INCOME TAX

Delhi HC Sets Aside Income Tax Action Against Rajat Sharma-Owned India TV's Parent Company Over Alleged Unaccounted Foreign Remittances

The Delhi High Court on Wednesday set aside the reassessment action initiated against journalist Rajat Sharma's company, M/S Independent News Service Pvt. Ltd., which owns and runs the India TV channel, over alleged foreign remittances.The notice was issued following a survey conducted by the Income Tax Department at the J&K Bank back in 2019, revealing that the company had made...

S. 245A Income Tax Act | Kerala High Court Allows Settlement Application Filed Beyond Cutoff Date, Citing SC's COVID Limitation Order

The Kerala High Court has allowed the settlement application under Section 245A of the Income Tax Act filed beyond cutoff date, while citing Supreme Court's COVID limitation order. Justices A.K. Jayasankaran Nambiar and P.M. Manoj referred to the order of Supreme Court in MA. Nos.665 of 2021 [In Re Cognizance For Extension Of Limitation] and stated that the assessee had filed...

DTAA Prevails Over S.206AA Of Income Tax Act For TDS On Payments To Non-Residents Without PAN: Gujarat High Court

The Gujarat High Court stated that DTAA (Double Taxation Avoidance Agreement) prevails over Section 206AA of Income Tax Act for TDS on payments to non-residents without PAN. Justices Bhargav D. Karia and Pranav Trivedi was addressing the appeals pertains to alleged short deduction of TDS and raising demand by invoking provisions of section 206AA of the Income Tax...

Assessment Based On DVO's Valuation Cannot Be Revised U/S 263 Of Income Tax Act In Absence Of Concrete Material: Kerala High Court

The Kerala High Court held that assessment based on DVO's (Department Valuation Officer) valuation cannot be revised under Section 263 of Income Tax Act in absence of concrete material. Justices A.K. Jayasankaran Nambiar and P.M. Manoj observed that “as on the date of invoking his power under Section 263 of the IT Act, the Commissioner could not have had a 'reason to believe' that...

S.245C Income Tax Act Does Not Require Prior Cut-Off Date, Pending S.153A/153C Notice Sufficient For Settlement Application: Kerala HC

The Kerala High Court stated that Section 245C of Income Tax Act does not require prior cut-off date; pending 153A/153C notice sufficient for settlement application. Justices A.K. Jayasankaran Nambiar and P.M. Manoj opined that “when Section 245C does not prescribe any prior cut-off date for an assessee to satisfy the requirements for filing an application before the Interim Board...

Assessee Cannot Be Penalised U/S 271(1)(c) Of Income Tax Act For Merely Raising A Plausible Claim: Bombay High Court

The Bombay High Court stated that the assessee cannot be penalised under Section 271(1) (c) of income tax act for merely raising a plausible claim. The Division Bench consists of Chief Justice Alok Aradhe and Justice Sandeep V. Marne opined that “the claim raised by the Assessee for claiming deduction in respect of the crystalised liability towards additional bonus was a...

Once AO Scrutinises Identity & Creditworthiness Of Shareholders, No Reassessment Action Without 'Additional Info' About Income Escapement: Delhi HC

The Delhi High Court recently rejected Revenue's appeal against deletion of additions made to the income of an assessee-company alleged to have evaded tax, observing that the AO had already scrutinised the identity and creditworthiness of the shareholders and in the absence of any additional material coming to light, reassessment action could not have been initiated.A division bench of...

Reassessment Notice Can't Be Based On 'General Information' From Investigation Wing Of Income Tax Dept: Delhi High Court

The Delhi High Court has made it clear that the Income Tax Department cannot issue reassessment notice to an assessee based on general information shared by its Investigation Wing, until the Assessing Officer forms definite 'reason to believe' escapement of income.A division bench of Justices Vibhu Bakhru and Tejas Karia observed,“It is clear from the information received from the...

Valuation Of Company's Unquoted Equity Shares By 'Discounted Cash Flow' Method Permissible Under Income Tax Rules: Delhi High Court

The Delhi High Court recently rejected the appeal preferred by the Income Tax Department against an ITAT order allowing the valuation of a software company's unquoted equity shares by discounted cash flow [DCF] method.In doing so, a division bench of Justices Vibhu Bakhru and Tejas Karia held that DCF method “is one of the methods that can be adopted by the Assessee under Rule 11UA(2)(b) of...

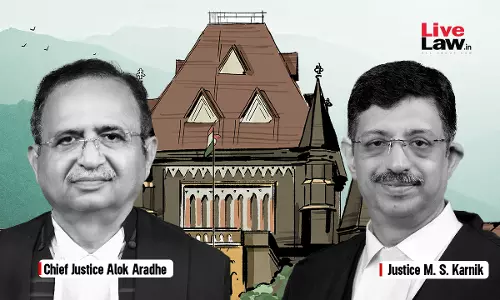

AO Cannot Alter Net Profit In Profit & Loss Account Except Under Explanation To S.115J Of Income Tax Act: Bombay High Court

The Bombay High Court stated that assessing officer do not have the jurisdiction to go behind net profit in profit and loss account except as per explanation to Section 115J Of Income Tax Act. The Division Bench consists of Chief Justice Alok Aradhe and Justice M.S. Karnik observed that “Section 115J of the 1961 Act mandates that in case of a company whose total income as...

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

Does Payment For Transponder Services Constitute 'Royalty' U/S 9(1)(vi) Of Income Tax Act? Bombay High Court Asks CIT To Decide

The Bombay High Court has asked the Commissioner of Income Tax to decide whether payment for transponder services constitutes 'royalty' under Section 9(1)(Vi) of Income Tax Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “the authorities have held the payment to constitute 'royalty' under the domestic law as well as under the Treaty, but by holding...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www.livelaw.in/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)