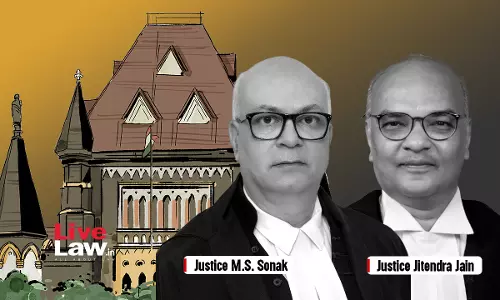

High Court

Pending Proceedings Under Omitted CGST Rules 89(4B) & 96(10) Lapse In Absence Of Savings Clause: Bombay High Court

The Bombay High Court has held that all pending proceedings under the omitted CGST Rules 89(4B) & 96(10) lapse in the absence of a savings clause. The bench agreed with the assessee/petitioners that the provisions of Section 6 of the General Clauses Act are not attracted and therefore the pending proceedings can claim no immunity or protection. Unless the Respondents...

Notice U/S 148 Income Tax Act Must Be Delivered To Addressee Personally By Post To Complete Service U/S 27: Allahabad High Court

The Allahabad High Court has held that notices under Section 148 and 282 of the Income tax Act, 1961 must be delivered to the assesee personally through speed post and not merely upon his address to complete service under Section 27 of the General Clauses Act, 1897. It held that presumption of sufficient service arises only when the notice is sent by registered post as in registered...

Provisional Attachment Of Bank Accounts Cannot Be Done Merely Upon Issue Of Show Cause Notice U/S 74 GST Act: Allahabad High Court

The Allahabad High Court has held that provisional attachment of bank accounts cannot be done merely upon issue of show cause notice under Section 74 of the Goods and Service Tax Act, 2017. Referring to the judgment of the Supreme Court in Radha Krishan Industries v. State of H.P. and its earlier judgment in R.D. Enterprises v. Union of India, the bench of Justice Shekhar B....

White Petroleum Jelly Classified As 'Drug', Not Cosmetic; Higher VAT & Entry Tax Not Leviable: Madhya Pradesh High Court

The Madhya Pradesh High Court stated that White Petroleum Jelly is classified as a 'Drug', not 'Cosmetic', and therefore is not liable to higher VAT and Entry Tax. Justices Vivek Rusia and Jai Kumar Pillai stated that a White Petroleum Jelly of IP grade manufactured and sold by appellant under a valid drug licence is liable to be classified as a category of drug and medicine under...

No Tax Exemption On Bakery Products Sold At Snack Bar: Madras High Court

The Madras High Court held that there is no tax exemption for bakery products sold in a snack bar. Justices S.M. Subramaniam and C. Saravanan were addressing the issue of whether bakery products sold in a snack bar are covered under the notification G.O.P.No.570 dated 10th June 1987 and exempted from tax. The assessee/petitioner is running a restaurant in which they are involved...

Employer Liable To Reimburse Customs Duty Paid By Contractor If Exemption Certificate Not Provided At Import Stage: HP High Court

The Himachal Pradesh High Court dismissed an appeal under section 37 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) filed by Himachal Pradesh Power Corporation Ltd. (HPPCL) upholding an arbitral award in favour of Orange Business Service India Technology Pvt. Ltd. The court held that the failure to provide exemption certificate by employer at the time of importation of...

Karnataka High Court Directs CBDT To Extend Tax Audit Due Date To 31st October

The Karnataka High Court today directed the Central Board of Direct Taxes to extend the due date for filing Tax Audit Reports under Section 44AB of the Income Tax Act, 1961, by one month to 31st October, 2025.For reference: “Section 44AB of the Income Tax Act, 1961 mandates compulsory audit of accounts for businesses and professionals above a specified turnover or gross...

Rejecting Appeal U/S 34 A&C Act On Grounds Of Jurisdiction Without Indicating Alternate Remedy Amounts To Refusal To Set Aside Award: Allahabad HC

Recently, the Allahabad High Court has held that rejecting an appeal under Section 34 of the Arbitration and Conciliation Act on grounds of lack of jurisdiction without providing alternate remedy amounts to refusing to set aside award, making such order appealable under Section 37 of the Act.Section 37(1)(c) of the Arbitration and Conciliation Act, 1996 provides for appeals against orders...

Allahabad High Court Issues Notice On Plea Challenging S.127 CGST Act Over 'Unbridled' Power Given To Authorities To Impose Penalty On Assessee

Recently, the Allahabad High Court has issued notices to office of the Solicitor General of India and Advocate General, Uttar Pradesh in a writ petition challenging the validity of Section 127 of the Central and State Goods and Service Tax Act, 2017. Section 127 of the Central and State Goods and Service Tax Act, 2017 empowers the proper officer to impose penalty when he is of the...

Delhi HC Declines To Restrain Encalm Hospitality From Doing Business With Clients Of Dreamfolks Services, Says No Mandate Of Exclusivity

The Delhi High Court Bench of Justice Amit Bansal refused to enforce a negative covenant against Encalm Hospitality Private Limited holding that its agreement with Dreamfolks Services Limited did not mandate exclusivity between the latter and its clients and thus Encalm was not in violation of the Agreement. Facts The present petition was filed under Section 9 of the Arbitration...

Does CESTAT Have Jurisdiction To Hear Challenge To Central Govt Notifications Imposing Anti-Dumping Duty? Delhi High Court To Examine

The Delhi High Court is set to examine whether the Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has jurisdiction to hear challenges to notifications issued by the Central Government, imposing Anti-Dumping Duty.Anti-dumping investigation determines whether a product is being dumped in the country at a lower price, causing material injury to the domestic industry. If found...

Rajasthan HC Grants One Month Extension For Filing Tax Audit Report After Complaints Of Glitches On E-Filing Portal

The Rajasthan High Court has extended the deadline for filing the Tax Audit Report by one month. A division bench of Justice (Dr.) Pushpendra Singh Bhati and Justice Bipin Gupta at the Rajasthan High Court extended the deadline under Section 44AB of the Income Tax Act, 1961, by 1 (one) month beyond September 30, 2025. It was submitted that in the previous years, CBDT had...