Tax

Object Of Introduction Of Faceless Assessment Stands Defeated If Show Cause Notice U/s 148 Is Issued By Jurisdictional AO: Punjab & Haryana HC

While pointing that scheme of faceless assessment is applicable from the stage of show cause notice u/s 148 as well as 148A, the Punjab & Haryana High Court ruled that notice u/s 148 cannot be issued by Jurisdictional Assessing Officer after introduction of faceless assessment scheme. Since the Revenue Department had issued show-cause notice u/s 148 relying on the Board's Memorandum and Instructions, the High Court clarified that circulars, instructions and letters issued by Board...

Interest Can't Be Levied When No Taxable Due Is Found: Gauhati High Court

The Gauhati High Court has held that once the assessment order of the authorities is set aside and the matter is remanded back and assessed, no taxable interest can be levied.The bench of Justice Arun Dev Choudhury has observed that in a judicial system that is administered by the court, one of the primary principles to keep in mind is that the court under the same jurisdiction must have similar opinions regarding similar questions, issues, and circumstances. If opinions given on similar legal...

No Service Tax Payable By CIPLA On Manufacturing And Exporting Of Pharmaceutical Products: CESTAT

The Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that no service tax is payable by Cipla on the manufacturing and export of pharmaceutical products.The bench of Binu Tamta (Judicial Member) and Hemambika R. Priya (Technical Member) has observed that the respondent-assessee is a holder of a letter of approval issued by the Development Commissioner for the manufacture of pharmaceutical products within the Special Economic Zone, Pithampur, Indore. The...

Dept. Failed To Put Assessee On Notice In Respect Of Section 69A Addition, Assessment Order Not Sustainable: Calcutta High Court

The Calcutta High Court has quashed the assessment order on the grounds that the department has failed to put the assessee on notice in respect of addition under Section 69A of the Income Tax.The bench of Justice Raja Basu Chowdhury has observed that the determination made by the respondent-department as reflected in the assessment order stands vitiated by reasons of failure on the part of the department to put the petitioner on notice in respect of addition under Section 69A. Since the...

GST Payable On Advance Received Against Supply Portion Of Work Contract: Gujarat AAR

The Gujarat Authority of Advance Ruling (AAR) has held that the GST is payable in advance received against the supply portion in respect of the work contract.The bench of Amit Kumar Mishra and Milind Kavatkar has observed that the turnkey contract entered into by the applicant has been held to be a work contract.The applicant is in the engineering, procurement, and construction (EPC) contract business with various distribution companies (DISCOMS).The applicant stated that they have a turnkey...

Deduction Of Nominal Amount From Employee's Salary For Availing Food Facility Is Not 'Supply': Gujarat AAR

The Gujarat Authority of Advance Ruling (AAR) has ruled that deduction of nominal amount from employee's salary for availing food facility is not 'supply' under the provisions of Section 7 of the CGST Act, 2017.The bench of Amit Kumar Mishra and Milind Kavatkar has observed that the exceptions are Schedule-I, which includes activities made or agreed to be made without consideration, and Schedule-III, which includes activities that shall not be treated as a supply of goods or services. The...

ITC Available On Capital Goods Used For Transmission Of Electricity From Power Station Of DISCOM To Factory Premises: Gujarat AAR

The Gujarat Authority of Advance Ruling (AAR) has ruled that the Input Tax Credit (ITC) available on capital goods used for transmission of electricity from power stations of Distribution Companies (DISCOM) to factory premises.The bench of Amit Kumar Mishra and Milind Kavatkar has observed that there is no provision under the CGST Act, 2017 which bars availment of ITC by the applicant if subsequently the capitalised goods are handed over to Gujarat Energy 'Transmission Corporation Ltd....

Not Permissible For TPO To Engage In Restructuring Of Transaction: Delhi High Court

The Delhi High Court has held that it is not permissible for the Transfer Pricing Officer (TPO) to engage in the restructuring of a transaction.The bench of Justice Yashwant Varma and Justice Ravinder Dudeja has observed that it would also not be permissible for the TPO to engage in the restructuring of a transaction unless the economic substance of the transaction differed from its form, and if the form and substance of the transaction were the same but the arrangements relating to the...

Non-Communication Of Reassessment And Demand Notice Within Time: Manipur High Court Quashes Assessment

The Manipur High Court has held that the reassessment made by the Income Tax Officer without communicating the order of reassessment and the demand notice of the reassessment within time cannot be treated as a valid assessment.The bench of Justice Ahanthembimol Singh has observed that the two reassessment notices under Section 148 were served in the months of December 2005 and March 2006. The period of limitation for completing the proceeding of the reassessment will be nine months, starting on...

State Not Liable To Collect Tax At Source While Giving Contractors Permit To Vend Liquor At Fixed Retail Price : Supreme Court

The Supreme Court recently held that any vendor who buys liquor from state manufacturers without obtaining it through auction and sells in retail at a fixed price would be excluded from the definition of 'buyer' under Section 206C of the Income Tax Act. Such a trade would be exempted from TCS (Tax Collected at Source)."If the buyer is a public sector company or it has obtained the goods in further sale or if the goods are not obtained by him by way of auction and where the sale price of such...

Indirect Tax Weekly Round-Up: 14 To 20 July 2024

Supreme CourtChewing Tobacco Packed In High-Density Polyethylene Bags Are 'Wholesale Package'; Cannot Be Taxed As Retail Product Under Excise Act : Supreme CourtCase Details: Commissioner of Central Excise, Jaipur -II v. M/s Miraj Products Pvt. Ltd. Citation : 2024 LiveLaw (SC) 470The Supreme Court recently held that pouches of chewing tobacco packed in High-Density Polyethylene (HDPE) bags would be considered a 'wholesale package' and could not be considered for imposing excise duty as per the...

Direct Tax Weekly Round-Up: 14 To 20 July 2024

Bombay High CourtJAO Cease To Have Jurisdiction To Issue Reassessment Notice Outside Faceless Assessment: Bombay High CourtCase Title: Royal Bitumen Private Limited, Mumbai Vs. Assistant Commissioner of Income-TaxThe Bombay High Court has held that the Jurisdictional Assessing Officer (JAO) would cease to have jurisdiction to issue any notice under Section 148A(b) and to take further actions under Section 148A(d) and Section 148 of the Act, outside the faceless assessment.Investment Allowance...

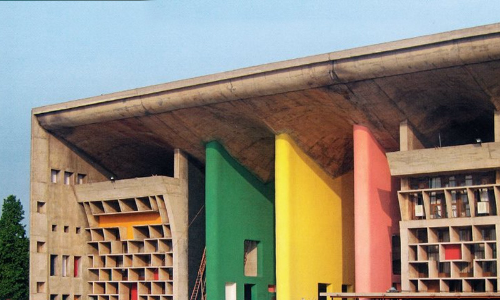

![Manipur High Court, denies bail, Conspiring, Secede, From India, Establish Kukiland, Secession, Mark Thangmang Haokip, Justice M. V. Muralidaran, People’s Democratic Republic of Kukiland, waging war against state, Mark Thangmang Haokip v. State of Manipur and another [Bail Appln. No. 11 of 2022], Manipur High Court, denies bail, Conspiring, Secede, From India, Establish Kukiland, Secession, Mark Thangmang Haokip, Justice M. V. Muralidaran, People’s Democratic Republic of Kukiland, waging war against state, Mark Thangmang Haokip v. State of Manipur and another [Bail Appln. No. 11 of 2022],](https://www.livelaw.in/h-upload/2022/11/06/500x300_442766-manipur-high-court-imphal.jpg)