High Courts

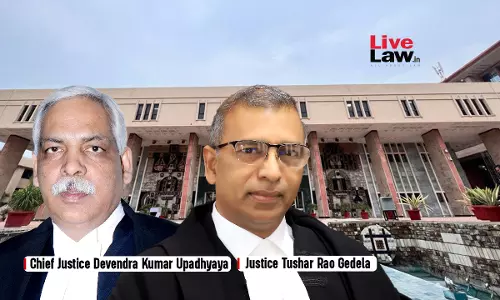

'Proof Beyond Reasonable Doubt' Is A Principle Of Criminal Law, Not Applicable To Tax Law: Delhi High Court

The Delhi High Court has made it clear that the principle of 'proof beyond reasonable doubt' cannot be made applicable to Section 148 of the Income Tax Act, 1961 which enables an assessing officer to open an assessment if he has 'reason to believe' that an assessee's income escaped assessment.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela observed,...

Expansion Of Definition Of 'Sikkimese' In S.10(26AAA) Of Income Tax Act Doesn't Affect Rights Of Indigenous People: Sikkim High Court

The Sikkim High Court has upheld the constitutional validity of the definition 'Sikkimese' under the Income Tax Act, which was slightly expanded by way of an amendment in terms of the Finance Act, 2023.A division bench of Chief Justice Biswanath Somadder and Justice Meenakshi Madan Rai upheld the vires of Explanation (v) contained under clause (26AAA) of section 10 of the Income Tax Act,...

Fair Market Value Of Shares Determined By Statutory Methods Can't Be Rejected By Income Tax Department: Karnataka High Court

The Karnataka High Court stated that fair market value of shares determined by statutory methods can't be rejected by the income tax department. The Division Bench of Justices Krishna S Dixit and Ramachandra D. Huddar was addressing a case where the revenue has challenged the order passed by the Tribunal where the Tribunal held that the valuation report on DCF Method produced...

Contingent Liability vs Laid Out Expense: Delhi HC Allows Vodafone To Claim ₹5.1 Crore Depreciation Over Estimated Costs To Restore Mobile Tower Sites

The Delhi High Court has allowed Vodafone Mobile, engaged in providing telecommunication services, to claim depreciation of ₹5.10 crores in respect of fixed assets over provisioned expenditure to discharge its contractual obligation of restoring mobile tower sites to their original condition at the end of the lease period.Though Asset reconstruction Cost (ARC) was laid out by Vodafone,...

Income Tax Rules | Centre's Power To Relax Conditions Under Rule 9C Exceptional & Discretionary, Not Ordinarily Subject To Judicial Review: Delhi HC

The Delhi High Court has made it clear that the power of the Central government to relax conditions prescribed under Rule 9C of the Income Tax Rules 1962, read with Section 72A of the Income Tax Act, 1962, is exceptional, discretionary and cannot ordinarily be subject to judicial review.In terms of Section 72A of the Act, the accumulated losses and unabsorbed depreciation of the...

S.36 Income Tax Act | Deduction For Bad Debt Allowed Only If Assessee Lends In Ordinary Course Of Banking/Money Lending Business: Delhi HC

The Delhi High Court has made it clear that allowance in respect of bad debts as an expense under Section 36 of the Income Tax Act, 1961, is permissible only if:(a) the debt was taken into account for computing the income of the assessee in the previous year in which the amount is written off or prior previous years; or (b) represents money lent in the ordinary course of business of banking...

Income Tax Act | Principal Commissioner Has Authority To Cancel Registration Of Assessee Without Waiting For Decision From Assessing Authority: Kerala HC

The Kerala High Court stated that principal commissioner has authority to cancel registration of assessee without waiting for decision from assessing authority. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “the provisions of Section 12AA independently empower the Principal Commissioner to consider whether or not the circumstances mentioned...

Income Tax | Whether There Was Proper Notice Or Not Is Disputed Question Of Fact, Can't Be Challenged Under Article 226: Kerala High Court

The Kerala High Court stated that the issue as to whether there was a proper notice or not is a disputed question of fact and cannot be challenged under Article 226 of the Constitution of India. “…….As rightly observed by the learned Single Judge, the question as to whether there was a proper notice or not is certainly a disputed question of fact, which cannot be gone into in...

Transfer Pricing | Existence Of International Transaction Must Be Determined Before Benchmarking Analysis Is Commenced: Delhi HC

The Delhi High Court has held that before the Income Tax Department commences transfer pricing benchmarking analysis of an assessee's international transactions, the very existence of such 'international transaction' must be determined.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar, while dealing with the case of an Indian entity producing liquor for brands like...

Income Tax Department Cannot Attach Properties Indefinitely Without Pursuing Steps To Resolve Matter: Delhi High Court

The Delhi High Court has held that the Income Tax Department cannot, suspecting escapement of tax on income by an assessee, indefinitely attach its properties without taking further steps to resolve the matter.Single judge Justice Sachin Datta observed that Section 222 of the Income Tax Act, 1961 which empowers the Tax Recovery Officer to proceed with “attachment and sale of assessee's...

Respondent Cannot File Cross-Objections To Appeal Before High Court U/S 260A Income Tax Act: Delhi High Court

The Delhi High Court has held that Section 260A of the Income Tax Act, 1961, which pertains to appeals to High Courts, does not envisage the filing of cross-objections by the opposite party, unlike Order XLI Rule 22 CPC.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar observed, “The Legislature appears to have consciously desisted from adopting principles akin...

Delhi High Court Expresses Concern Over Delay In Disposal Of Matters Before National Faceless Appeal Centre

The Delhi High Court has expressed grave concern over the pendency of over 5.4 Lakh appeals before the National Faceless Appeal Centre (NFAC).The body was created for faceless assessment under Section 143 or 144 of the Income Tax Act, 1961, by the insertion of Section 144B via the Taxation and Other Laws (Relaxation and Amendment of Certain Provisions) Act, 2020.A division bench of Chief...