Top Stories

Central Excise Exemption For Cotton Fabrics Not Available If Any Interlinked Process Uses Power : Supreme Court

The Supreme Court has held that manufacturers cannot claim central excise duty exemption for processed cotton fabrics if power is used at any stage of the manufacturing chain, even when the work is carried out through separate units. The Court restored a duty and penalty demand that had been set aside by the Customs, Excise and Service Tax Appellate Tribunal (CESTAT).To claim excise...

Arbitration | No Review Or Appeal Lies Against Order Appointing Arbitrator : Supreme Court

The Supreme Court observed that a review or appeal from an order of appointment of an arbitrator is impermissible.“Once an arbitrator is appointed, the arbitral process must proceed unhindered. There is no statutory provision for review or appeal from an order under Section 11, which reflects a conscious legislative choice.”, the Court held, while setting aside the Patna High Court's...

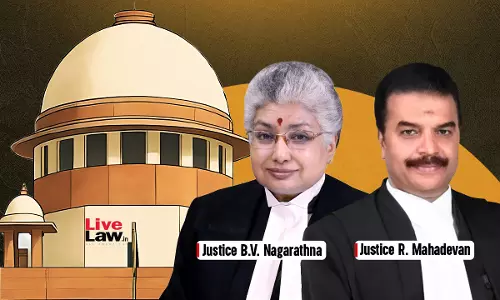

'Frivolous Cases Waste Judicial Time' : Supreme Court Raps Income Tax Dept For Filing SLP On Settled Issue

The Supreme Court on Friday pulled up the Income Tax Department for filing yet another Special Leave Petition (SLP) in a matter already settled by the Court, calling it a frivolous exercise that contributes to mounting pendency.A Bench of Justice BV Nagarathna and Justice R Mahadevan was hearing an SLP challenging a Karnataka High Court order on tax deduction at source (TDS) liability, an...

Supreme Court Dismisses Byju Raveendran's Appeal Against NCLAT Order Mandating CoC Nod For BCCI's Plea To Withdraw CIRP

The Supreme Court on Friday dismissed an appeal filed by Byju Raveendran, suspended director and promoter of Think and Learn Private Ltd (which ran the Ed-Tech firm Byju's), challenging an order of the National Company Law Appellate Tribunal which held that the approval of the Committee of Creditors is necessary for the application filed by the BCCI to withdraw the insolvency proceedings...

Arbitration | Unconditional Stay On Execution Of Award Only In Exceptional Cases: Supreme Court

The Supreme Court recently declined to grant an unconditional stay on the execution of the arbitral award, holding that the requirement to deposit the security amount was justified since the award was not shown to have been induced or tainted by fraud or corruption. Referring to its latest ruling in Lifestyle Equities C.V. and Another v. Amazon Technologies Inc., a bench of Justices...

Supreme Court Leaves Open Question Whether Customs Can Seize Goods Which Left Port

The Supreme Court recently refused to entertain an appeal against the Customs, Excise and Service Tax Appellate Tribunal (“CESTAT”) view that once goods are cleared from the port, customs authorities lose their power to confiscate them for violations such as non-compliance with license requirements. However, the bench of Justices Manoj Misra and Ujjal Bhuyan left open the question...

'Seems Tax Department Has Not Trusted Even Its Lawyers' : Supreme Court Flags Procedural Delays In IT Dept's Petition Filings

The Supreme Court recently criticised the Income Tax Department for filing its Special Leave Petition after a delay of 524 days, observing that the Department, despite having an entire team of legal experts, failed to act on its own lawyers' advice and instead allowed time to be wasted in unnecessary and prolonged litigation. A bench comprising Justices Pankaj Mithal and Prasanna B....

Indian Courts Have No Jurisdiction To Appoint Arbitrator For Foreign-Seated Arbitration : Supreme Court

The Supreme Court on Friday (November 21) dismissed a plea seeking the appointment of an arbitrator in an international commercial arbitration, holding that once the principal contract is governed by foreign law and provides for a foreign-seated arbitration, Indian courts lose jurisdiction, irrespective of the Indian nationality of any party. “Indian Courts have no jurisdiction to appoint...

Income Tax Act | Rejection Of Settlement Application Does Not Affect Assessee's Right To Contest Assessment Order On Merits : Supreme Court

Rejection of an assessee's settlement application by the Income Tax Settlement Commission without offering settlement terms does not bar the assessee's right to challenge the assessment order on merits under the Income Tax Act, observed the Supreme Court. "The stand of the Revenue that the assessee must give up his right to contest the assessment order on merits, if the settlement application...

Supreme Court Upholds View That Eden Gardens Not A 'Public Place' For Levy Of Advertisement Tax

The Supreme Court today dismissed a challenge to the Calcutta High Court order which held that Eden Gardens stadium was not a "public place" for the purpose of levying advertisement tax under the Kolkata Municipal Corporation Act.A bench of Justices Vikram Nath and Sandeep Mehta heard the matter. Senior Advocate Jaideep Gupta appeared for petitioner-Kolkata Municipal Corporation. Senior...

Bata v. Crocs : Supreme Court Dismisses Pleas Of Footwear Makers Against Maintainability Of Crocs' Passing Off Suits Over Design Infringement

The Supreme Court on Friday dismissed the petition filed by Bata India Ltd and five other footwear manufacturers challenging the Delhi High Court's judgment which held that the suits filed by Crocs Inc.USA alleging passing off over the infringement of the latter's footwear designs registered under the Designs Act were maintainable.A bench comprising Justice Sanjay Kumar and Justice Alok...