VAT

Coconut Oil Sold By Amway As Hair Oil, Not Classifiable As Edible Oil Under DVAT Act: Delhi High Court

The Delhi High Court has held that coconut oil sold by Amway as a hair oil cannot be classified as edible oil under the DVAT Act.The bench of Justice Vibhu Bakhru and Justice Amit Mahajan, while ruling in favour of the department, observed that the coconut oil is sold by the appellant in small packs, is displayed in the category of hair care, the manner in which it is to be applied to hair, and the purpose for which it is purchased by the consumer leaves no manner of doubt that the coconut oil...

Bihar VAT Act | Penalty Imposable U/S 56(4)(B) On Account Of Clerical Mistake In Mentioning Of Invoice Number In Suvidha Form: Patna High Court

Patna High Court has ruled that penalty is imposable under section 56(4)(b) of the Bihar Value Added Tax Act, 2005 (Bihar VAT Act) on account of clerical mistake in mentioning of invoice number in SUVIDHA Form.The above ruling came in a case filed by the petitioner, M/s Ceat Ltd. engaged in the manufacture and sale of tyres, tubes and flaps who was concerned with a penalty order passed under Section 60(4) (b) read with Section 56(4) (b) of the Bihar Value Added Tax Act, 2005 after detention of a...

Bihar Entry Tax Act | Adjustment Of Entry Tax Paid On Damaged Cement Against VAT Liability Not Admissible: Patna High Court

In affirming the directive of the Commercial Tax Tribunal, the Patna High Court ruled that the adjustment of entry tax paid on damaged cement is not permissible under the Bihar Tax on Entry of Goods into Local Areas for Consumption, Use, or Sale therein Act, 1993. The court reiterated and upheld the tribunal's decision, reinforcing that the provisions of the aforementioned act do not allow for the adjustment of entry tax in the case of damaged cement.The above ruling came in an appeal arising...

Agreement To Provide Manpower For Maintenance Is Contract Of Service And Not A Sale Under MVAT Act: Bombay High Court

The Bombay High Court has held that an agreement to provide manpower to perform maintenance is a contract of service and not a sale contract under the MVAT Act.The bench of Justice K. R. Shriram and Justice Neela Gokhale has observed that the pith and substance of the contract or true nature of the transaction show that the contract is a contract for service simpliciter and is not a works contract or composite contract consisting of two contracts, one for service and one for sale, but is an...

UP VAT Act | Enhancement Of Turnover Not A Necessary Consequence To Rejection Of Books Of Accounts: Allahabad High Court

The Allahabad High Court has held that turnover cannot be enhanced merely based on rejection of books of accounts. There has to be material as to suppression of turnover by the assesee to indicate evasion of tax.Relying on various judgments of the Allahabad High Court, Justice Piyush Agrawal held “Once the findings of fact has been recorded in favour of the petitioner, there is no cogent reason for enhancing the turnover. The tribunal was not justified in confirming the enhancement of turnover...

Rejection Of Books Of Accounts Under UPVAT Act Will Not Necessarily Lead To Rejection Of Books Under Central Sales Tax Act: Allahabad HC Reiterates

The Allahabad High Court has reiterated that in absence of any material on record, rejection of books of accounts under local laws cannot be the sole ground for rejection of books of accounts under Central Sales Tax Act.“Merely because books of account under local sales have been rejected, the same will not necessarily be the ground for rejecting the books of account under Central Sales Tax Act also in the absence of any cogent material available on record,” held Justice Piyush Agrawal....

Kerala High Court Rejects Assessee ’s Claim For Service Tax Refund To Meet VAT Demand On Pest Control Contract

The Kerala High Court has rejected the assessee's claim for a service tax refund to meet the VAT demand on the pest control contract.The bench of Justice Anu Sivaraman has observed that the claim of the petitioner that the service tax authorities must be directed to meet the demand for VAT, if any, found payable by the petitioner cannot be accepted.The petitioner or assessee is in the business of pest control. As per the assessee, pest control falls under the category of a service contract and...

