Tax

'Comedy Of Errors': Delhi HC On CESTAT Passing Contradictory Orders In Appeal Which Did Not Meet Its Pecuniary Jurisdiction

The Delhi High Court recently took a critical view of the Customs Excise And Service Tax Appellate Tribunal at New Delhi for repeatedly passing contradictory orders in an appeal, which should have been dismissed for want of pecuniary jurisdiction.“This order reveals a complete comedy of error…The petition reveals an unfortunate situation wherein the CESTAT while intending to correct an error in its initial order…continued to make repeated errors resulting in the impugned order and the present...

Service Tax Leviable On RIICO And RASMB For Commercial And Industrial Construction Services: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that there is a service tax liability on RIICO and RASMB for commercial and industrial construction services. The Bench of Dr. Rachna Gupta (Judicial) and Hemambika R. Priya (Technical) was addressing the issue of the tax liability of the service provider providing “Commercial and Industrial Construction Service” to the public authorities. In this case, the assessee/appellant had entered...

Tax Weekly Round-Up: March 17 - March 23, 2025

HIGH COURTSAllahabad HCProceedings U/S 129 Of GST Act Are Summary Proceedings, Burden To Prove Actual Movement Of Goods Lies On Assesee: Allahabad High CourtCase Title: M/S Jaya Traders Through Its Proprietor Mr. Vishwanath Tiwari v. Additional Commissioner Grade-2 And Another Case no.: WRIT TAX No. - 1022 of 2021The Allahabad High Court has held that proceedings under section 129 of the GST Act are summary proceedings where the burden to prove the actual physical movement of goods is on the...

No Penalty Leviable If Assessee Fails To Discharge Tax Liability Under Bonafide Belief That No Tax Needed To Be Paid: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has held that if an assessee fails to discharge his tax liability under the bonafide belief that tax did not need to be paid, no penalty is leviable. The Bench of Dr. Rachna Gupta (Judicial) and Ms. Hemambika R. Priya (Technical) has observed that, “even if payment is made through CENVAT for GTA services, which is impermissible, it cannot be stated that the assessee had misstated or suppressed any...

Revenue Cannot Re-Assess Time Barred Assessment Under KVAT Act Based On CAG Report: Kerala High Court

The Kerala High Court stated that revenue cannot re-assess time barred assessment under KVAT Act based on CAG report. The Division Bench of Justices A.Y. Jayasankaran Nambiar and Easwaran S. observed that “there cannot be an exercise of power under Section 25A of the KVAT Act beyond the period of limitation prescribed under Section 25(1) of the KVAT Act. In fact the provisions of Section 25A allude to this aspect when it refers to the satisfaction to be recorded by the Assessing...

Advertising Agency Not Liable To Pay Service Tax On Amount Payable To Media Companies On Behalf Of Their Clients: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that the advertising agency being a pure agent is not liable to pay service tax on amount payable to media companies on behalf of their clients. The Bench of Dilip Gupta (President) and P. V. Subba Rao (Technical) has observed that, “The assessee has conceded about their liability to pay service tax on the amount of commission received by them while rendering the advertising agency service to...

Joint Commissioner Has Jurisdiction To Initiate Proceedings Against Assessment Order Passed Pursuant To Remand: Kerala High Court

The Kerala High Court stated that Joint Commissioner has jurisdiction to initiate proceedings under Section 56 of the KVAT Act against assessment order passed pursuant to remand. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. observed that “when the fresh assessment order was passed consequence to the remand, the original assessment order ceased to exist in law and thereafter the only assessment order that survived for the purposes of exercise of the power of...

Ayurvedic Treatment Is Only Incidental To Facilities Provided By Assessee In Resort, Liable To Be Taxed: Kerala High Court

The Kerala High Court stated that ayurvedic treatment is only incidental to facilities provided by assessee in a resort, hence liable to be taxed. “the main activities of the assessee as per the brochures produced before the assessing officer, are canoeing, motor boat cruises, houseboat stay, trekking, Alleppey beach visit, coir factory visit, elephant ride, Kathakali, temple dance, dramas, Mohiniyattam and Kalaripayattu. Therefore, the main activities of the assessee are not running...

Vehicles Registered As Goods Carriage Vehicles Can't Be Classified Under Different Head For Demanding One-Time Tax: Kerala High Court

The Kerala High Court stated that vehicles registered as goods carriage vehicles, could not be classified under a different head for the purposes of demanding one-time tax under the second proviso to Section 3(1) of the Kerala Motor Vehicles Taxation Act. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. stated that “the department cannot alter their stand and classify the vehicles separately for the purposes of levy of one- time tax to the Kerala Motor Vehicles...

Activity Of “Chilling Of Milk” Is A Service, Leviable To Service Tax: CESTAT

The New Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) has stated that activity of chilling of milk is leviable to service tax. The Bench of Binu Tamta (Judicial Member) and P.V. Subba Rao (Technical Member) has observed that “the activity of chilling of milk during the post negative period amounts to rendering 'services' as defined in section 65B (44) and is therefore, leviable to service tax.” In this case, the assessee/appellant in engaged in...

NRI's Entitled To Benefits Provided To 'Eligible Passengers' Under 2016 Baggage Rules: Delhi High Court

The Delhi High Court has held that a non-resident Indian is fully entitled to the benefit provided to an “eligible passenger” under the Baggage Rules, 2016 for the purposes of Customs on arrival to India.Eligible passenger was defined by the Finance Ministry via a Notification dated June 30, 2017, to mean a passenger of Indian origin or a passenger holding a valid Indian passport, coming to India after not less than six months of stay abroad.Baggage Rules allow duty-free clearance of certain...

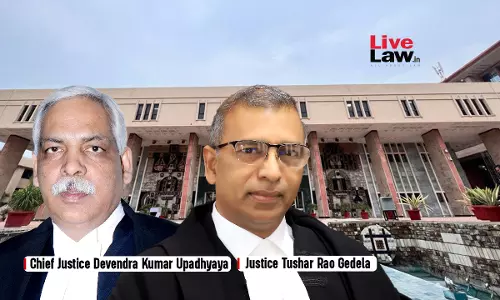

'Proof Beyond Reasonable Doubt' Is A Principle Of Criminal Law, Not Applicable To Tax Law: Delhi High Court

The Delhi High Court has made it clear that the principle of 'proof beyond reasonable doubt' cannot be made applicable to Section 148 of the Income Tax Act, 1961 which enables an assessing officer to open an assessment if he has 'reason to believe' that an assessee's income escaped assessment.A division bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela observed, “It is trite that the concept of “proving beyond reasonable doubt” applies “strictu senso” to penal...