ITAT

Assessee Cannot Be Asked To Prove Non-Occurrence Of Transaction Once Documentary Evidence Is Produced: ITAT

LThe Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has stated that the assessee is not required to prove negative once documentary evidence is produced.Section 69C of the Income Tax Act, 1961 provides that if an assessee incurs any expenditure during a financial year and fails to provide a satisfactory explanation, or if the Assessing Officer does not accept the explanation, the amount...

Wedding Gifts Can't Be Automatically Treated As 'Unexplained Income' Without Evidence: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has stated that wedding gifts can't be automatically treated as unexplained income without evidence. Dr. BRR Kumar (Vice President) and Siddhartha Nautiyal (Judicial Member) stated that the fact that marriage gifts were received prior to the date of marriage itself could not lead to the conclusion that the same are not...

Property Transfer Between Spouses Without Actual Consideration Not Taxable As Capital Gains: ITAT

The New Delhi Bench of Income Tax Appellate Tribunal (ITAT) has stated that property transfer between spouses without actual consideration is not taxable as capital gains. S. Rifaur Rahman (Accountant Member) and Anubhav Sharma (Judicial Member) were dealing with the issue arises out of addition of Rs. 1,40,00,000/-, being consideration amount mentioned in conveyance deed, executed...

Income Tax Act | Rebate U/S 87A Available On Short-Term Capital Gains U/S 111A Under New Regime: ITAT

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has stated that rebate under section 87A available on short-term capital gains under section 111A under new regime. Suchitra R. Kamble (Judicial Member) and Makarand V. Mahadeokar (Accountant Member) stated that on a plain reading of the statutory provisions, there exists no express bar either in section 87A or section 111A...

Widow Eligible To Claim TDS Credit On Deceased Husband's Income: ITAT

The Kolkata Bench of Income Tax Appellate Tribunal (ITAT) has stated that widow eligible to claim TDS credit on deceased husband's income. Sonjoy Sarma (Judicial Member) and Rakesh Mishra (Accountant Member) stated as per sub-rule (2) of Rule 37BA and sub-rule 3(i) of the Income Tax Rules, 1962, if the income is assessable in the hands of any other person, the credit of TDS shall...

ITAT Rejects Congress Party's Appeal To Exempt ₹199.15 Crore From Income Tax, Cites Belated Filing Of Return

The Income Tax Appellate Tribunal dismissed an appeal by the Indian National Congress seeking income tax exemption for the income of ₹199.15 crore during the assessment year 2018-19.The Tribunal rejected the party's claim for exemption on the ground that there was a violation of the conditions in Section 13A of the Income Tax Act. The returns were filed late, the ITAT noted. Calling for...

Income Tax | Salary Received By Chinese Resident For Services In China Not Taxable In India, Even If Credited To Indian Bank Account: ITAT

The Chennai Bench of Income Tax Appellate Tribunal (ITAT) has stated that salary received by Chinese resident for the services in China not taxable in India, even if credited to the Indian bank account. Manu Kumar Giri (Judicial Member) and S.R. Raghunatha (Accountant Member) observed that “the AO has disallowed the exemption claimed with respect to salary received in India...

S.148 Income Tax Notice Issued After 31.03.2021 Under Old Regime Invalid Despite TOLA Extension: ITAT

The Chennai Bench of Income Tax Appellate Tribunal (ITAT) has held that S.148 Income Tax notice issued after 31.03.2021 under old regime invalid despite TOLA [Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020] extension. Section 148 of Income Tax Act, 1961 empowers the Income Tax Department to reopen assessments if there's reason to suspect...

Transferor Not Liable U/S 56(2) Of Income Tax Act For Undervalued Property Sale To Spouse: ITAT

The Income Tax Appellate Tribunal Chennai stated that transferor not liable under Section 56(2) Of Income Tax Act for undervalued property sale to spouse. The Bench of SS Viswanethra Ravi (Judicial Member) and Amitabh Shukla (Accountant Member) observed that “the hypothesis propounded by the Ld.AO is flawed and not supported by the statutory stipulations governing the matter. It...

ITAT Rejects Revenue's Appeal Seeking To Make ₹63.21 Billion Addition To DLF's Income For AY 2017-18

The Income Tax Appellate Tribunal at New Delhi has dismissed an appeal preferred by the Revenue against an order of the National Faceless Centre (CIT(A)), deleting aggregate ₹63,02,13,86,035 addition made to income of real estate giant DLF Limited on various counts, for the Assessment Year 2017-18.In its 82-page judgement, the Tribunal also disposed of the company's appeal against...

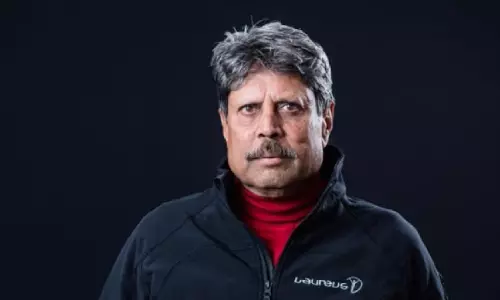

ITAT Exempts Tax On ₹1.5 Crore Granted By BCCI To Kapil Dev In Recognition Of His Services To Cricket

The Income Tax Appellate Tribunal at Delhi allowed renowned cricketer Kapil Dev to claim exemption on Rs. 1.5 crore one-time benefit granted to him by the BCCI in 2013, in recognition of his services.Noting that the cricketer had offered the amount for tax under ignorance, bench of M. Balaganesh (Accountant Member) and MS Madhumita Roy (Judicial Member) said,“It is trite law that right...

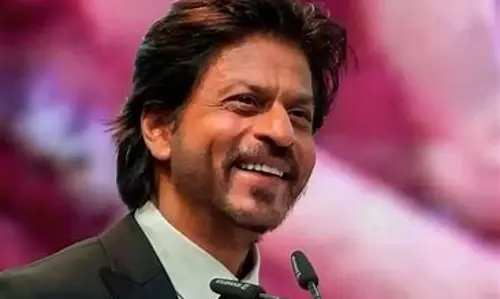

'Entire Case Based On Records Already Considered During Scrutiny': Mumbai ITAT Quashes Reopening Of Assessment Against Shah Rukh Khan For AY 2012-13

The Mumbai ITAT has quashed the reopening of assessment proceedings against the Assessee/ Appellant i.e., Shah Rukh Khan for AY 2012-13.The tribunal held that the reasons recorded while initiating the re-assessment, were completely silent as regards the allegation that income chargeable to tax has escaped assessment due to failure on the part of the assessee to disclose fully and truly...