Tax

Mistake On Part Of AO Resulting In Under Assessment Of Income No Ground To Re-Open Assessment U/S 147 Of Income Tax Act: Delhi HC

The Delhi High Court has made it clear that once scrutiny assessment is held under Section 143 of the Income Tax Act but due to a mistake of the Assessing Officer there is under assessment of income, reopening assessment under Section 147 of the Income Tax Act, 1961 is not permissible. “...AO specifically records in the reasons that it was a 'mistake' which resulted in under assessment of the income…It is, therefore, manifest that AO has not attributed the alleged escapement of income to...

Sale Deed Not Document Issued By Revenue, Can't Be Used To Verify Land's Classification As 'Agricultural' For Taxation Purposes: Delhi HC

The Delhi High Court has held that sale deed is not a document issued by the revenue authorities or any government authority which would certify the agricultural nature of a land. “A sale deed primarily reflects the transaction between the parties and the terms of sale, but it does not, in itself, verify the land's classification as agricultural for the taxation purposes. Therefore, heavy reliance on the sale deed to establish the agricultural character of the land would be misplaced,”...

DRI Officers Can Issue Show-Cause Notices Under Customs Act : Supreme Court Allows Review Against 'Canon India' Judgment

The Supreme Court today (November 7) held that the officers of the Directorate of Revenue Intelligence(DRI) have the power to exercise powers under the Customs Act, 1962 to issue show-cause notices and recover dutiesThe Court held that DRI officers are "proper officers" to issue show cause notices under Section 28 of the Customs Act, 1962."Subject to the observations made in the judgment, the officers of the Directorate of Revenue Intelligence, Commissionates of Customs-Preventive, Directorate...

No Basis For Reassessment If Nature & Source Of Receipts Are Verified, AO Doesn't Find Any Contradictory Evidence: Delhi High Court

The Delhi High Court stated that once nature and source of receipts have been satisfactorily proved and AO has not contradicted information given by assessee, there lies no cause for initiating the reassessment action. The Division Bench of Justices Yashwant Varma and Ravinder Dudeja observed that “………Once the nature and source of receipts have been satisfactorily explained/proved and AO has not contradicted the explanation/information given by the assessee, there lies no cause for...

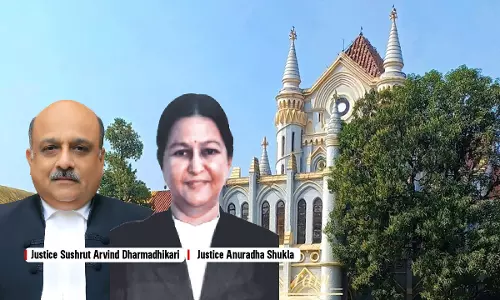

Once Income From AOP/BOI Is Included In Assessee's Taxable Income, Any Post-Tax Share Received Cannot Be Taxed Again: Madhya Pradesh High Court

The Madhya Pradesh High Court ruled that if an assessee has already included income from an Association of Persons (AOP) or Body of Individuals (BOI) in their taxable income, any post-tax share received from the AOP/BOI cannot be taxed again in the assessee's hands. The Division Bench of Justices Sushrut Arvind Dharmadhikari and Anuradha Shukla observed that “……the assessee was a member of an association of persons or body individuals, share of members of such association of persons...

GST Rate On Bricks With Less Than 90% Fly Ash Content To Be Charged At 5% Instead Of 18%: Gujarat High Court Clarifies

The Gujarat High Court on 25th September (Wednesday) held/clarified the Goods and Services Tax (GST) applicable to fly ash bricks and blocks with less than 90% fly ash content. The court ruled that the products qualify for the lower GST rate of 5%, than 18% GST rate on products not meeting the 90% fly ash threshold and quashed and aside the orders of the Advance Ruling Authority and Advance Ruling Appellate Authority. The fly ash, a by-product from thermal power plants, is used as a key material...

Kerala High Court Strikes Down Rule 96(10) of CGST Rules Retrospectively, Finds Them Ultra Vires To CGST Act

The Kerala High Court struck down Rule 96(10) of the Central Goods and Service Tax Rules holding that it was ultra vires to the Section 16 of the Integrated Goods and Service Tax Act and was manifestly arbitrary.Justice P. Gopinath noted that Section 16 has not imposed any restriction in availing refund of taxes paid on input goods and input services or claiming refund of IGST after payment of IGST on the exports. The Court, therefore held that the restriction imposed under Rule 96(10) on...

Two Adjudication Orders Against One Show Cause Notice For The Same Period Is Not Permissible: Delhi High Court

The Delhi High Court stated that two adjudication orders against one show cause notice for the same period is not permissible.The Division Bench of Justices Yashwant Varma and Ravinder Dudeja was dealing with a case where a show-cause notice had been issued to the assessee under Section 74 of the CGST Act, 2017. This notice was duly adjudicated by the department, resulting in an order. The assessee filed an appeal against this order, which was pending before the proper officer. During the...

Proceedings U/S 130 Of UPGST Act Not Applicable If Excess Stock Is Found At Time Of Survey: Allahabad High Court

Recently, the Allahabad High Court has held that proceedings under Section 130 of the Uttar Pradesh Goods and Service Tax Act, 2017 cannot be initiated where stock is found excess at the time of survey. Section 130 of the UPGST Act provides for confiscation of goods and penalty in cases where supply, transport of goods has been made in contravention to the provisions of the Act with the intention to evade tax. It also includes penalty when an assesee does not account for the goods on...

Assessment Order Passed Before Expiry Of Time To File Reply Is Liable To Be Set Aside: Kerala High Court

The Kerala High Court stated that any assessment order issued before the time allowed for filing a reply has no legal validity and can be overturned.The Bench of Justice Gopinath P. observed that “…….the assessee had filed an appeal against the order is no ground to refuse relief to the assessee as the original order was clearly issued in violation of principles of natural justice…….”In this case, a show cause notice dated June 20, 2023, granted the assessee until July 21, 2023, to file a...

Condonation Of Delay Application Should Focus On Sufficient Reason, Not Merits Of Claim U/S 119(2)(B) Of Income Tax Act: Kerala High Court

The Kerala High Court stated that an application for condonation of delay should focus on whether there was sufficient reason to condone the delay under Section 119(2)(B) of the Income Tax Act, rather than on the merits of the assessee's claim.Section 119(2)(B) of the Income Tax Act, 1961 empowers CBDT to direct income tax authorities to allow any claim for exemption, deduction, refund and any other relief under the income tax act even after the expiry of the time limit to make such claim.The...

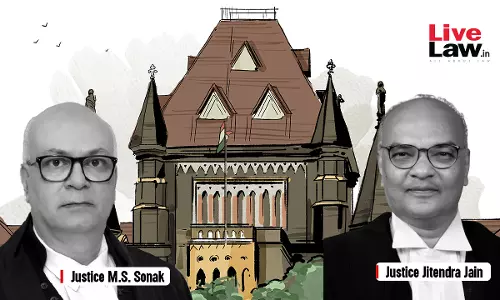

Outstanding Demand Under Maharashtra Settlement Can't Be Adjusted Against Refund Payable Under Maharashtra VAT Act: High Court

The Bombay High Court held that authorities under MVAT Act while exercising powers under Maharashtra Settlement of Arrears of Taxes, Interest, Penalties or Late Fees Act, 2022, cannot invoke provisions of Section 50 of MVAT and that too in review proceedings under Settlement Act.The Division Bench of Justice M. S. Sonak and Justice Jitendra Jain observed that there is no provision under Settlement Act which provides for calculation of outstanding arrears of a particular year to be arrived at...