INCOME TAX

Punjab & Haryana High Court Directs CBDT To Issue Circular Extending ITR Due Date For Audit Cases To 30.11.2025 For A.Y. 2025-26

The Punjab and Haryana High Court has directed the CBDT (Central Board of Direct Taxes) to issue a circular extending the ITR (Income Tax Return) due date for audit cases to 30.11.2025 for the Assessment Year 2025-2026. Justices Lisa Gill and Meenakshi I. Mehta were addressing a petition filed by the assessee/petitioner seeking a direction to the Central Board of Direct Taxes to...

Income Tax Act | Mechanical 'Rubber-Stamp' Approval U/S 153D Vitiates Entire Search Assessment: Bombay High Court

The Bombay High Court has held that prior approval under Section 153D of the Income Tax Act is not a mere technical or procedural formality, and that mechanical, en masse sanction without application of mind vitiates the entire assessment under Section 153A. A Division Bench of Justice M.S. Sonak and Justice Advait M. Sethna, while deciding a batch of over 60 Income Tax Appeals filed...

Income Tax Act | SBI Not 'Assessee In Default' U/S 201 For Not Deducting TDS While Obeying Court's Interim Order: Kerala High Court

The Kerala High Court has held that the State Bank of India (SBI) cannot be treated as an 'assessee in default' under Section 201 of the Income Tax Act for not deducting Tax Deducted at Source (TDS) on Leave Travel Concession (LTC) payments, as it was bound by an interim order which prohibited such deduction. Justices A. Muhamed Mustaque and Harisankar V. Menon examined whether the...

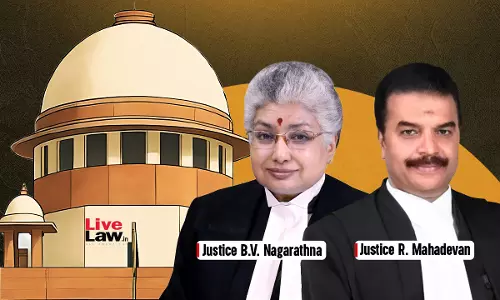

'Frivolous Cases Waste Judicial Time' : Supreme Court Raps Income Tax Dept For Filing SLP On Settled Issue

The Supreme Court on Friday pulled up the Income Tax Department for filing yet another Special Leave Petition (SLP) in a matter already settled by the Court, calling it a frivolous exercise that contributes to mounting pendency.A Bench of Justice BV Nagarathna and Justice R Mahadevan was hearing an SLP challenging a Karnataka High Court order on tax deduction at source (TDS) liability, an...

Delhi High Court Refuses To Condone 9-Month Delay By Assessee In Filing Revised Income Tax Return

The Delhi High Court has refused to condone a delay of 9-months by an assessee in filing his revised income tax return (ITR).A division bench of Justices V. Kameswar Rao and Vinod Kumar remarked,“Surely it should not take nine months to realize that initial ITR has some mistakes, which requires a revised return.”The Court was dealing with a plea against rejection of Petitioner's...

CBI Arrests Jaipur Income Tax Appellate Tribunal's Judicial Member For Indulging In 'Corrupt Practices'

The CBI has arrested a lawyer as well as a judicial member of the Income Tax Appellate Tribunal, Jaipur for allegedly indulging in corrupt practices. As per the agency's post on X, the agency has busted a "criminal network" stated to involve an advocate as well as a judicial member of ITAT, Jaipur, an assistant registrar of the tribunal, and other unknown public servants and private persons...

'Estimation Theory Doesn't Apply To Sham Purchases': ITAT Mumbai Restores Full Disallowance Of ₹26.49 Lakh

The Income Tax Appellate Tribunal (ITAT) Mumbai has held that where purchases are conclusively proven to be bogus and the assessee fails to substantiate the genuineness of suppliers, the entire purchase amount must be added to income and the benefit of estimating profit element cannot be applied. A Bench of Smt. Beena Pillai (Judicial Member) and Shri Omkareshwar Chidara...

IT Act | Reassessment Cannot Be Used To Review Assessment When All Documents Were Earlier Disclosed: Bombay High Court

The Bombay High Court has held that reassessment proceedings under Sections 148 & 148A of the Income Tax Act, 1961 cannot be initiated to re-open issues that were already scrutinized and accepted during the original assessment, observing that a mere change of mind on the part of the Assessing Officer does not constitute reason to believe nor permit reassessment. A Division Bench...

'Seems Tax Department Has Not Trusted Even Its Lawyers' : Supreme Court Flags Procedural Delays In IT Dept's Petition Filings

The Supreme Court recently criticised the Income Tax Department for filing its Special Leave Petition after a delay of 524 days, observing that the Department, despite having an entire team of legal experts, failed to act on its own lawyers' advice and instead allowed time to be wasted in unnecessary and prolonged litigation. A bench comprising Justices Pankaj Mithal and Prasanna B....

Income Tax Act | Reassessment Against Entity Converted Into LLP Is Void: Bombay High Court Sets Aside S.148 Notice Issued To Defunct Company

The Bombay High Court has set aside a reassessment notice issued under Section 148 of the Income Tax Act, 1961 against a company that had ceased to exist due to conversion into a Limited Liability Partnership (LLP), holding that reopening of assessment against a non-existent entity is “illegal and bad-in-law”. A Division Bench of Justice B.P. Colabawalla and Justice Amit...

NFAC Doesn't Take Away Jurisdictional Assessing Officer's Power To Initiate Reassessment U/S 148 Income Tax Act: Delhi High Court

The Delhi High Court has held that the Jurisdictional Assessing Officer (JAO) and Faceless Assessing Officer (FAO) have jurisdiction to issue reassessment notices under Section 148 of the Income Tax Act, 1961.The position has been in dispute since introduction of the E-Assessment of Income Escaping Assessment Scheme, 2022, which led to the setting up of the National Faceless Assessment...

Income Tax Reassessment Notice Generated On Last Day Of Limitation But Uploaded Next Day Due To Portal Glitch Is Time-Barred: Delhi HC

The Delhi High Court recently found time-barred, an income tax reassessment notice generated by the Department on the last day of the limitation window but, issued to the assessee only a day after.The limitation period in the case at hand expired on June 30, 2025 (inclusive).The Income Tax Department claimed that the notice was generated on June 30, 2025 at 21:14:46 and signed on June 30, 2025...