Supreme Court & High Courts

Delhi High Court Slams GST Authorities For 'Mechanically' Cancelling Registration Of BoAt's Parent Company

The Delhi High Court has slammed the GST authorities for cancelling the registration of Imagine Marketing Ltd., the parent company of smart wearables brand boAt, without considering the company's replies.A division bench of Justices Prathiba M. Singh and Shail Jain further criticised the GST Appellate Authority, which upheld the cancellation in a 'cavalier' manner. The judges...

Power To Extend Arbitrator's Mandate Lies With Civil Court Of Original Jurisdiction, Not Appointing Court: Telangana High Court

The Telangana High Court dismissed a Civil Revision Petition filed by Employees State Insurance (ESI) Corporation. ESI had challenged an order passed by the Civil Court allowing the application seeking extension of the arbitrator's mandate. Justice P. Sam Koshy held that the mandate of the arbitrator under section 29A(4) of the Arbitration and Conciliation Act, 1996 (Arbitration Act)...

Delhi High Court Imposes ₹50K Costs On Customs For “Harassing” Companies Importing Body Massagers

The Delhi High Court has slammed the Customs Department for “unnecessarily harassing” two entities involved in import of body massagers.Petitioners' import goods were confiscated for alleged mis-declaration of sex toys as body massagers. While ordering their provisional release, the Court had previously asked the Department to come up with a uniform policy permitting or prohibiting the...

Delhi High Court Finds No Similarity Between 'OPAL' and 'SHEOPAL'S' Mark, Denies Injunction to OPAL Cosmetics

The Delhi High Court has upheld a Commercial Court order refusing interim injunction to cosmetics brand OPAL, holding that its mark is not deceptively similar to “SHEOPAL'S,” a mark used by Sheopals Pvt. Ltd. (SPL), which also manufactures beauty and wellness products. Delivering judgment on November 26, 2025, a Division Bench of Justice C. Hari Shankar and Justice Om Prakash Shukla...

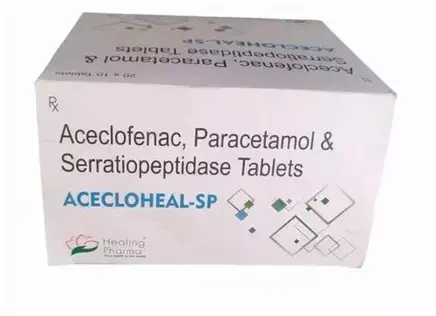

Drug Names Based On International Non-Proprietary Names Cannot Be Monopolised: Bombay High Court Reaffirms

The Bombay High Court has refused to grant an interim injunction to Aristo Pharmaceutical Pvt. Ltd. in its trademark infringement and passing-off suit against Healing Pharma India Pvt. Ltd., ruling that pharmaceutical companies cannot claim exclusivity over trademarks derived from International Non-Proprietary Names (INNs). Justice Sharmila U Deshmukh held that Aristo's registered...

Delhi High Court Protects Gaay Chhap Detergent, Restrains Use Of 'Gopal Gai Chhap' and 'Cow Brand' Marks

The Delhi High Court has granted an interim injunction in favour of Gaay Chhap, a Kanpur-based detergent brand, restraining a Uttar Pradesh trader from using the marks “Gopal Gai Chhap” , “Cow Brand,” and similar labels for detergent soaps, cakes, and washing powders. Justice Tejas Karia passed the order on November 24, 2025, after finding that Gaay Chhap had shown prior and...

Pre-CIRP Tax Claims Extinguished After Plan Approval, Bombay High Court Quashes Tax Notices To V Hotels

The Bombay High Court has recently reaffirmed that income-tax assessment proceedings for any period prior to the approval of a resolution plan under the Insolvency and Bankruptcy Code (IBC) stand extinguished once the National Company Law Tribunal (NCLT) approves the plan, ruling that the tax department cannot initiate or continue such proceedings thereafter.A Division Bench of Justice B...

Delhi High Court Sets Aside Rejection Of Medilabo's Patent For Neurodegenerative-Disease Drug

The Delhi High Court has set aside a Patent Office order refusing Medilabo RFP's patent application for a pharmaceutical composition used in treating neurodegenerative diseases, holding that the authority rejected the application without examining the amended claims and without explaining how the invention fell within the bar on “methods of treatment” under Section 3(i) of the Patents...

Customs | Oral Waiver Of SCN Untenable In Law, Continued Detention Of Goods Illegal: Delhi High Court

The Delhi High Court has held that continued detention or seizure of goods by the Customs Department would be untenable in law, where the Show Cause Notice or the personal hearing have been waived via an oral waiver.A division bench of Justices Prathiba M. Singh and Shail Jain was dealing with a challenge to detention of Petitioner's gold chain weighing 54 grams.Briefly put, Petitioner...

Karnataka High Court Orders Refund Of ₹10 Crore, Says Payment During GST Search Was 'Not Voluntary' U/S 74(5) CGST Act

The Karnataka High Court held that the assessee's payment of Rs. 10 crores could not be treated as a voluntary payment under Section 74(5) of the CGST Act (Central Goods and Services Tax Act), as the DRC-03 shows 'NIL' entries for both interest and penalty. The bench observed that the 'NIL' entries clearly indicated that the payment was made by the assessee under coercion and...

Arbitration | Unconditional Stay On Execution Of Award Only In Exceptional Cases: Supreme Court

The Supreme Court recently declined to grant an unconditional stay on the execution of the arbitral award, holding that the requirement to deposit the security amount was justified since the award was not shown to have been induced or tainted by fraud or corruption. Referring to its latest ruling in Lifestyle Equities C.V. and Another v. Amazon Technologies Inc., a bench of Justices...

Statement Made Before Customs Officer U/S 108 Customs Act Over Goods Seizure Not Admissible In Evidence: Delhi High Court

The Delhi High Court has held that statements made by an assessee to the Customs Department under Section 108 of the Customs Act 1962, upon seizure of its goods, is not admissible as evidence in court of law.“Statements under Section 108 would not be admissible in evidence,” said a division bench of Justices Prathiba M. Singh and Shail Jain.Section 108 deals with the power of customs...