High Court

Amount Deposited Under Protest Can't Be Treated As Admission Of Tax Liability: Himachal Pradesh High Court

The Himachal Pradesh High Court has held that when a taxpayer deposits an amount “under protest”, it does not amount to an admission of tax liability.A Division Bench of Justice Tarlok Singh Chauhan and Justice Sushil Kukreja observed as follows; “Once the petitioner had deposited the amount 'under protest', the same could not have been considered to be an admission of liability because...

Jurisdiction Of Arbitral Tribunal Continues Despite Provisional Attachment Of Assets Under PMLA Or Parallel Proceedings: Delhi High Court

The Delhi High Court bench of Justice Amit Mahajan has held that the mere reference to certain assets in a provisional attachment order does not, by itself, oust the jurisdiction of the arbitral tribunal. Similarly, the pendency of parallel investigations by the CBI or ED into allegations of fraud does not bar the arbitrator from adjudicating the dispute. Arbitration proceedings...

Injunction Can't Be Granted In Absence Of Any Risk Of Assets Dissipating Or Pleadings Indicating Frustration Of Award: Calcutta High Court

The Calcutta High Court bench of Justice Shampa Sarkar has held that at this stage, the petitioner is adequately secured under the schedule to the deeds of hypothecation agreement. The respondent remains fully operational and continues its business activities. There is nothing in the pleadings to suggest that the respondent has attempted to remove or alienate its assets in a...

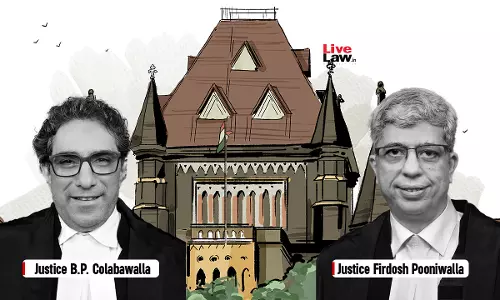

Design & Engineering Services To Foreign Entities Are Zero-Rated Supplies; Assessee Eligible For Refund Of Unutilized ITC U/S 54 Of CGST Act: Bombay HC

The Bombay High Court stated that design and engineering services to foreign entities are zero-rated supplies; assessee eligible for refund of unutilized ITC U/S 54 CGST. The Division Bench of Justices B.P. Colabawalla and Firdosh P. Pooniwalla observed that assessee is not an agency of the foreign recipient and both are independent and distinct persons. Thus, condition (v)...

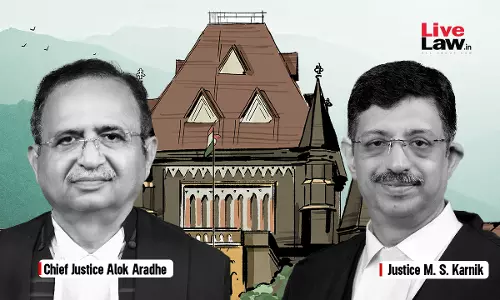

AO Cannot Alter Net Profit In Profit & Loss Account Except Under Explanation To S.115J Of Income Tax Act: Bombay High Court

The Bombay High Court stated that assessing officer do not have the jurisdiction to go behind net profit in profit and loss account except as per explanation to Section 115J Of Income Tax Act. The Division Bench consists of Chief Justice Alok Aradhe and Justice M.S. Karnik observed that “Section 115J of the 1961 Act mandates that in case of a company whose total income as...

'File Movement' & 'Change In Counsel' Not Sufficient Cause For Condonation Of Delay In Filing S.37 Arbitral Appeals: Delhi High Court

The Delhi High Court bench comprising Justice Prathiba M. Singh and Justice Rajneesh Kumar Gupta has held that mere movement of file and change in counsel due to administrative issues does not constitute “sufficient cause” to condone inordinate delay in filing an appeal under Section 37 of the Arbitration and Conciliation Act, 1996.The court reiterated that for appeals under Section 37...

GST | Separate Demands For Reversal Of Availed ITC & Utilisation Of ITC Is Prima Facie Duplication Of Demand: Delhi High Court

The Delhi High Court has observed that demand raised against an assessee qua reversal of availed Input Tax Credit (ITC) and qua utilisation of ITC prima facie constitutes double demand.A division bench of Justices Prathiba M. Singh and Rajneesh Kumar Gupta thus granted liberty to the Petitioner-assessee to approach the Appellate Authority against such demand, and waived predeposit qua demand...

[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court

The Bombay High Court stated that a breach of Article 265 of the constitution cannot be alleged or sustained based upon a tentative or inconclusive opinion formed by assessing officer. The Division Bench consists of Justices M.S. Sonak and Jitendra Jain stated that “If the communication dated 29 November 2018 is an order, it being like a preliminary, prima facie, or interlocutory...

Does Payment For Transponder Services Constitute 'Royalty' U/S 9(1)(vi) Of Income Tax Act? Bombay High Court Asks CIT To Decide

The Bombay High Court has asked the Commissioner of Income Tax to decide whether payment for transponder services constitutes 'royalty' under Section 9(1)(Vi) of Income Tax Act. The Division Bench of Justices M.S. Sonak and Jitendra Jain observed that “the authorities have held the payment to constitute 'royalty' under the domestic law as well as under the Treaty, but by holding...

Once Arbitration Commences After Failure Of Conciliation Under MSME Act, It Cannot Be Reinitiated By Halting Arbitration: Calcutta High Court

The Calcutta High Court bench of Justice Sabyasachi Bhattacharyya has held that once arbitral proceedings commenced under Section 18(3) under the MSME Act, the process could not be reversed to reinitiate pre-arbitral conciliation. The Council did not do so either. It was only at the petitioner's request that additional avenues for mutual settlement were explored alongside the...

Bombay High Court Upholds Arbitral Award Against BCCI, Directs Payment Of ₹538.9 Crore To Defunct IPL Franchise Kochi Tuskers Kerala

The Bombay High Court has upheld an arbitral award granting damages amounting to 538.9 crore to Kochi Cricket Private Limited ("KCPL”), the parent company of defunct IPL franchise Kochi Tuskers Kerala.It was held that the Court cannot act as a Court of First Appeal and delve into a fact-finding exercise by revisiting and re-appreciating the record and accepting competing interpretations...

Ex Parte Order Can Be Recalled If Party Complies With Directions & Legal Issues Require Full Hearing For Proper Adjudication: MP High Court

The Madhya Pradesh High Court bench of Justice Subodh Abhyankar has held that an ex parte order may be recalled when the concerned party appears later, complies with the court's directions, and the matter involves complex legal issues requiring a fair hearing from both sides for an effective adjudication. Brief Facts: This application has been filed for recalling an ex-parte...

![[Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court [Income Tax] Breach Of Article 265 Cannot Be Alleged Based On Inconclusive Opinion By Assessing Officer: Bombay High Court](https://www.livelaw.in/h-upload/2024/10/17/500x300_566535-justices-mahesh-sonak-and-jitendra-jain-bombay-hc.webp)