All High Courts

College Supplying Food Through Canteen Managed By Educational Trust Is Liable For Registration Under KVAT Act: Kerala High Court

The Kerala High Court held that college supplying food through canteen, though managed by educational trust, is liable for registration under KVAT Act. The bench disagreed with the assessee that even if it is assumed that the sales in the canteen are found to be assessable under the provisions of the VAT, it falls within the threshold limit and therefore, the assessee cannot...

Goods Exempted From Customs Duty, May Still Be Subject To Levy Of Additional Duty Under Respective Enactments: Madras High Court

The Madras High Court stated that goods imported exempted from basic customs duty, may still be subject to levy of additional duty under respective enactments. “The goods imported, even though exempted from basic customs duty, may still be subject to levy of additional duty under the respective enactments and they would be so subject unless and until they are specifically exempted...

Substitution Of Arbitrator Can't Be Allowed When Petitioner Voluntarily Withdraws From Arbitral Proceedings: Calcutta High Court

The Calcutta High Court bench of Justice Shampa Sarkar has held that an application under Section 15 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), seeking substitution of the arbitrator, cannot be allowed when the petitioner had voluntarily withdrawn from the arbitral proceedings and failed to participate despite being given ample opportunities, especially after a...

Mandate Of Arbitration U/S 29A Of Arbitration Act Can Be Extended By High Court Only When Arbitrator Is Appointed By It: Telangana High Court

The Telangana High Court bench of Justice Moushumi Bhattacharya and Justice B.R.Madhusudhan Rao has held that when an arbitrator is appointed by the High Court under Section 11(6) of the Arbitration and Conciliation Act, 1996 (Arbitration Act) in a domestic arbitration, the mandate of the arbitrator can be extended by the High Court only under Section 29A of the Arbitration Act and not...

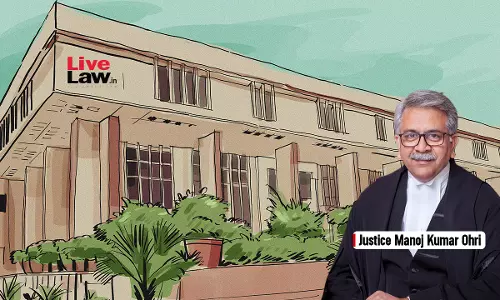

Writ Petition Cannot Be Construed As “Earlier Application” U/S 42 Of Arbitration & Conciliation Act: Delhi High Court

The Delhi High Court Bench of Justice Manoj Kumar Ohri has observed that a writ petition cannot be construed as an "earlier application" under Section 42 of the Arbitration Act to decide jurisdiction as the very nature of a writ petition is to challenge an administrative action or a legal decision, not to initiate arbitration proceedings.Section 42 specifically refers to an "application...

Withholding Tax Refunds Without Justification Violates Section 55 Of JVAT Act: Jharkhand High Court

The Jharkhand High Court has held that withholding tax refunds beyond the statutorily prescribed period without adequate justification, violates Section 55 of the Jharkhand Value Added Tax Act, 2005, and deprives the taxpayer of rightful dues. The Court ruled that the refund must carry interest from the date the excess demand was determined, and non-allocation of funds by the State...

Scheme Governing Auction Disputes Applies In All Auction Cases Unless Contrary Scheme Without Arbitration Clause Is Shown: Calcutta High Court

The Calcutta High Court bench Justice Shampa Sarkar has held that when a scheme generally applicable to all auction related disputes contains an arbitration clause, that clause will govern disputes arising between the parties, unless a contrary scheme without such a clause is shown. Brief Facts: Satya Narayan Shaw (petitioner) has filed this petition under section 11(6) of...

Successor To Merger Transaction Can Invoke Arbitration Clause When All Rights And Liabilities Are Transferred: Calcutta High Court

The Calcutta High Court bench of Justice Shampa Sarkar has held that once all liabilities, rights, and obligations are transferred to an entity through a merger approved by the competent forum, the arbitration clause contained in a loan agreement executed between the parties prior to the merger can be invoked by a third party that has acquired all such rights...

Arbitrator Cannot Be Appointed Unless Arbitration Clause Is Invoked With Proper Notice U/S 21 Of A&C Act: Telangana High Court

The Telangana High Court bench of Acting Chief Justice Sujoy Paul has held that unless a proper notice under Section 21 of the Arbitration and Conciliation Act, 1996 (Arbitration Act), suggesting the name of the proposed arbitrator, is sent to the other party, the court cannot exercise its jurisdiction under Section 11(6) of the Arbitration Act. Merely demanding outstanding payment...

Kerala High Court Strikes Down GST Act Provision Which Levied Tax On Supplies By Clubs/Associations To Members

In a significant judgment, the Kerala High Court has struck down the provisions of the Central Goods and Services Tax Act, 2017, which allowed the levy of GST on supply by clubs and associations to its members.As per the 2021 amendment made to the CGST Act, the definition of "supply" was amended to include within its fold "activities or transactions, by a person, other than an individual, to...

Once Tax Has Been Assessed, Entire Amount Has To Be Paid, Unless There Are Amnesty Schemes: Kerala High Court

The Kerala High Court stated that once tax has been assessed, entire amount has to be paid, unless there are amnesty schemes. “The assessee had even acquiesced into the order by paying the first instalment and thereafter he has turned around and now requests for acceptance of a portion of the amount in satisfaction of the entire tax assessed. Such a procedure is unheard in law....

CENVAT Credit Can't Be Denied Merely On Non-Submission Of User Test Certificate: Madras High Court

The Madras High Court stated that user test certificate is not mandatory before adjudicating show cause notice. The Division Bench of Justices R. Suresh Kumar and G. Arul Murugan opined that show cause notices cannot be adjudicated merely on the ground that the User Test Certificate has not been produced by the assessee. In this case, the respondent/assessee is a manufacturer of...