Supreme Court & High Courts

Delhi High Court Stays Registration Of Mark Found Similar To Dabur's Pudin Hara

The Delhi High Court has stayed the opertaion of trademark registration for “Wellford Pudin Hara,” holding that its adoption appears prima facie dishonest and likely to confuse consumers familiar with Dabur's digestive remedy “Pudin Hara". Pudin Hara is a popular mint based over-the-counter herbal product used for indigestion and stomach discomfort. The court said the impugned mark “completely subsumes” Dabur's mark for goods in the same class, creating “an irrefutable and real likelihood...

Non-Signatory, Non-Existent LLP Cannot Invoke Arbitration Protection Through Group Of Companies Doctrine: Meghalaya High Court

The Meghalaya High Court has dismissed an appeal filed by Suraksha Salvia LLP against the State Government's termination of a Public-Private Partnership (PPP) for a diagnostic centre in Shillong, ruling that a company that was not even in existence on the date of agreement execution cannot seek protection under section 9 of the Arbitration and Conciliation Act. The Division Bench comprising...

ITC Cannot Be Denied For Non-Filing Of TRAN-1 Due To Transition Issues When GST Regime Came Into Effect: Delhi High Court Allows Credit Of ₹99 Lakh

The Delhi High Court held that legitimate transactional Input Tax Credit (ITC) cannot be denied when the assessee was unable to file TRAN-1 due to a GST portal glitch during the shift to the GST regime. The bench noted that since the form could not be filed in time, the distribution could not take place as per Rule 39(1)(a) of the CGST Rules within one month.Rule 39(1)(a) of the Central Goods...

Bombay High Court Sets Aside Award Ordering Sharekhan To Refund Rs 4.87 Lakh In Brokerage

The Bombay High Court has set aside an arbitral award that had directed Sharekhan Limited, a broking firm, to refund Rs 4.87 lakh in brokerage to its client Darshini Shah. The court held that the arbitral tribunal had irrationally treated the same 2007 contract between the parties as valid for permitting trades but invalid for charging brokerage and that such a conclusion was...

'Did Not Apply Mind': Gujarat High Court Quashes Tax Authority's Order Refusing To Condone Delay In Filing Return Due To COVID Pandemic

The Gujarat High Court quashed an order of the tax authorities rejecting a partnership firm's application seeking condonation of 13 day delay in filing income tax return on account of Covid pandemic, observing that authority "did not apply its mind" to the reasons given by the firm. The petitioner partnership firm engaged in real estate development business had challenged a 27.10.2023...

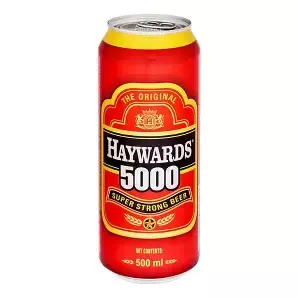

Bombay High Court Bars Use Of 'COX 5000' Mark, Says '5000' Belongs To Haywards 5000 And Imposes ₹10 Lakh Cost

The Bombay High Court has permanently restrained Madhya Pradhesh-based Jagpin Breweries Limited, a manufacturer of mass-market beer brands, from using the mark “COX 5000” or any other beer mark containing the numeral “5000”. The court held that the numeral is the “dominant, essential, and memorable feature” of the famous strong beer brand “HAYWARDS 5000”, now owned by...

S. 29A Arbitration Act | Arbitrator's Mandate Terminates On Expiry Of Time; Substituted Arbitrator Must Resume After Extension : Supreme Court

The Supreme Court on Wednesday (December 10) held that once the statutory 18-month period for delivering an arbitral award expires, the arbitrator's mandate automatically comes to an end as per Section 29A(4) of the Arbitration and Conciliation Act, 1996, when no application for extension is made. Therefore, when an extension of time is granted by the Court after the mandate of the arbitrator...

Bombay High Court Temporarily Restrains Rival From Using Trade Dress Similar To Parachute Jasmine Hair Oil

The Bombay High Court has temporarily restrained Minolta Natural Care and its associated entities from using packaging and bottle designs that the court found deceptively similar to Marico's Parachute Jasmine/ Parachite Advansed Jasmine Hair Oils. A single bench of Justice Sharmila U Deshmukh passed the interim injunction on December 9, 2025, after Marico alleged that Minolta had copied...

Municipality Must Accept Only Tax Component, Penal Charges Not Required For Filing Appeal Under Municipal Act: Kerala High Court

The Kerala High Court held that under Section 509(11) of the Municipality Act, only the tax component shown in the demand notice is required to be paid for filing an appeal. The bench clarified that the Municipality cannot insist on payment of penal interest or any other additional charges for entertaining the appeal. Section 509(11) of the Municipality Act, 1994, provides that...

Income Tax Act | No Addition U/S 153A Without Incriminating Material Found During Search: Bombay High Court

The Bombay High Court has held that no income addition can be made under Section 153A of the Income Tax Act, 1961 unless incriminating material is found during a search, even if the Revenue relies on information received from foreign authorities. A Division Bench of Justice G.S. Kulkarni and Justice Aarti Sathe dismissed an income tax appeal filed by the Revenue and upheld the order...

Delhi High Court Orders 'Mask' Movie Makers To Drop Disputed Kannada Song Or Deposit ₹30 Lakh Before OTT Release

The Delhi High Court on Tuesday directed Black Madras Films, the producers of the Tamil feature film "Mask", to either remove the Kannada song “Naguva Nayana” from the movie or deposit Rs 30 lakh with the court before releasing it on OTT platforms, satellite television, or any other online medium. The order was passed on December 9, 2025, by Justice Tejas Karia while hearing an...

NAFED's 'Society Commission' Deductions From Rice Millers' Bills Contrary To Contract: Orissa High Court Upholds Refund Award

The Orissa High Court bench of Justice (Dr.) Sanjeeb K Panigrahi while dismissing an appeal under Section 37, Arbitration and Conciliation (“ACA”) observed that deductions from invoices made by NAFED under the head “society commission” were contrary to the contractual agreements entered with rice millers and the latter were entitled to reimbursement of such deducted amounts....