All High Courts

Send RPAD Reminders If No Reply Received After Repeated Uploading Of Notices In GST Portal: Madras High Court Tells Revenue

The Madras High Court stated that if the taxpayer is not at all participating in the proceedings, even after repeated uploading of notices and reminders in GST portal, the Department should have resorted to other mode of service, viz., Registered Post with Acknowledgement Due (RPAD), so that considerable time of officers, assessee and the Court could be saved. The court...

Unilateral Option To Terminate Arbitration Agreement Does Not Render It Illegal: Bombay High Court

The Bombay High Court Bench of Justice Somasekhar Sundaresan while disposing an application for appointment of arbitrator has observed that an arbitration clause which gives option to only one party to opt out of the arbitration agreement is not invalid per se. Such arbitration agreement can be saved by eliminating the unilateral option or by making such right...

Amalgamated Company Can Adjust Written Down Assets Of Constituent Companies & Claim Depreciation Without Central Govt Approval: Bombay HC

The Bombay High Court stated that amalgamated company can adjust written down of assets of amalgamating companies and claim depreciation without central government's approval. The Division Bench of Chief Justice Alok Aradhe and Justice M.S. Karnik stated that “The Tribunal was not justified in law in holding that in view of insertion of Section 72A in the Income Tax Act,...

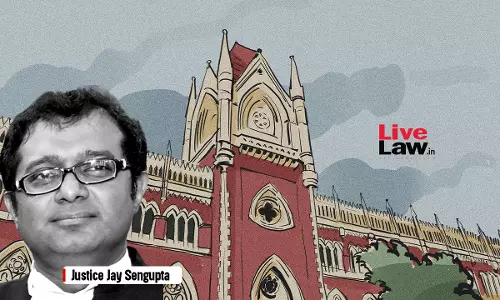

Proceedings U/S 37 A Of FEMA Can't Be Continued During Moratorium U/S 33(5) Of IBC: Calcutta High Court

The Calcutta High Court bench of Justice Jay Sengupta has held that once a liquidation order against the Corporate Debtor is passed, all proceedings including those pending at the time of such order under the Foreign Exchange Management Act, 1999 (FEMA) cannot be continued, nor can any new proceedings be initiated, in view of the bar under Section 33(5) of the Insolvency and Bankruptcy...

Service Of Notices & Orders Through Common Portal Is A Valid Mode Of Service U/S 169 Of GST Act: Madras High Court

In a recent ruling, the Madras High Court held that service of notices and orders through Common portal is a valid mode of service in terms of Section 149 of the GST Act. The bench rejected the argument that the GST portal is not a “designated computer resource of the assessee” and hence as per Sec. 13 (2) (a) (ii) of the Information Technology Act, receipt occurs only when...

Grant Of Post-Award Interest U/S 31(7)(B) Of A&C Act Is Mandatory, Arbitrator's Discretion Limited To Rate Of Interest: Delhi HC

The Delhi High Court bench of Justice Ravinder Dudeja has held that the grant of post-award interest under Section 31(7)(b) of the Arbitration and Conciliation Act, 1996 (“the Act”) is mandatory. The only discretion which the Arbitral Tribunal has is to decide the rate of interest to be awarded. Where the Arbitrator does not fix any rate of interest, then statutory rate, as...

Writ Petition Can Be Entertained When Order U/S 9 Of Arbitration Act Neither Grants Nor Refuses Relief: Kerala HC

The Kerala High Court bench of Justice Harisankar V. Menon has held that a writ petition under Articles 226/227 of the Constitution of India can be entertained against an order passed by the Commercial Court under Section 9 of the Arbitration and Conciliation Act, 1996 (Arbitration Act) when such an order neither grants nor refuses to grant relief, thereby not making it appealable...

Delhi High Court Rejects Income Tax Dept's Appeal Raising ₹42 Crore Demand On NTPC Subsidiary

The Delhi High Court dismissed an appeal preferred by the Income Tax Department raising a demand of ₹42,16,04,786/- from a wholly owned subsidiary of National Thermal Power Corporation Limited (NTPC).The demand was raised in view of alleged income from sale of fly ash, transferred to it by NTPC.As per factual matrix of the case, the fly ash was transferred to the assessee in view of Environment Ministry's notification requiring all thermal plants to utilize the fly ash generated from the power...

GST Authorities Can't Deny Refund Of Pre-Deposit On Grounds Of Limitation, Violates Article 265: Jharkhand High Court

The Jharkhand High Court has held in a recent judgement that rejecting a refund claim for a statutory pre-deposit which has been made under Section 107(6)(b) of the GST Act, on the ground that the claim was filed after the 2-year limitation under Section 54(1), is legally unsustainable. The Division Bench comprising Chief Justice M.S. Ramachandra Rao and Justice Deepak Roshan stated, “There...

Contractors Are Liable To Pay GST At Rate Prevalent On Day Of Receipt Of Tender, Not When Work Is Allotted: J&K High Court

The Jammu and Kashmir High Court held that the contractors were liable to pay GST at a rate prevalent on the last day for the submission of the tenders and not when the work was allocated as the same was clear from the Special Condition No.49 existing in the contract agreement. The petitioners had filed the review on the ground that as per section 13 of the CGST Act the liability to...

Statutory Protection Under Maharashtra Rent Control Act Can't Be Circumvented By Invoking Arbitration Petition To Seek 'Speedy Eviction': High Court

The Bombay High Court bench of Justice Somasekhar Sundaresan has held that the jurisdiction under Section 9 of the Arbitration and Conciliation Act, 1996 (“the Act”) cannot be invoked to circumvent the statutory protection afforded to tenants under the Maharashtra Rent Control Act, 1999 (“Rent Act”). Interim measures under Section 9 must aid arbitral proceedings and cannot...

Burden Of Court Increasing Over Violations Of Natural Justice: Allahabad HC Imposes 20K Cost On GST Official For Not Following Mandatory Provision

The Allahabad High Court has imposed a cost of Rs. 20,000 on Joint Commissioner SGST, Corporate Circle-1, Ghaziabad who had issued a show cause notice without specifying the date and time for personal hearing and had passed an order under Section 74 of the Goods and Services Tax Act, 2017 creating a demand of more than Rs. 5 crore ignoring the specific request for personal hearing made by...