Tax

ITAT Cannot Overstep Its Authority By Deciding On Merits When It Had Already Concluded Appeal Was Not Maintainable: Bombay High Court

The Bombay High Court stated that ITAT cannot overstep its authority by deciding on merits when it has already concluded an appeal was not maintainable. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “Once the ITAT concluded that the Appeal before it against the impugned communication/order was not “maintainable”, there was no question of the ITAT evaluating the impugned communication/order on its merits or making any observations or recording any findings...

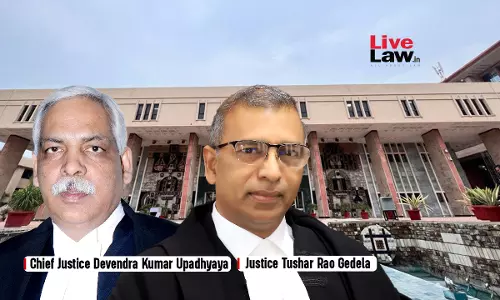

AO Becomes 'Functus Officio' After Closure Of Assessment, Must Put Relevant Incriminating Material To Assessee To Re-Confer Jurisdiction: Delhi HC

The Delhi High Court has made it clear that after the closure of assessment proceedings, the Assessing Officer becomes 'functus officio' and to re-confer jurisdiction upon the AO to initiate re-assessment proceedings, relevant incriminating material ought to be put to the assessee.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela made the observation while dealing with a writ petition filed by Vivo Mobiles, assailing the reassessment proceedings initiated...

Consolidated SCN Involving Multiple Assessment Years Can Be Issued Only When Common Period Of Adjudication Exists: Kerala High Court

The Kerala High Court stated that consolidated show cause notice involving multiple assessment years can be issued when common period of adjudication exists. “Issuing a consolidated show cause notice covering various financial/assessment years would cause prejudice to an assessee who would not get the full period envisaged for adjudication under the Statute, if that period is circumscribed by the limitation period prescribed in relation to an earlier financial/assessment year” stated...

Cash Seized From Assessee Cannot Be Retained By GST Dept Or IT Dept Prior To Finalisation Of Proceedings: Kerala High Court

The Kerala High Court stated that illegal cash seizure by GST Department and handing over to Income Tax Department is illegal under Section 132A of the Income Tax Act. The Division Bench of Justices A.K. Jyasankaran Nambiar and Easwaran S. held that “Cash amount seized from the premises of the assessee cannot be retained either by the GST Department of the State or the Income Tax Department prior to a finalisation of respective proceedings initiated by them,” In this case, the...

Benefit Of Input Tax Credit Can't Be Reduced Without Statutory Sanction : Supreme Court

The Supreme Court recently held that Rule 21(8) of the Punjab Value Added Tax Rules, 2005, which was notified on January 25, 2014, could not be applied to transactions before April 1, 2014, as the enabling amendment to Section 13 of the parent statute, the Punjab Value Added Tax Act, 2005, was effective from that date.This means businesses that bought goods at a higher tax rate before this date are not subject to the limitation imposed by Rule 21(8) when claiming ITC, even if the tax rate was...

Delay Of Two Days In Issuing GST Notice Can't Be Condoned: Andhra Pradesh High Court

The Andhra Pradesh High Court stated that delay of two days in issuing the GST notice cannot be condoned. The Division Bench of Justices R. Raghunandan Rao and Harinath N. observed that “the time permit set out under 73(2) of the Act is mandatory and any violation of that time period cannot be condoned, and would render the show cause notice otiose.” In this case, the assessee/petitioner received a show cause notice, dated 30.11.2024, in relation to the assessment year 2020-2021...

Income Tax Act | 'Fee For Technical Services' Means Transfer Of 'Specialised'/ 'Distinctive' Knowledge Or Skill By Service Provider: Delhi HC

The Delhi High Court has held that Fee for Technical Services (FTS) as contained under Section 9(1)(vii) of the Income Tax Act, 1961 is concerned with the transfer of 'distinctive', 'specialized' knowledge, skill, expertise and know-how by a service provider.A division bench of Justices Yashwant Varma and Harish Vaidyanathan Shankar thus observed that assistance provided by the assessee-respondent with respect to rules and regulations for clearance of customs frontiers is not 'specialised...

Transaction Value Is Not The Only Basis For Assessment Of Duty: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the transaction value is not the only basis for assessment of the duty. The Bench of Dilip Gupta (President) and P. V. Subba Rao (Technical) has observed that, “transaction value is not the only basis for assessment of the duty. The Valuation Rules and Section 14 of the Act provide for rejection of transaction value. When rejecting the transaction value, the customs officer does not...

Two Or More Bills Of Entry Or Shipping Bills Cannot Be Taken Together And Assessed: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that two or more bills of entry or shipping bills cannot be taken together and assessed. The Bench of Dilip Gupta (President) and P. V. Subba Rao (Technical) has observed that, “Two or more Bills of Entry or Shipping Bills cannot be taken together and assessed. The only exception made in the law are the Project Imports under Project Import Regulations, 1986.” The Bench further stated that,...

Quashing Of Show Cause Notice On One Issue Doesn't Mean Other Demands Are Not Liable To Be Adjudicated: Delhi High Court

The Delhi High Court has made it clear that if a show cause notice is quashed by a higher authority on one issue, it doesn't mean that other issues raised in the SCN are not liable to be adjudicated.The observation was made by the bench of Justices Prathiba M. Singh and Dharmesh Sharma in a case where the SCN was quashed by another division bench of the High Court so far as the issue relating to duty on free supply of materials was concerned. However, the CESTAT proceeded to discharge the entire...

Charitable Trust's Registration For Income Tax Exemption To Be Decided Based On Proposed Activities & Not Actual Activities : Supreme Court

The Supreme Court reiterated that when a charitable trust applies under Section 12-AA of the Income Tax Act (“Act”) for income tax exemptions (under Sections 10 and 11), the tax authorities should decide on the registration based on the charity's "proposed activities" than its actual activities, as stated in the Ananda Social case. The Court, however, clarified that mere registration under Section 12-AA would not entitle a charitable trust to claim exemption under Sections 10 and 11...

Tax Weekly Round-Up: February 10 - February 16, 2025

NEW INCOME TAX BILLNew Income Tax Bill 2025: Concept Of "Tax Year" To Be Introduced Instead Of "Assessment Year", "Financial Year" To Remain UnchangedThe new Income Tax bill is set to introduce the concept of 'Tax Year'. This will replace the current concept of assessment year (or previous year) from the Income Tax Act.Persons engaged in digital content creation, including social media influencers and online platforms, shall be required to register for Goods and Services Tax (GST) if their...