All High Courts

Transitional Credit Under GST Not Allowable For Capital Goods Received After 1 July 2017: Patna HC Upholds Recovery Of Ineligible CENVAT Credit

The Patna High Court, while upholding the recovery of ₹8,62,566 as ineligible CENVAT credit, held that transitional credit under the GST regime cannot be availed for capital goods received after 1st July 2017. The Division Bench of the High Court comprising Justices Rajeev Ranjan Prasad and Ramesh Chand Malviya held, “The distinction in the matter of giving benefit of CENVAT credit on...

Penalty U/S 271(1)(c) Of Income Tax Act Not Applicable If Assessee Voluntary Discloses Bona Fide Mistake: Chhattisgarh High Court

In a recent ruling, the Chhattisgarh High Court held that penalty under Section 271(1)(c) of Income Tax Act not applicable if assessee voluntary discloses bona fide mistake. Section 271(1)(c) of the Income Tax Act, 1961 deals with penalties for concealment of income or furnishing inaccurate particulars of income. The Division Bench of Justices Sanjay K. Agrawal and...

Kerala Municipality Act | Building Owners Liable To Pay Revised Property Tax For Past Three Years After Adjusting Previously Paid Amount: HC

The Kerala High Court stated that building owners liable to pay revised property tax for past three years, after adjusting previously paid amounts. The Bench of Justice Bechu Kurian Thomas was addressing the issue of whether, despite the creation of charge on the property enabling the Municipality to recover the arrears of tax as arrears of public revenue, the limitation period...

Delay Of 17 Months In Filing Appeal Not Condonable U/S 107 Of CGST Act: Jharkhand High Court Dismisses Plea Challenging Cancellation Of Registration

The Jharkhand High Court has held that an appeal filed beyond the statutory period of limitation, as prescribed under Section 107 of the Central Goods and Services Tax Act, 2017, is not maintainable and the delay cannot be condoned beyond the limits expressly stated in the statute. The Division Bench comprising Chief Justice M. S. Ramachandra Rao and Justice Deepak Roshan held, “Even...

[Arbitration Act] No Automatic Stay On Award Upon Filing Of Appeal U/S 34 Within Time: Allahabad High Court Reiterates

Following the judgment of the Supreme Court in Board of Control for Cricket in India Vs. Kochi Cricket Pvt. Ltd. and others and Hindustan Construction Company Limited and others Vs. Union of India and others, the Allahabad High Court has reiterated that automatic stay on the operation of arbitral award is not granted merely by filing appeal under Section 34 of the Arbitration and...

[S. 93 GST Act] No Provision Empowering Authorities To Make Tax Determination Against Dead Assesee: Allahabad High Court

The Allahabad High Court has held that Section 93 of the Goods and Services Tax Act, 2017 does not empower the authorities to make determination of tax against a dead person and recover the same his legal representatives. Section 93 of Goods and Services Tax Act, 2017 provides for liability to pay tax in case of death of the proprietor of the firm. Section 93(1)(a) provides that when...

Income Tax | Amount Received As Compensation For Compulsory Acquisition Of Landed Property Is Income Under 'Capital Gains': Kerala High Court

In a recent judgment, the Kerala High Court stated that the amounts received by an assessee as compensation or enhanced compensation for compulsory acquisition of his landed property would be treated as income under the head of 'Capital Gains' for the purposes of the I.T. Act. The Division Bench of Justices A.K. Jayasankaran Nambiar and Easwaran S. stated that “Interest...

Delivering Arbitral Award To Power Of Attorney Holder Satisfies Requirement Of 'Delivery' U/S 31(5) Of A&C Act: Delhi High Court

The Delhi High Court bench of Justices Navin Chawla and Ravinder Dudeja has observed that the delivery of a copy of the Award to the Power of Attorney holder, who has also represented the party in the arbitral proceedings, shall be a due compliance with Section 31(5) of the A&C Act. Facts Disputes arose between the parties in relation to the Collaboration...

Delhi High Court Reduces Suspension Period Imposed By IBBI Disciplinary Committee On Insolvency Professional, Finds Penalty Disproportionate

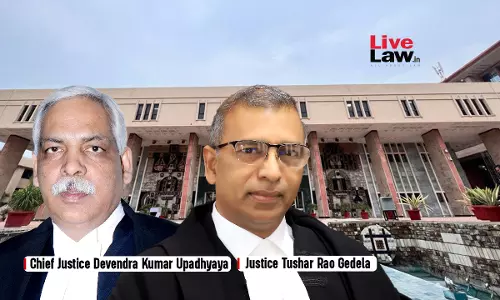

The Delhi High Court bench of Chief Justice Devendra Kumar Upadhyaya and Justice Tushar Rao Gedela have reduced the suspension period imposed on the Appellant/Resolution Professional, noting that the Disciplinary Committee of IBBI overlooked material aspects and relied on incorrect data while imposing the penalty. It reduced the suspension to the period already...

GST Appellate Authority Must Pass Order On Merits Even If There's No Appearance; Can't Dismiss For Default: Kerala High Court

The Kerala High Court has held that an appellate authority under the Central Goods and Services Tax Act (CGST Act 2017) must consider the merits of an appeal even if there is no appearance on behalf of the appellant.The Court stated that the order must be passed on merits and that the dismissal cannot be merely for default. Justice Bechu Kurian Thomas was considering a writ petition filed by...

[GST] Seller Registered At Time Of Transaction; Cannot Draw Adverse Inference Against Purchasing Dealer Over Subsequent Cancellation: Allahabad HC

The Allahabad High Court has held that if the seller is a registered dealer at the time of transaction, no adverse inference can be drawn against the purchasing dealer based on the subsequent cancellation of seller's registration.Justice Piyush Agrawal held “Once the seller was registered at the time of the transaction in question, no adverse inference can be drawn against the...

Arbitration Clause Cannot Be Considered Binding If Mandatory Arbitration Reference Is Missing: Calcutta High Court

The Calcutta High Court bench of Justice Shampa Sakar has held that if a clause in an agreement gives the parties discretion to refer the matter to arbitration after disputes have arisen, it cannot be construed as a binding arbitration agreement. Such invocation of the arbitration clause requires fresh consent of the other party before the matter can be referred to...

![[Arbitration Act] No Automatic Stay On Award Upon Filing Of Appeal U/S 34 Within Time: Allahabad High Court Reiterates [Arbitration Act] No Automatic Stay On Award Upon Filing Of Appeal U/S 34 Within Time: Allahabad High Court Reiterates](https://www.livelaw.in/h-upload/2022/07/19/500x300_426550-allahabad-high-court-prayagraj-live-law.jpg)

![[S. 93 GST Act] No Provision Empowering Authorities To Make Tax Determination Against Dead Assesee: Allahabad High Court [S. 93 GST Act] No Provision Empowering Authorities To Make Tax Determination Against Dead Assesee: Allahabad High Court](https://www.livelaw.in/h-upload/2025/03/05/500x300_589738-allahabad-high-court9.webp)

![[GST] Seller Registered At Time Of Transaction; Cannot Draw Adverse Inference Against Purchasing Dealer Over Subsequent Cancellation: Allahabad HC [GST] Seller Registered At Time Of Transaction; Cannot Draw Adverse Inference Against Purchasing Dealer Over Subsequent Cancellation: Allahabad HC](https://www.livelaw.in/h-upload/2022/12/04/500x300_447539-prayagraj-allahabad-high-court.jpg)