High Court

Telangana High Court Holds Telangana Value Added Tax (Second Amendment) Act, 2017 To Be Unconstitutional

The Telangana High Court has held that the Telangana Value Added Tax (Second Amendment) Act, 2017 is unconstitutional.The division bench of Chief Justice Ujjal Bhuyan and Justice P. Madhavi Devi has observed that the intention of Parliament in ushering in the GST regime through the Constitution Amendment Act, enactment of the CGST Act and simultaneous enactment of various State GST Acts by the State Legislatures was to avoid a multiplicity of taxes by subsuming those indirect taxes into a...

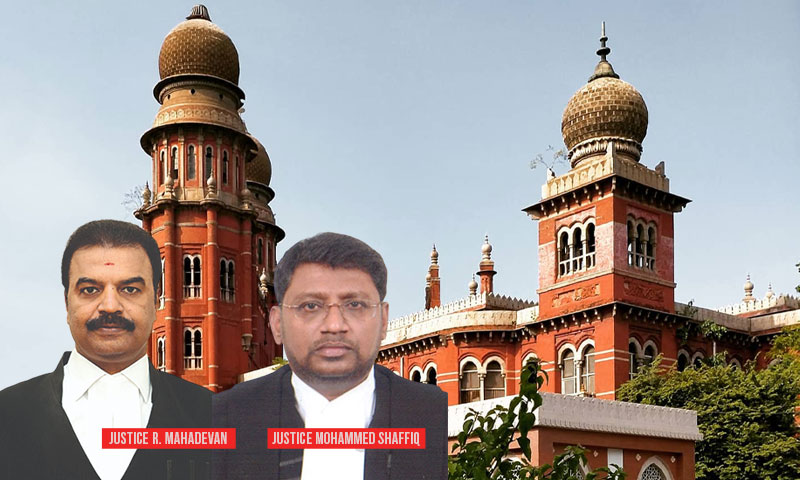

Madras High Court Upholds Validity Of Section 6 Of The Tamil Nadu Value Added Tax Act 2006

The Madras High Court recently upheld the validity of amendments made to Section 6 of The Tamil Nadu Value Added Tax Act, 2006. The court observed that in matters relating to tax, the interest of the State must be considered as against the interest of certain individuals. The court also discussed the power of the legislature in taking decisions with respect to tax "The hardship that is caused to individuals seldom matters as validity of any fiscal enactment ought to be tested on the...

Outright Rejection Of Stay Application Is Not Justified, Need To Exercise The Appellate And Revisional Jurisdiction Judicially:Telangana High Court

The Telangana High Court has held that the appellate and revisional authorities must judiciously exercise their discretionary power to grant a stay under the Telangana VAT Act.A division bench of Justice Ujjal Bhuyan and Justice Surepalli Nanda, while staying the demand in terms of the assessment order, directed the petitioner to deposit twelve and a half percent of the disputed tax within a period of 30 days. The petitioner/assessee was a registered dealer under the Telangana Value...

Assessee To Claim Refund of Tax Collected By State Without Authority Within 3 Years From The Date of Payment: Madras High Court

The Madras High Court bench of Justice R.Mahadevan and Justice Mohhammed Shaffiq has held that any tax collected without authority would certainly amount to unjust enrichment and the assessees must claim a refund of the tax collected or retained by the state within three years from the date of their payments to the department.The assessee has sought the order to quash the orders passed by the respective Assessing Officers as it relates to reversal of Input Tax Credit (ITC) under the...

Gujarat High Court Condemns Coercive Steps Taken By Dept. For Recovery Of Dues From Wipro While Appeal Was Pending

The Gujarat High Court bench of Justice J.B. Pardiwala and Justice Nisha M. Thakore has condemned the coercive steps of the department for recovery of dues from Wipro when the appeal was pending before the first appellate authority as well as the Tribunal.The writ petitioner, Wipro Ltd. is in the business of information technology services, including the sale of hardware and software, the sale of consumer products, and the supply and installation of solar power generation plants. The writ...

Section 44 Of GVAT Act Akin To Garnishee Order; Requires Debtor-Creditor Relationship: Gujarat High Court

"It can be said that in interpreting a taxing statute, the equitable considerations are entirely out of place. The reasons of morality and fairness can have no application to bring a citizen who is not within the four corners of the taxing statute within its fold so as to make him liable to payment of tax," Justice JB Pardiwala of the Gujarat High Court has opined. The Bench was hearing a writ application under Art 226 wherein the Applicants had prayed for the quashment of the impugned...

Survey Not Disputed By The Partner Of The Firm Who Was Present - Can't Question Later: Allahabad High Court

The Allahabad High Court bench of Justice Piyush Agrawal has ruled that once the partner of the firm was available at the time of the survey, who must have signed the survey report, he could very easily request to correct the entries or refuse to sign the survey report, if it was not recorded as per his statement. The applicant/assessee is in the business of manufacturing and selling rough C.I. Castings. The business premises of the applicant were surveyed on August 18, 2010, where...

Attachment of Immovable Properties Of Director Despite settlement of Tax Dues Under Tax Resolution Scheme: Gujarat High Court Condemns Dept.

The Gujarat High Court bench of Justice J.B. Pardiwala and Justice Nisha M. Thakore has condemned the act of the department for attaching the personal immovable properties of the director even though the tax dues were settled under the Tax Resolution Scheme. The writ-petitioner/assessee, a company which is a taxable entity, has incurred liability towards the payment of tax under the provisions of the GVAT Act. The company incurred a liability in the year 2013. The company preferred an...

No Manufacturing Activity Within State , ITC Cannot Be Denied Under JVAT Act: Jharkhand High Court

The Jharkhand High Court has ruled that Input Tax Credit can be denied on Inter-State sale or transfer of stock under Section 18(8)(ix) of the Jharkhand Value Added Tax Act, 2005 only when some manufacturing activity is undertaken by the assessee in the State. The Bench, consisting of Justices Aparesh Kumar Singh and Deepak Roshan, has held that in a taxing statue there is no room for intendment and therefore Section 18(8)(ix) cannot be stretched to cover persons who are not ...

Failure Of The Dealer To Attend Assessment Proceedings, No Violation Of Principles Of Natural Justice: Kerala High Court

The Kerala High Court has held that failure of a dealer to attend assessment proceedings cannot be regarded as the violation of principles of natural justice. The single bench of Justice Bechu Kurian Thomas has observed that petitioner/dealer was granted sufficient opportunity to contest the assessment proceedings and the failure to do so cannot be regarded as a violation of the principles of natural justice to invoke the discretionary jurisdiction under Article 226 of the Constitution....

Rajasthan VAT Act Enacted To Provide Remedy For Loss Of Revenue & Not To Punish Offender For Committing Economic Offence: High Court

The Rajasthan High Court, Jaipur has observed that provisions of Rajasthan Value Added Tax Act, 2003 have been enacted to provide remedy for loss of revenue and not to punish the offender for committing economic offence and, therefore, mens rea is not an essential ingredient for contravention of such provision. The court added that breach would attract levy of penalty whenever the goods in movement have travelled with an incomplete form. A division bench of Justice Pankaj...