Tax

S.67 Of CGST Act & S.110 Of Customs Act Are Pari Materia; GST Department Must Give Notice To Assessee Before Extending Seizure Period: Delhi HC

The Delhi High Court has held that an assessee must be issued notice within six months of seizure of its goods under Section 67 of the Central Goods and Services Tax Act 2017, failing which the goods must be returned by the Department.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar further held that the period of seizure cannot be extended under Section 67)7) for a further six-month period without giving notice to the accused.This, as the Court found the provision to...

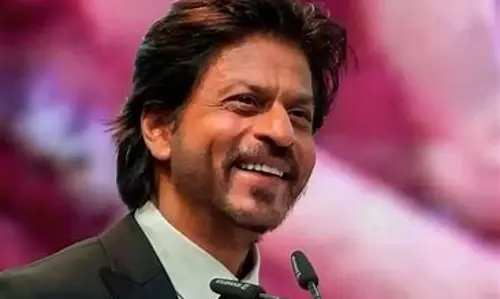

'Entire Case Based On Records Already Considered During Scrutiny': Mumbai ITAT Quashes Reopening Of Assessment Against Shah Rukh Khan For AY 2012-13

The Mumbai ITAT has quashed the reopening of assessment proceedings against the Assessee/ Appellant i.e., Shah Rukh Khan for AY 2012-13.The tribunal held that the reasons recorded while initiating the re-assessment, were completely silent as regards the allegation that income chargeable to tax has escaped assessment due to failure on the part of the assessee to disclose fully and truly all material facts. The ITAT held so after perusing the AO's order disposing the assessee's objections,...

Legal & Consultancy Services Under RCM Is Liable To Service Tax: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that legal & consultancy services under RCM is liable to service tax. The Bench of Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) has stated that “in absence of any reply or any supporting documents, Legal fees expense incurred by the assessee are expenses towards Legal services. Accordingly, Service Tax on Legal Fee expense incurred by the assessee is upheld.” ...

'Highly Undesirable Practice, Wastes Judicial Time': Delhi High Court Laments Frequent Non-Appearance Of Govt Counsel In Customs Matters

The Delhi High Court recently expressed its displeasure at the frequent non-appearance of government counsel in customs related matters.A division bench comprising Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed, “It is noticed that in a large number of customs matters, the Counsels are either not appearing or appear without proper instructions. In cases of nonappearance, the Court is compelled to request Standing Counsels present in Court to accept notice. This reflects a clear...

Assessee Entitled To Interest On Refund Under Direct Tax 'Vivad Se Vishwas' Scheme: Gujarat High Court

The Gujarat High Court stated that the assessee is entitled to the interest on refund under Direct Tax Vivad Se Vishwas Scheme. “it is true that the assessee is not entitled to interest under Section 244A of the Income Tax Act, 1961, however, when the assessee has opted for direct tax for Vivad se Visvas Scheme 2020 and filed the application which was approved by the designated authority and refund order is also passed as per the said scheme on 12/05/2022 by the Jurisdictional...

'Extra Duty Deposit' Different From Customs Duty, Limitation For Seeking Refund U/S 27 Of Customs Act Is Inapplicable: Delhi High Court

The Delhi High Court has held that an Extra Duty Deposit (EDD) does not constitute a payment in the nature of customs duty under the scope of Section 27 of the Customs Act, 1962 and thus, the period of limitation for seeking a refund of customs duty under the provision would not apply qua EDD.Section 27 deals with a person/entity's claim for a refund of Customs duty in certain circumstances.A division bench of Justices Prathiba M. Singh and Dharmesh Sharma observed, “A perusal of Section 27...

Survey Report On Existence Of 'Permanent Establishment' In Tax Year Not Relevant For Previous/Future AYs: Delhi HC Grants Relief To Swiss Co

The Delhi High Court has held that the existence of a foreign entity's Permanent Establishment (PE) in India is required to be determined in law for each year separately on the basis of the scope, extent, nature and duration of activities in each year.A division bench of Justices Yashwant Varma and Ravinder Dudeja made the observation while dealing with a Swiss company's case, which was aggrieved by various reassessment notices issued for AYs 2013-18 for alleged escapement of income generated by...

CESTAT Can't Reject Appeal Merely Because Pre-Deposit Was Made In Wrong Account, Especially When Rules Were Unclear: Delhi High Court

The Delhi High Court has held that merely because a pre-deposit prescribed under Section 35F of the Central Excise Act, 1944, for preferring an appeal is made in the wrong account, that too when the integrated portal might not have been fully functional, cannot result in rejection of appeal on the ground of defects.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta was dealing with a petitioner preferred by M/s DD Interiors, challenging the return of its appeal by CESTAT,...

New Income Tax Bill Proposes To Allow IT Officers To Access Social Media, E-mail Accounts Of Assessees During Scrutiny

Recently, the new Income Tax Bill 2025 was introduced in Parliament. Although touted as a step to make Income tax law in India simpler, the Bill contains some provisions which may disturb taxpayers by infringing on their right to privacy. One such provision in the new Bill would allow the Income tax department to access the email, trading account, social media profiles and other personal data of assesses during tax investigation. However, it has been clarified that before the law is enacted, a...

Delhi HC Asks CESTAT To Decide If Tax On Services Purchased By Prepaid Mobile Subscribers From Existing Balance Would Amount To Double-Tax

The Delhi High Court has asked the Customs Excise & Service Tax Appellate Tribunal to decide whether levy of tax on the services purchased by a prepaid subscriber of Tata Teleservices, using the existing mobile balance on which tax was already paid, would amount to double taxation.Considering that the matter would involve factual evaluation of the manner in which services are provided and charged by the company, a division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta...

Supreme Court Upholds Allahabad HC Decision That Chargers Sold With Cell Phones Cannot Be Taxed Separately Under UP VAT Act 2008

The Supreme Court recently upheld the decision of the Allahabad High Court which observed that the charger sold with a cell phone under the MRP cannot be taxed separately under the UP VAT Act 2008. The bench of Justice BV Nagarathna and Justice SC Sharma was hearing a challenge to the order of the Allahabad High Court which held that a mobile charger contained in a composite package with the cell phone cannot be taxed separately under Entry 28 Part B Schedule II U.P. VAT Act 2008. The...

Restaurant Service Or Bakery Product? Bombay High Court To Decide If Donuts & Cakes Should Be Taxed At 5% Or 18% Under GST

The Bombay High Court is to decide whether the donuts and cakes should be classified as restaurant service or a bakery product under Goods and Services Tax. The Division Bench of Justices B.P Colabawalla and Firdosh P. Pooniwalla were addressing the issue of whether the supply of donuts falls within the ambit of restaurant services under Service Accounting Code (SAC) 9963 or should be categorized as a bakery product subject to separate tax treatment under the Goods and Services Tax...