Tax

AO Can Determine Annual Value Of Property Higher Than Municipal Rateable Value U/S 22 Income Tax Act: Bombay High Court

The Bombay High Court stated that the assessing officer (AO) can determine the annual value of the property higher than the municipal rateable value under Section 22 of the Income Tax Act. Section 22 of the Income Tax Act, 1961 deals with the "taxability of 'Income from House Property”. It says the annual value of property consisting of any buildings or lands appurtenant thereto...

GST Council Announces Revised Slabs Of 5%, 18% And 40% , Cuts Rates On Small Cars, ACs

The 56th meeting of the GST Council was held on 3rd September, 2025. The GST Council inter-alia made the recommendations relating to changes in GST tax rates.The changes in GST rates on services will be implemented with effect from 22nd September 2025.The changes in GST rates of all goods except pan masala, gutkha, cigarettes, chewing tobacco products like zarda, unmanufactured tobacco and...

Govt Is Promoting Start-Up Culture, Customs Should Be Sensitive In Proceedings Against Them: Delhi High Court

The Delhi High Court has asked the Central Board of Indirect Taxes and Customs to consider whether some “preferential treatment” ought to be given to Start-ups and MSMEs in terms of timelines, warehousing and provisional release in cases of misdeclaration of goods, especially in case of low value consignments.A division bench of Justices Prathiba M. Singh and Shail Jain observed...

Refund Of CVD & SAD Paid After GST Introduction Maintainable U/S 142(3) Of CGST Act: CESTAT

The Ahmedabad Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that refund of CVD (Countervailing Duty) & SAD (Special Additional Duty) paid after GST introduction maintainable U/S 142(3) CGST Act. Dr. Ajaya Krishna Vishvesha (Judicial Member) was addressing the issue of whether refund claim is admissible under Section 142 (3) of CGST Act, 2017 in...

ADG DRI Does Not Have Power To Declare DEPB Scripts Issued By DGFT Null And Void: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that ADG DRI (Additional Director General of the Directorate of Revenue Intelligence) does not have power to declare DEPB (Duty Entitlement Pass Book) scripts issued by DGFT Directorate General of Foreign Trade) null and void. Justice Dilip Gupta (President) and P.V. Subba...

Service Tax Not Leviable On Deposits Made Under Interim Orders: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that service tax can't be levied on deposits made pursuant to interim orders. Binu Tamta (Judicial Member) and P.V. Subba Rao (Technical Member) were dealing with the issue of whether service tax can be levied on the amounts paid or deposited during the pendency of the proceedings...

Refund Claim On Service Tax For Cancelled Property Bookings Maintainable: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that refund claim on service tax for cancelled property bookings maintainable. The Tribunal stated that the assessee had issued credit notes in respect of service which is not rendered to the customers on account of cancellation of the agreement and hence there was no scope of rendering...

Tax Weekly Round-Up: August 25 - August 31, 2025

SUPREME COURTSupreme Court Directs DGFT & CBIC To Update Tech Systems To Ensure Genuine Exporters Don't Lose Benefits Over Clerical ErrorsCause Title: M/S SHAH NANJI NAGSI EXPORTS PVT. LTD. Versus UNION OF INDIA AND ORS.The Supreme Court observed that an exporter cannot be denied legitimate entitlements under the government's incentive schemes merely because of an inadvertent clerical...

Customs Act | Electronic Evidence Admissible Without S.138C(4) Certificate If Assessee's S.108 Statement Admits Contents : Supreme Court

The Supreme Court recently held that electronic evidence seized by the Directorate of Revenue Intelligence (“DRI”) can be admissible even without a certificate under Section 138C(4) of the Customs Act, if the assessees has acknowledged these the documents in the devices in their statements under Section 108 of the Customs Act.Section 138C (4) of the Customs Act requires the production of...

Cash Deposits During Demonetisation Not 'Unexplained Money' If Traceable To Previous Year's Balance: Chhattisgarh High Court

The Chhattisgarh High Court held that cash deposits during demonetisation are not unexplained money if traceable to previous year's balance. Section 69 of the Income Tax Act, 1961 requires the assessee to provide proof of income and provide a proper explanation of the source of such unexplained income. Justices Sanjay K. Agrawal and Deepak Kumar Tiwari stated that the factum...

Vehicles Plying Only Within Enclosed Premises Of Factory/Plant Not Liable To Pay Motor Vehicle Tax : Supreme Court

The Supreme Court on Friday (Aug. 29) ruled that the vehicles operating exclusively within the enclosed premises of a factory or plant are not liable to pay motor vehicle tax, as such areas do not constitute a "public place." “Motor vehicle tax is compensatory in nature. It has a direct nexus with the end use. The rationale for levy of motor vehicle tax is that a person who is using...

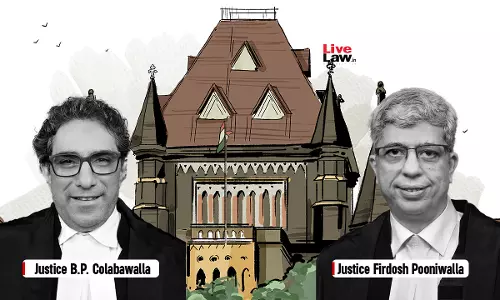

Income Tax | Interest On Fixed Deposits, TDS Refund Linked To Business Qualifies For S. 80IA Deduction: Bombay High Court

The Bombay High Court held that interest on fixed deposits, TDS refund linked to business qualifies for deduction under Section 80IA of the Income Tax Act. Section 80IA of the Income Tax Act, 1961 provides tax incentives for businesses operating in certain sectors such as infrastructure, power, and telecommunications. Justices B.P. Colabawalla and Firdosh P. Pooniwalla...