Supreme Court & High Courts

Punjab & Haryana High Court Quashes Negative Blocking of ITC Under Rule 86A; Holds Ledger Cannot Be Blocked Beyond Available Credit

The Punjab & Haryana High Court has quashed orders that disallowed debit from Electronic Credit Ledgers of taxpayers in excess of the Input Tax Credit (ITC) available at the time of passing of the said order. The Division Bench comprising, Justice Lisa Gill and Justice Meenakshi I. Mehta followed the principles judicial reasoning for blocking of Electronic Credit Ledger under Rule 86-A...

Rebate Under Rule 18 CER Cannot Be Denied Without Examining Duty On Exported Goods: Bombay High Court Remands Yamaha's Claim

The Bombay High Court has held that a rebate under Rule 18 Central Excise Rules, 2002, cannot be denied without determining the tax liability on exported goods, and has remanded Yamaha's rebate claim to the principal commissioner for fresh consideration. Justices M.S. Sonak and Advait M. Sethna were examining whether the India Yamaha Motor P. Limited was entitled to a rebate...

Delhi High Court Dismisses Aqualite's Appeal; Upholds Interim Injunction Granted To Relaxo In Design Piracy Suit

The Delhi High Court has dismissed an appeal filed by Aqualite Industries Pvt. Ltd. and upheld the interim injunction granted by a Single Judge restraining Aqualite from manufacturing and selling slippers alleged to infringe Relaxo Footwears Ltd.'s registered designs. Delivering judgment on 18 November 2025, a Division Bench of Justice C. Hari Shankar and Justice Om Prakash Shukla...

Audit Assessment Under Orissa VAT Act Is Invalid If Audit Visit Report Is Time-Barred: High Court

The Orissa High Court has held that an audit assessment under Section 42 of the OVAT Act (Odisha Value Added Tax Rules, 2005) cannot be initiated when the AVR (Audit Visit Report) is beyond the limitation period. Chief Justice Harish Tandon and Murahari Sri Raman were examining whether the Assessing Authority has jurisdiction to proceed with Audit Assessment under Section 42 of the...

Cancelled GST Registration Cannot Be Restored Solely To Claim ITC Benefit U/S 16(6) CGST Act: Kerala High Court

The Kerala High Court has held that a cancelled GST registration cannot be restored solely to claim the ITC (Input Tax Credit) benefit under Section 16(6) CGST Act (Central Goods and Services Tax Act, 2017). Section 16(6) of the Central Goods and Services Tax Act, 2017, enables the taxpayer to claim the input tax credit available in the ledger, in case the order...

IT Act | 'Charitable Trust's Bona Fide Mistake Due To Misprint In Taxmann Bare Act': Bombay High Court Condones Delay In Filing Form 9A

The Bombay High Court allowed a writ petition filed by the Charitable Trust “Savitribai Phule Shikshan Prasarak” seeking quashing and setting aside of the Order passed by the Directorate General of Income Tax Investigation (Investigation) Pune whereby the Trust/Petitioner's application for condonation of delay 509 days in filing its Form 9A for the Assessment Year 2022-23 was...

Delhi High Court Refuses To Entertain Foreign National's Plea Alleging Illegal Arrest By Customs Dept In Gold Smuggling Case

The Delhi High Court recently refused to entertain the writ petition moved by a Turkmenistan national, alleging that the Indian Customs Department had illegally arrested him in connection with alleged gold smuggling back in 2018.A division bench of Justices Prathiba M. Singh and Shail Jain observed that the Department had produced the seized gold jewellery in a sealed cover and the same,...

Multiple Remand Orders U/S 37 A&C Act “Unworkable” Without Reversing Findings On Merits: Madras High Court

The Madras High Court held that multiple remand orders issued by courts under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) without disturbing or reversing the findings on merits recorded by earlier Single Judges were incapable of implementation. The court found the situation unprecedented and unusual holding that the statutory scheme of the Civil Procedure...

Delhi High Court Bars Former Distributor from Selling CREED Perfume, Awards Rs 37.42 Lakh in Damages

The Delhi High Court has granted a permanent injunction in favor of Fontaine Limited, owner of the luxury perfume brand CREED, restraining a former distributor from selling CREED products or using the CREED trademark after the expiry of their distribution agreement. The court also awarded Fontaine damages of Rs 37.42 lakh and legal costs of Rs 7.97 lakh for the unauthorized use of the...

Centre Cannot Retain Wrongly Paid IGST Once Correct Tax Is Paid To State GST Authorities: Karnataka High Court

The Karnataka High Court has held that the Centre cannot retain wrongly paid IGST (Integrated Goods and Services Tax) once the correct tax is paid to the State authorities. Justice S.R. Krishna Kumar observed that since the assessee had wrongly paid IGST and later paid the correct tax to the State GST, the Central government must refund IGST to the assessee....

Tariff During Registration Was To Remain Fixed For 25 Years; CSPDCL Waived Its Rights: Delhi High Court Allows IREDA's Appeal Over GBI Scheme

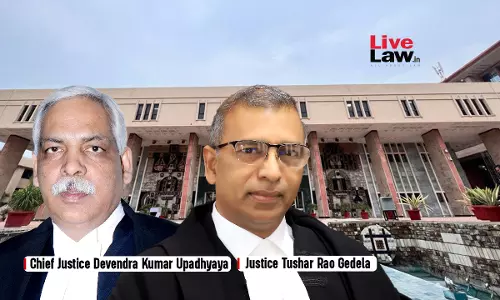

The Delhi High Court Bench of Chief Justice and Justice Tushar Rao Gedela has observed that under the Generation Based Incentive Scheme (GBI) Scheme, 2010 by Ministry of New and Renewable Energy, the tariff at the time of registration of project would remain constant for a period of 25 years and any upward revision of tariff by State Electricity Regulatory Commissions (“SERC”) from...

Contractor Can Claim Increased GST During Work, Even If Bills Were Paid Before Rates Increased: Kerala High Court

The Kerala High Court has held that a contractor can claim increased GST (Goods and Services Tax) during work, even if bills were paid before the rate increase. Justice Ziyad Rahman A.A. opined that at the time of execution of the contract, the rate was only 5% and the increase took place during the execution of the work. Thus, the assessee is entitled to a differential amount of tax....