High Court

Customs Wrongly Treated 998 Purity Gold Jewellery As Prohibited Goods Under Baggage Rules: Delhi High Court Grants Relief To Traveller

The Delhi High Court recently granted relief to a woman whose 998 purity (equivalent to 24 karat) gold jewellery was treated as prohibited goods under the Baggage Rules 2016, and absolutely confiscated by the Customs Department on her return to the country.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“On the aspect of personal effects and jewellery,...

Failure To Notify GST Commissioner About Partner's Retirement Makes Ex-Partner Liable For Firm's GST: Punjab & Haryana High Court

The Punjab and Haryana High Court stated that failure to notify commissioner of partner's retirement makes former partner liable for firm's GST. Section 90 of the CGST Act, 2017 extends the liability in case of partnership firm to its partners as well. Justices Lisa Gill and Sudeepti Sharma stated that “intimation of retirement of partner has to be given to the Commissioner...

Trader Can't Be Labelled Defaulter Over Unpaid Demand During Pendency Of GST Appeal, After Making Pre-Deposit: Delhi High Court

The Delhi HIgh Court has held that once a trader prefers an appeal against a demand raised by the GST Department and makes the mandatory pre-deposit, the demand order is automatically stayed and the trader cannot be treated as a defaulter.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted relief to the Petitioner-proprietorship firm and directed the Department...

No KVAT Levy On Advertisement Hoardings Where Right To Use Has Not Been Transferred: Kerala High Court

The Kerala High Court has held that transactions involving the display of advertisements on hoardings are not taxable under the Kerala Value Added Tax Act (KVAT), where the right to use has not been transferred. Justice Ziyad Rahman A.A. agreed with the assessee that the charges collected by the assessee for displaying the advertisement included the charges for erection, printing...

Merely Attaching Tax Determination Statement To DRC-01 Summary Cannot Be Treated As A Valid SCN: Gauhati High Court

The Gauhati High Court held that merely attaching tax determination statement to Drc-01 summary cannot be treated as a valid show cause notice. Justice Sanjay Kumar Medhi stated that “…….a formal and duly authenticated SCN is mandatorily required to initiate proceedings under Section 73. The Statement of tax determination under Section 73(3), which is attached to the summary...

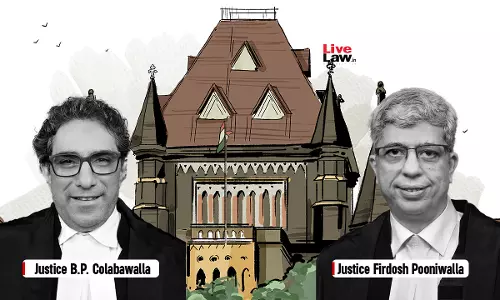

Income Tax | S.194C & S.194LA Would Not Apply When TDR Certificates Are Issued In Lieu Of Compensation: Bombay High Court

The Bombay High Court held that Section 194C and Section 194LA of the Income Tax Act would not apply when TDR Certificates are issued in lieu of compensation. Justices B.P. Colabawalla and Firdosh P. Pooniwalla agreed with the assessee that the words “or by any other mode” appearing in Section 194C would have to be read ejusdem generis to the words “payment thereof in cash or...

Phrase 'Three Months' U/S 73(2) GST Act Means Three Calendar Months, Not 90 Days: Delhi High Court

The Delhi High Court has held that the 'three months' period prior to expiry of three years within which show cause notice for alleged wrongful availment of Input Tax Credit must be issued under Section 73 of the CGST Act, means three calendar months and not 90 days.Under Section 73, SCN is issued to an assessee for determination of tax not paid or short paid. The Proper Officer is required...

GST Refund Can't Be Granted To Trader Until Cancelled Registration Is Restored: Delhi High Court

The Delhi High Court has made it clear that GST refund cannot be granted to a trader whose GST registration stands cancelled.In the case at hand, the Petitioner's registration was cancelled in February 2023 with retrospective effect from July 2018.In this backdrop a division bench of Justices Prathiba M. Singh and Shail Jain observed,“When the GST registration itself has been cancelled in...

DM Can Re-Execute Possession Orders U/S 14 Of SARFAESI Act After Illegal Re-Entry By Borrower: MP High Court

A division bench of Madhya Pradesh High Court, comprising Justice Anand Pathak and Justice Hirdesh, has allowed an appeal and upheld that a district magistrate can re-execute possession orders u/s 14 of the SARFAESI Act after illegal re-entry by the borrower. The Court directed the respondent authorities to provide necessary assistance to the petitioner to dispossess the borrower...

S.74 CGST Act | Consolidated SCN For Multiple Financial Years Necessary To Establish Wrongful Availment Of ITC: Delhi High Court

The Delhi High Court has held that consolidated show cause notice under Section 74 of the CGST is not only permissible but necessary, to unearth wrongful availment of ITC over a span of period.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta observed,“The nature of ITC is such that fraudulent utilization and availment of the same cannot be established on most...

Stock Exchange & Banking Channels Cannot Mask Sham Transactions Carried Out Through Bogus Capital Loss Claim Companies: Calcutta High Court

The Calcutta High Court held that stock exchange and banking channels cannot mask sham transactions carried out through bogus capital loss claim companies. Justices T.S. Sivagnanam and Chaitali Chatterjee (Das) observed that “the entire information contained in the investigation report was apprised to the assessee by the assessing officer and thereafter the show cause notices...

Mere Incorporation Of Investing Companies Under Companies Act Not Enough To Prove Genuineness Of Share Transactions: Calcutta High Court

The Calcutta High Court held that mere incorporation of investing companies under the Companies Act is not enough to prove the genuineness of share transactions. The bench opined that, admittedly, the shares were by way of a private placement. Though the investing companies might have been incorporated under the provisions of the Company's Act, that by itself will not...