Tax

LiveLawBiz: Business Law Daily Round-Up: November 28, 2025

IBC NSEL Gets NCLT Nod For ₹1,950-Crore Settlement With 5,682 Traders Affected In 2013 ScamUploading Debt Details On Information Utility Does Not Extend Limitation For CIRP: NCLATNCLAT Upholds Order Directing Satra Properties' Suspended Directors To Refund ₹91 Lakh For Clearing Cheques During MoratoriumIBC Does Not Override Statutory First Charge Under Gujarat VAT Act, Both Laws Operate...

No Service Tax On Income Received From Joint Venture: CESTAT Kolkata Sets Aside ₹5.72 Crore Demand

The Kolkata Bench of the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that an assessee's/partner's share of income from a joint venture is not consideration for any taxable service and therefore not liable to Service Tax. R. Muralidhar (Judicial Member) and K. Anpazhakan (Technical Member) observed that the activities undertaken by a partner/co-venturer for...

Cancellation Of GST Registration Announces Economic Death Of Business Entity; Reasoned Order Needed: Allahabad High Court

The Allahabad High Court has observed that the cancellation of GST registration of a business entity leads to it economic death and it is sine qua non that a reasoned order is passed by the authority for cancelling the registration of an assesee. The bench of Justice Saumitra Dayal Singh and Justice Indrajeet Shukla observed: “We are equally mindful that the order of cancellation...

Income Tax Act | SBI Not 'Assessee In Default' U/S 201 For Not Deducting TDS While Obeying Court's Interim Order: Kerala High Court

The Kerala High Court has held that the State Bank of India (SBI) cannot be treated as an 'assessee in default' under Section 201 of the Income Tax Act for not deducting Tax Deducted at Source (TDS) on Leave Travel Concession (LTC) payments, as it was bound by an interim order which prohibited such deduction. Justices A. Muhamed Mustaque and Harisankar V. Menon examined whether the...

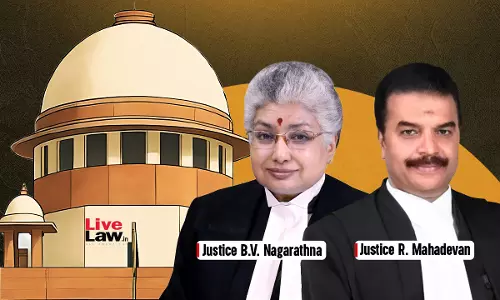

'Frivolous Cases Waste Judicial Time' : Supreme Court Raps Income Tax Dept For Filing SLP On Settled Issue

The Supreme Court on Friday pulled up the Income Tax Department for filing yet another Special Leave Petition (SLP) in a matter already settled by the Court, calling it a frivolous exercise that contributes to mounting pendency.A Bench of Justice BV Nagarathna and Justice R Mahadevan was hearing an SLP challenging a Karnataka High Court order on tax deduction at source (TDS) liability, an...

Tax Authorities Cannot Resurrect Repealed VAT Powers After GST Regime, Nor Retain Deposits Without Statutory Backing: Tripura High Court

The Tripura High Court has held that where show-cause notices imposing penalty under Section 77 of the Tripura Value Added Tax Act, 2004 (TVAT Act) were issued after delay of 9 years, long after the repeal of the TVAT Act after GST Regime, are arbitrary, illegal and vitiated by malafides. The Court further held that the State cannot retain the security deposit taken for VAT registration...

Delhi High Court Refuses To Condone 9-Month Delay By Assessee In Filing Revised Income Tax Return

The Delhi High Court has refused to condone a delay of 9-months by an assessee in filing his revised income tax return (ITR).A division bench of Justices V. Kameswar Rao and Vinod Kumar remarked,“Surely it should not take nine months to realize that initial ITR has some mistakes, which requires a revised return.”The Court was dealing with a plea against rejection of Petitioner's...

LiveLawBiz: Business Law Daily Round-Up: November 27, 2025

IPR Delhi High Court Grants Relief To Tesla Inc, Extends Bar on Indian Company's Use of 'Tesla' Marks In EV MarketDelhi High Court Rejects Philips' Plea For Perjury Action Against Ex-Employee In Software Piracy CaseMadras High Court Quashes Order Allowing Pfizer To Seek Documents From Indian Drug Manufacturer For US SuitDelhi High Court Declines To Return Plaint In Sun Pharma's Trademark...

Delhi High Court Condones Company's Delay In Filing GST Appeal On Ground Of Director's Illness

The Delhi High Court recently condoned the delay made by a company in challenging the GST demand of over ₹75 lakhs, on grounds of illness of its Director.A division bench of Justices Prathiba M. Singh and Shail Jain, after considering the facts of the case and on the basis of the medical records, were of the view that the lapse was “bonafide”.As per Section 107 of the Central Goods...

GST Act | S.130 Cannot Be Invoked For Excess Stock Found During Survey; Action Must Proceed U/S 73/74: Allahabad High Court

The Allahabad High Court held that Section 130 of the Goods and Service Tax Act, 2017 could not be invoked where excess stock was found at the time of survey While dealing with a case regarding a search conducted under the GST Act, where upon finding discrepancies, proceedings had been initiated against the petitioner under S. 130 of the Act, Justice Piyush Agarwal held “A...

Marketing For Foreign University Prima Facie Constitutes 'Export Of Services'; Entitled To GST Refund: Delhi High Court

The Delhi High Court recently said that a private consultancy providing marketing services to a foreign university is prima facie covered by its decision in Delhi Goods and Service Tax DGST v. Global Opportunities Private Limited (2025).Vide the said decision, the division bench of Justices Prathiba M. Singh and Shail Jain had held that foreign education consultancy services to students...

CESTAT Delhi Sets Aside ₹1 Crore Interest, Penalty On Hindustan Zinc For Reversed CENVAT Credit

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has set aside disallowance of CENVAT credit as well as interest and penalty worth about Rs. 1 crore for electricity wheeled out to sister concerns as well as to State Electricity Board. In an order dated November 24, 2025, the Bench comprising Justice Dilip Gupta (Principal Bench) and Smt. Hemambika R....