Tax

No Service Tax Can Be Determined Without Clarifying The Category Of Service Under Which The Said Amount Can Be Attributed: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that no service tax can be determined without clarifying the category of service under which the said amount can be attributed. Under Section 78 of the Finance Act, 1994, if service tax has not been levied, paid, short-levied, short-paid, or erroneously refunded due to fraud, collusion, willful misstatement, suppression of facts, or contravention with the intent to evade payment, the person...

No Evidence Of Over-Valuation Of Goods; Transaction Value Wrongly Rejected Under Rule 8 of Customs Valuation Rules: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that there is no evidence of over-valuation of Goods and the transaction value has been wrongly rejected under Rule 8 of Customs Valuation Rules. Section 113 of the Customs Act, 1952 provides the list of goods that are liable to be confiscation if they are attempted to be improperly exported. Section 113 (a) of the Customs Act, 1952 provides that the goods are liable for confiscation if...

Indian-Subsidiary Which Is Compensated At Arm's Length Can't Be Construed As Dependent Agent PE: Delhi High Court

Finding that subsidiary company (KIPL) is only undertaking marketing enterprise, whereas contracts are finalized and signed by the assessee (Principal company) outside India, the Delhi High Court held that KIPL cannot be said to be habitually securing and concluding order on behalf of assessee, and hence it is not Dependent Agent PE (DAPE) of Assessee. The Division Bench comprising Justice Yashwant Varma and Justice Ravinder Dudeja observed that “for an enterprise to be considered as...

No Notional Interest Can Be Levied On Delayed Receivables From AEs/ Non-AEs If Taxpayer Is Debt Free Company, Reiterates Delhi H[gh Court

Since the TPO has failed to answer the issue of international transactions bearing in mind Explanation (i)(c) of Section 92B, the Delhi High Court reiterated that no transfer pricing addition of arms' length interest is warranted on account of delayed receivables. Section 92B of the Income Tax Act lays down the method for computing the income arising from international transactions or specified domestic transactions. Explaining on the issue of interest on outstanding receivables on...

Impact Of Delayed Receivables From AE Already Factored In Working-Capital: Allahabad HC Directs TPO To Adjudicate Interest On Receivables

The Allahabad High Court recently reiterated that once working capital adjustment is granted to assessee, there is no need for further imputation of interest on outstanding receivables at the end of the year, as the same gets subsumed in working capital adjustment. The Division Bench comprising Justice Shekhar B. Saraf and Justice Manjive Shukla reiterated that “In respect of bills raised on or after Apr 01, 2010 to its AEs, what was the date of realization and whether the same has...

Income Tax Act | Supreme Court Refuses To Give Retrospective Application To 2022 Amendment To S.80DD Regarding 'Jeevan Adhar' Policies

In a recent case, the Supreme Court refused to give the retrospective operation to the amended Section 80DD of the Income Tax Act, 1961 (“IT Act”) which provided an option to the subscriber the Jeevan Adhar Policy (“Policy”) upon attaining the age of 60 years to discontinue the deposit made under the policy and make use of the money accumulated for the benefit of the disabled person for whom the policy was purchased. It is worthwhile to mention that before amended Section 80DD of the IT Act,...

Substantial Question Is Absent To Entertain Appeal U/s 260A: Madhya Pradesh HC Confirms Deletion Of Addition U/s 68

Finding that the legal principles have been properly applied by the Tribunal in appreciating the evidence and no substantial question has arisen for consideration, the Madhya Pradesh High Court confirmed the action of the Tribunal in deleting the additions made u/s 68. As per Section 68 of Income tax Act, where any sum is found credited in the book of an assessee maintained for any previous year, and the assessee offers no explanation about the nature and source thereof or the...

Tax Liability Already Attaining Finality Under VSV Can't Be Altered By Invoking Rectification Action U/s 154: Delhi High Court

The Delhi High Court held that when the determination as carried out by the Designated Authority has finality, it cannot possibly be reopened or revised by any authority under the Income Tax Act by taking recourse to a power u/s 154 which may otherwise be available to be exercised. The High Court held so after finding that the Revenue initiated the rectification action after the Assessee had already obtained a settlement of all disputes pertaining to Income Tax for the relevant AY by...

Final Assessment Order Passed Without Issuing Draft Assessment U/s 144C, Deprives Taxpayer's Statutory Right, And Hence Invalid: Delhi High Court

The Delhi High Court held that a failure to frame an assessment order in draft would clearly be violative of the mandatory prescriptions of Section 144C and the final order of assessment framed in violation thereof liable to be viewed as a nullity. The High Court therefore clarified that final assessment order passed without passing draft assessment u/s 144C would be untenable. The Division Bench of Justice Yashwant Varma and Justice Ravinder Dudeja observed that “A failure to...

UPVAT| "Vitamins And Minerals Pre-Mix" Are Unclassified Goods, Do Not Fall Under "Ores And Minerals", "Drugs And Medicines" Or "Chemicals": Allahabad High Court

The Allahabad High Court has upheld the finding of the Commercial Tax Tribunal holding that "vitamins and minerals pre-mix" are unclassified goods, do not fall under "ores and minerals", "drugs and medicines" or "chemicals” under Schedule II of the U.P. Value Added Tax Act, 2008. Challenging the order of the Commercial Tax Tribunal, counsel for revisionist-assesee argued that the department had been treated "vitamins and minerals pre-mix" as “chemicals” and were consequently taxing it...

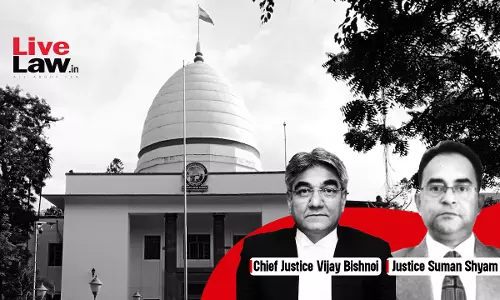

No Element Of Misstatement And Intention To Evade Payment Of Service Tax: Gauhati High Court Quashes Demand & Penalty

Finding that the Assessee company had provided every detail regarding availment of CENVAT Credit in the ST-3 Returns, and the same was considered by the Central Excise Commissioner, the Gauhati High Court held that the fact of wilful misstatement or suppression should specifically be mentioned in the show-cause notice. Since the Department had not misstated any fact with intent to evade the payment of service tax, the Division Bench of Chief Justice Vijay Bishnoi and Justice Suman...

Central Charges & International Taxation Charges Are Not Excluded From Purview Of Faceless Mechanism U/s 144B R/w/s 151A: Bombay High Court

The Bombay High Court held that the faceless mechanism would be applicable to all cases of Central Charges and International Taxation charges. However, the High Court clarified that it is only the assessment proceedings which would be required to be undertaken outside the faceless mechanism. Section 151A of the Income Tax Act empowers the Central Government to make a scheme for purpose of assessment, reassessment, or recompilation u/s 147; issuance of notice u/s 148 for conducting...