indian Contract Act, as well as relevant provisions of the Sale of Goods Act in modifying the arbitral award. The court, therefore, refused to interfere with the award under section 37(e) of the Arbitration and ...

Filing Application U/S 8 Of Arbitration Act Before Statement On Substance Of Dispute Doesn't Waive Right To Invoke Arbitration Clause: Karnataka HC

The Karnataka High Court bench of Justice H.P. Sandesh has held that if an application under Section 8 of the Arbitration and Conciliation Act, 1996 is filed before submitting the first statement on the substance of the dispute, the party cannot be deemed to have waived its right to invoke the arbitration clause. The court observed that the filing of the written statement and application for reference under Section 8 simultaneously cannot lead to an inference that the Appellant had...

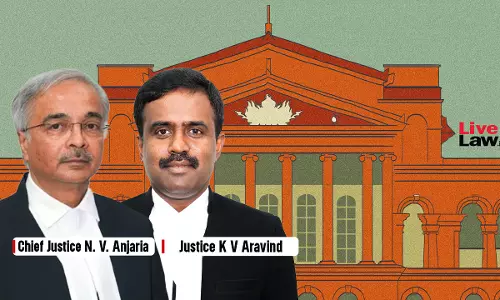

Resolution Professional At S.94/95 Stage Cannot Decide On Maintainability Of Petition By Entering Into Merits: Karnataka High Court

The Karnataka High Court Bench of Justice N.V. Anjaria and K.V. Aravind, held that the role of the Registrar while registering the application under Section 95 of the Insolvency and Bankruptcy Code (IBC) is not adjudicatory in nature and this duty of the Registrar, NCLT was in no way adjudicatory trapping. Application of judicial mind towards merits has no place in discharge of a ministerial or clerical function. Brief Facts A petition under section 95 of the IBC was...

Recovery By Department During Pendency Of Investigation In The Name Of 'Self-Ascertainment Of Tax' U/S 74 CGST Act Is Violative To Art 265: Karnataka High Court

The Karnataka High Court held that voluntary determination by the assessee himself as regards the liability of tax, is sine qua non for 'self-ascertainment of tax' under CGST Act. The High Court therefore clarified that when notice sought to be issued u/s 74(1) indicate a fresh and complete adjudication and does not refer to short fall of actual tax required to be paid as contemplated u/s 74(7), the State itself is estopped from contending that there was self-ascertainment by the...

Ruchi Soya (Patanjali) – Claim Not Included In Approved Resolution Plan Stand Extinguished : Karnataka High Court

The Karnataka High Court division bench comprising Mr. Justice S.G. Pandit and Mr. Justice C.M. Poonacha has held that once a resolution plan is approved by the Adjudicating Authority under Section 31(1) of the Insolvency and Bankruptcy Code, 2016 (IBC), claims which are not included in the resolution plan are extinguished, and no further proceedings can be initiated against the corporate debtor in respect of such claims. The Court also clarified that Rule 22 of the Customs, Excise and...

Karnataka High Court Notifies Guidelines For Live Streaming Of Court Proceedings, Restricts Usage Of Recordings

The Karnataka High Court on Friday posted a note before live streaming of court proceedings would begin, informing the general public about the Karnataka Rules on Live Streaming and Recording of Court Proceedings, which prohibits/restricts usage of court proceedings recordings or live stream. The note was issued after videos of court proceedings went viral on social media, where the judges are reported to have made objectionable comments while hearing cases. The note referred to Rule 10 (2),...

Appeal Against Endorsement Seeking Production Of Account Books Lies Before Joint Commissioner Of Appeals: Karnataka High Court

The Dharwad Bench of the Karnataka High Court has held that the appeal against endorsement seeking production of account books lies before the joint commissioner of appeals.The bench of Justice Jyoti Mulimani has observed that there is an alternative efficacious statutory remedy under Section 62 of the KVAT Act, 2003.The petitioner/assessee is a partnership firm running a bar, restaurant, and lodging. The firm is duly registered under the provisions of the Karnataka Value Added Tax Act, 2003,...

Breaking: Karnataka High Court Refuses To Quash FIR Against Rahul Gandhi, Jairam Ramesh & Supriya Shrinate For KGF Song Copyright Infringement

The Karnataka High Court today refused to quash the FIR registered by music company MRT Music against Congress leaders Rahul Gandhi, Jairam Ramesh and Supriya Shrinate over the alleged copyright infringement by the use of song from the Kannada movie "KGF Chapter 2" in the promotional video for the "Bharat Jodo Yatra".A single bench of Justice M Nagaprasanna observed,"Petitioner appeared to have tampered with source code, which would amount to infringement. Copyright of complainant is taken for...