UPVAT Rules | Stricter Approach To Be Followed Before Giving Benefit Of Exemptions/ Deductions: Allahabad High Court

The Allahabad High Court has held that though in case of doubt, taxing statues are to be interpreted in favour of the assesee. However, a stricter approach needs to be followed before giving the benefit of exemptions and deductions.“The general rule of law in taxing statutes is that in case of any doubt the benefit should be given to the assessee. However, in case of exemption and deduction to be given, a stricter approach may be followed, as per catena of judgments of the Supreme Court, to...

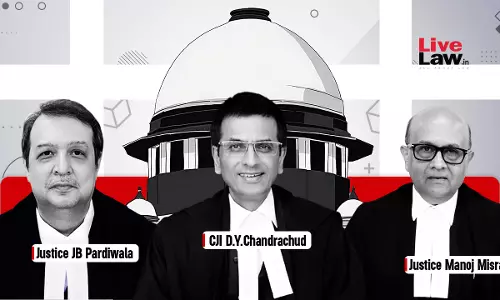

UP VAT Act | Definition Of “Goods” Under Sec. 2(m) And Sec. 13(1)(f) Includes Taxable As Well As Exempted Goods: Supreme Court

The Supreme Court has held that the definition of “Goods” under Section 2(m) of Uttar Pradesh Value Added Tax Act, 2008 (“UP VAT Act”) includes both taxable as well as exempted goods. Similarly, the word “goods” under Section 13(1)(f) of the UP VAT Act cannot be said to be qualified by the word “taxable”.The Bench comprising the Chief Justice Dr. Dhananjaya Y. Chandrachud, Justice J.B. Pardiwala and Justice Manoj Misra, has held that the legislative intent behind the 2010 amendment to the UP VAT...

UP VAT Act | Assessee Entitled To Claim Full Input Tax Credit On Exempted Goods Produced As By-Products Or Waste Products During Manufacturing Of Taxable Goods : Supreme Court

The Supreme Court while relying on Explanation (iii) to Section 13 of Uttar Pradesh Value Added Tax Act, 2008 (“UP VAT Act”), has held that if during the manufacture of any taxable good any tax exempted goods are produced as by-product/waste product, then it shall be deemed that the goods purchased from within the State for such manufacturing have been used in manufacture of taxable goods alone. Thus, the Assessee would be entitled to claim full benefit of Input Tax Credit (“ITC”) in respect of...

UPVAT | Exemption/Concession Form Not Produced During Assessment Due To Unavoidable Circumstances, Can Be Considered By Tribunal: Allahabad HC

The Allahabad High Court has held that if a form through which exemption/concession has been claimed under the Uttar Pradesh Value Added Tax Act, 2008 could not be produced at the time of assessment due to unavoidable circumstances, the same can be produced before the Tribunal. The Tribunal is bound to consider it before passing any order.The bench comprising of Justice Piyush Agrawal held,“The transaction already claimed by the applicant as exempt/concession rate of tax in its hand, the form,...

UPVAT Act | Family Entitled To Insurance Money Under Group Insurance Policy If Registration Valid On Date Of Death Of Registered Dealer: Allahabad HC

The Allahabad High Court held that if registration under the Uttar Pradesh Value Added Tax Act, 2008 was subsisting on the day of his death, his family would be entitled to insurance claim under the Group Insurance Policy.The bench comprising of Justices Saumitra Dayal Singh and Surendra Singh-I held“If the deceased held a registration certificate prior to the occurrence of his death and that registration did not stand cancelled on the date of occurrence of his death, the status of the deceased...

![Allahabad High court, prayagraj wtaer crisis, drinking water, District Magistrate, Dev Raj Singh And 4 Others vs. State Of U.P. And 3 Others 2023 LiveLaw (AB) 392 [PUBLIC INTEREST LITIGATION (PIL) No. - 2254 of 2023] Allahabad High court, prayagraj wtaer crisis, drinking water, District Magistrate, Dev Raj Singh And 4 Others vs. State Of U.P. And 3 Others 2023 LiveLaw (AB) 392 [PUBLIC INTEREST LITIGATION (PIL) No. - 2254 of 2023]](https://www.livelaw.in/h-upload/2023/07/12/500x300_480867-allahabad-high-court-01.webp)