High Court

Income Tax Act | To Claim Deduction U/S 54F, Assessee Must Show Intention To Repay Borrowed Funds With Capital Gains: Kerala HC

The Kerala High Court stated that to claim the Section 54F deduction under the Income Tax Act, the assessee must satisfy the authorities that borrowed funds were used at their own risk with the intention to be repaid with capital gains. Section 54F of the Income Tax Act, 1961, allows a tax exemption on capital gains earned from selling a residential property, but only if certain...

Scope Of Appeal Is Limited U/S 28KA Customs Act; Advance Ruling Binding Unless Arbitrary: Madras High Court

The Madras High Court has held that the scope of appeal is limited under Section 28KA of the Customs Act and an advance ruling is binding unless it is palpably arbitrary or irrational. Section 28KA of the Customs Act, 1962 provides that an appeal can be filed to the appellate authority against any ruling or order passed by the Authority within sixty days from the date of communication...

Tax Exemption Cannot Be Claimed For Inter-State Purchases Without Segregating Local Purchases: Madras High Court

The Madras High Court has held that if the assessee has purchased goods both within the State and from other States, then to claim exemption for inter-State purchases, the purchases made within the State must be segregated from those made from others. Justices S.M. Subramaniam stated that when the facts are established in clear terms that the goods were found mingled during...

Foreign Arbitral Awards To Be Enforced Under Indian Law, Interpretation Of 'Public Policy' U/S 48(2)(b) A&C Act Is Limited: Delhi HC

The Delhi High Court observed that to enforce a New York Convention Award, an application u/s 47 of the A&C Act, 1996 has to be filed. Thereafter, the onus shifts on the party opposing the enforcement to make out a ground enlisted in Section 48 of the A&C Act. The bench observed "The settled legal position with respect to foreign awards is that, except strictly in terms of...

One Rolex Watch Can Be For Personal Use, Not 'Commercial Quantity': Delhi High Court To Customs

The Delhi High Court has made it clear that one Rolex watch seized by the Customs Department from an air passenger cannot be called 'commercial quantity'.It thus cautioned the Department's Adjudicating Authority against “error” on its part, in declaring the same as commercial.“Clearly, this Court is of the view that one Rolex watch cannot be held to be a commercial quantity and there is...

CCTV Footage Of Assessee's Family Cannot Be Used By GST Dept, Violates Right To Privacy: Delhi High Court

The Delhi High Court has issued directions safeguarding the right to privacy in GST search proceedings, stating that any family-related CCTV footage which violates the privacy of family members cannot be used or disseminated in any manner. “Some of the concerns which are raised by the Petitioners such as right to privacy of the family being violated, etc., deserve to be...

Plea Against Misuse Of Digital Signature Does Not Amount To Denying Existence Of Arbitration Agreement: Calcutta High Court

The Calcutta High Court Bench of Justice Krishna Rao, while referring parties to arbitration, has observed that if the Plaintiff alleges that its digital signatures were used without its consent, such an allegation of fraud does not amount to a denial of the existence of the arbitration agreement. Facts The Plaintiffs had filed an application praying for an interim order, whereas...

Commercial Unit Buyers Not Barred From Seeking Arbitration Relief After Availing Remedies Under RERA: Delhi High Court

The Delhi High Court bench of Justice Pratibha M. Singh and Justice Shail Jain has held that Buyers of commercial units are not prohibited from seeking arbitration relief subsequent to availing remedies under RERA, provided that the arbitration petitions were filed after a change in circumstances. Background The Appellants had entered into a Memorandum of Understanding (MoU) with...

Compensation Received From NHAI For Acquisition Of Land Not Taxable: Chhattisgarh High Court

The Chhattisgarh High Court held that the compensation received against the acquisition of land from the NHAI (National Highways Authority of India) is not exigible to tax under Section 96 of the RFCTLARR Act (Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013). Section 96 of the Right to Fair Compensation and Transparency in...

Unadjudicated Claims Cannot Be Secured Through Interim Relief U/S 9 Of A&C Act Merely Due To Financial Distress: Delhi HC

The Delhi High Court Bench of Justice Jasmeet Singh has observed that mere financial distress of the other party would not be a ground to allow interim relief and grant its unadjudicated claim under Section 11 of the Arbitration Act (ACA)."However, the calculation of any permissible rebate and the resolution of quality-based objections require factual findings and interpretation of the terms...

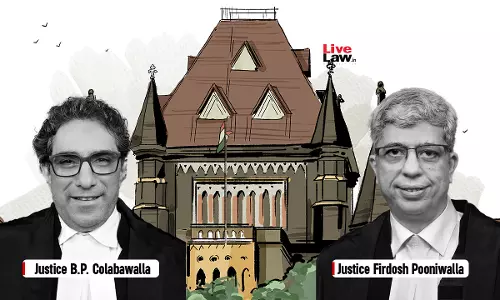

Income Tax Act | Payment To Consulting Doctors Appointed On Probation Is Not Salary; TDS Deductible U/S 194J, Not U/S 192: Bombay High Court

The Bombay High Court has held that payments to consultant doctors are not salary. Hence, TDS is deductible under section 194J and not under section 192 of the Income Tax Act. Justices B.P. Colabawalla and Firdosh P. Pooniwalla stated that there does not exist an employer-employee relationship between the assessee and consultant doctors, and the payments made to them by the...

Delhi High Court Transfers Winding-Up Petitions Against Vigneshwara Developwell Pvt Ltd To NCLT

The Delhi High Court has transferred winding-up petitions filed against Vigneshwara Developwell Pvt Ltd to the NCLT. The petition was filed under Sections 433(e), 434, and 439 of the Companies Act, 1956, seeking winding up of the respondent company due to its inability to pay the debt of the petitioner. During the pendency of the petition, an application was filed for the transfer...